A 'Fundamental' Look At Home Values

It's been a rather quiet weekend on the New Jersey Bubble news front. I've had a few things on the back-burner, so now seems like a good time to pull them out. This first one is on the fundamentals that govern home prices.. Let's take a look.

Historically, home values have tracked three different fundamentals very closely, the relationship is well known, and the reasons behind them are sound. Those three fundamentals are local wages, local rents, and inflation. Wages and rents are the obvious fundamentals, so let's take a quick look at those first.

Local wages and rents are tightly intertwined. If wages rise, it's likely a sign that rents will rise shortly there after. Likewise, increased rental prices put wage pressures on local employers (I personally think this scenario is all but impossible in many areas, it would require that the entire local rental stock be controlled by a monopoly). But both typically move together rather tightly. Over the past few years, wage increases have been minimal, as have rental increases.

Lets take a look at median wage increases in New Jersey:

NJ Median Income

1996-1997 $56,506

1997-1998 $57,816

1998-1999 $58,092

1999-2000 $57,438

2000-2001 $56,895

2001-2002 $57,441

2002-2003 $58,313

2003-2004 $57,007

As you can see, median wages have been relatively flat. So lets take a look at how median rents have moved.

Housing Info

Median Rent For NJ

2001 $625

2000 $618

2002 $638

2003 $670

2004 $685

So it's pretty obvious, both rents and wages stayed pretty much confined and in-check throughout the housing bubble. The wage and rent fundamentals are still pretty tightly bound.

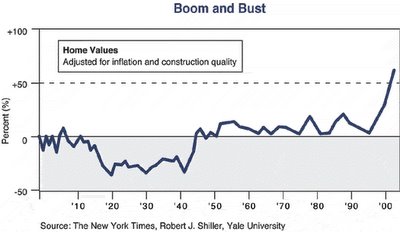

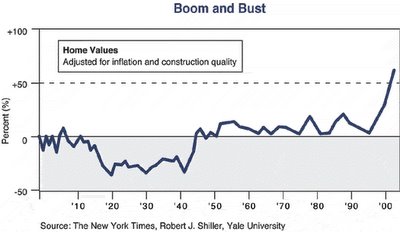

So that leaves inflation. Housing has always been thought of as a hedge against inflation, but seldom much more than that. A chart by Shiller that appeared in the NYT illustrates that very well.

Aside from that little dip we refer to as the Great Depression", it's obvious that home values have appreciated at rates slightly higher than inflation. Had inflation significant increased since 1990, we wouldn't have seen the spike. Now, I'm sure we can get into an argument about how the government is keeping the inflation calculations low so it doesn't need to pay COLA, but I'd prefer to table that one..

Caveat Emptor!

Grim

Historically, home values have tracked three different fundamentals very closely, the relationship is well known, and the reasons behind them are sound. Those three fundamentals are local wages, local rents, and inflation. Wages and rents are the obvious fundamentals, so let's take a quick look at those first.

Local wages and rents are tightly intertwined. If wages rise, it's likely a sign that rents will rise shortly there after. Likewise, increased rental prices put wage pressures on local employers (I personally think this scenario is all but impossible in many areas, it would require that the entire local rental stock be controlled by a monopoly). But both typically move together rather tightly. Over the past few years, wage increases have been minimal, as have rental increases.

Lets take a look at median wage increases in New Jersey:

NJ Median Income

1996-1997 $56,506

1997-1998 $57,816

1998-1999 $58,092

1999-2000 $57,438

2000-2001 $56,895

2001-2002 $57,441

2002-2003 $58,313

2003-2004 $57,007

As you can see, median wages have been relatively flat. So lets take a look at how median rents have moved.

Housing Info

Median Rent For NJ

2001 $625

2000 $618

2002 $638

2003 $670

2004 $685

So it's pretty obvious, both rents and wages stayed pretty much confined and in-check throughout the housing bubble. The wage and rent fundamentals are still pretty tightly bound.

So that leaves inflation. Housing has always been thought of as a hedge against inflation, but seldom much more than that. A chart by Shiller that appeared in the NYT illustrates that very well.

Aside from that little dip we refer to as the Great Depression", it's obvious that home values have appreciated at rates slightly higher than inflation. Had inflation significant increased since 1990, we wouldn't have seen the spike. Now, I'm sure we can get into an argument about how the government is keeping the inflation calculations low so it doesn't need to pay COLA, but I'd prefer to table that one..

Caveat Emptor!

Grim

9 Comments:

Who needs salary increases?

Just get 10% + homeprice increases and extract home equity. It's a god given right.

HAHHAHAHA

Lots and lots and lots of people counting on this scenario continuing are in for a very big shock.

Money doesn't grow on trees and none of this computes.

FLAT INCOMES DOES NOT = 100% HOME PRICE APPRECIATION LAST 5 YEARS!

THIS IS LUNACY. FOOLS BORN DAILY.

GO AHEAD LEVERAGE UP AND SIGN YOUR LIFE AWAY TO BUY A POS SHACK MCMANSION.

JUST REMEMBER PROPERTY TAXES AND ENRGY COSTS AND LIVING EXPENSES ESCALATING UP.

I looked ata couple of open houses in the Edison condo hot spot, and several were empty already and realtors gave the familiar "owner is anxious!" Hope it is true for this potential buyer !!

Roy G Biv

Hey Roy,

How anxious are they?

They are probably asking a price that is 150% higher than just 5 years ago.

A 10% reduction is not anxious.

Ask the friggen commissioned realtor to run a price comparison at year 2000. Add in 5% increase per year and that's your number.

I know what the commisssioned realtor will say. You can't

put the bid in for it would be an insult. Tell the realtor to buy it since it's such a great bargain.

DO NOT BUY A CONDO NOW. CONDOS WILL CRASH 50% IN VAUE. THEY DID IN EARLY 1990'S. NO REALTOR WILL EVER SHARE THIS INFO.

WHAT THE HELL DO YOU GET WHEN YOU BUY A CONDO. MAINTENANCE PAYMENTS NO PRIVACY AND NO LAND. WHAT DO YOU OWN?

Whenever anyone tells me they are interested in buying a place now, I tell them to register and log into taxrecords.com. Then, for every home you are interested in, do a lookup into the tax database and find out what the owner paid for the place.

If you are feeling generous offer about 7% a year on the price they paid..

grim

Thanks grim.

The taxrecords.com is really useful.

In recent 3 weeks, my wife and I were looking at houses in North Brunswick and Edison area. At least 5 out of around 14 are reducing price about 10k to 20k. Some of them were in the market for a while and some are just a few weeks before the reduction.

Now even my wife believes that the market is going down and is willing to stay in appartment for a bit longer.

ailuj

My agent told me one of his clients bought 1db condo in Edison Hollow at 160,000 last year and ask for 190,000+ now.

this condo has been on the market since sept. and has been relisted this month.

an acquaintance of mine just bought an $800,000 1BR apt on the upper east side in Oct. when he told me at a party I held my breath so as not to start screaming IDIOT. he proceeded to explain how house prices in NY could never go down because there isn't any more land, and "there's only one Upper East Side."

well, seems to me, Manhattan was already pretty built up in 1998 before co-ops appreciated 150%. so is there 150% less land now?

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home