October 2005 Sales

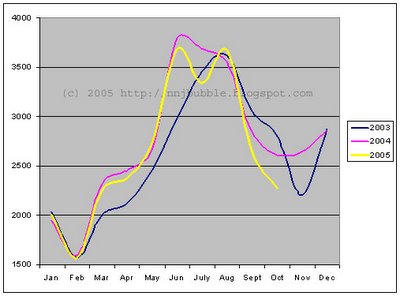

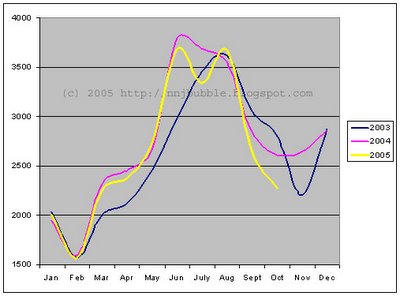

Here is perhaps the most interesting of the October data. I provided this chart for the first time last month, and will continue to update it in the future. The chart overlays the monthly sales data for 2003, 2004, and 2005. The data is not seasonally adjusted so that you can view the actual sales data and make your own assumptions about trends in activity. This data is based on sales activity for Bergen, Essex, Hudson, Morris, Passaic, Somerset, Sussex, Union, and Warren Counties. This chart is based on GSMLS data only.

I think it's quite obvious to see that sales this year have dropped off rather significantly after the end-of-summer peak. We're headed into the early winter slump rather quickly and steeply. It will be very interesting to see how this data plays out over the next few months.

Caveat Emptor,

Grim

8 Comments:

I applaud you for your efforts in reporting the facts. NOT SPIN. I just hope this information may help a few people not get sucked into the real estate lunacy.

I suggest you send this information to various media outlets. The FACTS need to get out.

Unfortunately price reductions go from insane to insane. Ran a 7% compounded growth (I think this is very generous growth) in several N. NJ areas and prices are about 34% overvalued to get to that 7% trendline. If it was at 5% it would be about 43% overpriced to the 5% trendline.

Prices are ridiculous and the drops are a joke.

Agree with the 30% overvalued estimate. No matter what models and scenarios I run through (be it rent/buy, earnings/home prices, rent/home prices, inflation/home prices, wage growth/home appreciation) the ~30% figure seems to always come up. At this point, I really have no doubt about my overvaluation estimates.

We've got a long way to go until we hit the bottom. Aggregate, I don't think we've seen more than a ~2-3% reduction off peak prices yet.

grim

I agree, the radically overpriced homes have are dropping significantly as of late. However, I'd still hesitate before I called anything a 'deal' in today's market.

I think the tough part is so many of us have become numb to the prices.

grim

I see I have to bring you back to reality..

108 Hazel sold for $307,000 in 2000

107 Hazel sold for $208,000 in 2000

110 Hazel sold for $250,000 in 2001

Judging from the comps, I see that they probably bought the house updated, and didn't do the work themselves. 80% in 5 years? Sorry, I don't buy it. That house should be priced just about at $400.

grim

I pray every night that there won't be a taxpayer (i.e. fed) bailout of the big lenders when this thing falls apart. Taxpayers, will ultimately, get the shaft for the reckless lending. Not unlike the Long-Term Capital Management (LTCM) bailout. For those new to economics and the Fed, grab some popcorn, a drink, and read about the LTCM fiasco (plenty of good articles via google). It's pretty interesting from an econogeek point of view.

grim

The Real estate industry is built on taxpayor subsidies and guarantees. This BS needs to end. Keep the primary mtg writeoff and eliminate everything else.

House contruction does not add lots of value to make an economy competitive especially when the citizens are going into deeper debt and leveraging the future to a house.

A house is meant to be lived in not speculated or traded.

Prices are ridiculous and the drop is going to be harsh and swift. At least the first wave down. 3 waves down and then the regret and bankruptcies and hate for real estate surfaces.

Prudence and thrift will be rewarded. The Facts are on our side. Anyway way you want to dice it.

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home