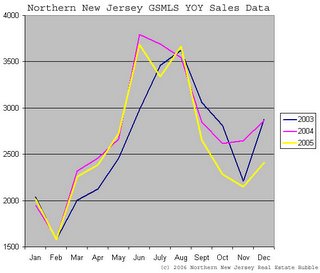

Northern NJ December '05 Residential Home Sales

I believe this to be the most up-to-date indicator available for the Northern New Jersey market. Why? Because anything else either lags the market by many months, or aggregates data into quarters.

The data shows what we've been seeing and hearing anecdotally for Northern NJ. While December sales did increase over November as usual, sales were significantly below what was seen in 2003 and 2004.

This data is not seasonally adjusted and consists of sales of GSMLS listed properties in Bergen, Essex, Hudson, Morris, Passaic, Somerset, Sussex, Union, and Warren counties. This data does not include sales from other listing services (NJMLS or Hudson MLS) nor does it contain FSBO sales. However, GSMLS is the largest MLS service in Northern NJ, thus we're confident that the data provided is representative of the market.

This data is not seasonally adjusted and consists of sales of GSMLS listed properties in Bergen, Essex, Hudson, Morris, Passaic, Somerset, Sussex, Union, and Warren counties. This data does not include sales from other listing services (NJMLS or Hudson MLS) nor does it contain FSBO sales. However, GSMLS is the largest MLS service in Northern NJ, thus we're confident that the data provided is representative of the market.

December 2005 sales were approximately 15% lower than both December 2003 and 2004, in line with anecdotal evidence as well as the NAR Pending Home Sales Index data posted for November.

While demand is still following typical seasonal patterns the trend is unmistakably downwards. The cooling of the Northern NJ market should be fairly obvious at this point. Waining demand isn't due to seasonal factors, it's due to significant changes in consumer psychology. I can't see how there will be any soft landing for Northern NJ.

Caveat Emptor!

Grim

12 Comments:

If not a secret, how do you obtain the sales data from gsmls?

Grim:

Just off-hand, do you recall what occurred in Nov 2003 to cause that blip? Was that a Sep/Oct 2003 event?

Not a secret at all, I've mentioned it in the past actually. I have a 'team' of local real estate agents that provide me the data directly.

I am not an 'insider'. In the past I mentioned that I was planning on getting a real estate license and setting up a corporation in order to gain direct access to the data. I'm still planning on it, but haven't seem to have found the time to go through with it (or justify the money it will cost me).

grim

chicago,

Not entirely sure, I've been trying to go back through news articles to understand. I did some minor investigation when I first plotted the data but never dug deep.

The best I could find is that in August and September 2003 mortgage rates spiked very high.

HSH Mortgage Statistics 2003

Since the data represents closed sales, it's possible that the rate spike in August and September significantly deterred new buyers from signing contracts in that time period. The significant drop in rates shortly thereafter can possibly explain the dramatic rebound seen a month later (6.47% in August on the 30Y Fixed to 6.07% in November on the same paper).

grim

Sir you are dreaming.

Ever take a look at the typical bubble aftermath. It took Japan 13 years to bottom. And finally it's going up but when your down 60% on a $200,000 house or $80,0000 value 50% increase only takers you to $120,000. Sounds real scvary doesn't it. But this is reality at some pojnt and there are risks to owining a house.

IMO any baby boomer that purchased in the last few years will be lucky just to breakeven by retirement, if they can even retire because most are living way beyond income capaicty and not saving. The housing ATM isn't going to bail them out in retirement.

when you say "Northern NJ" but get your information from the GSMLS, you are missing some key information regarding Northern NJ home sales.The Hudson County MLS accounts for a large portion of "Northern NJ" housing and information from this service really should be taken into account in your recaps and conclusions regarding the bubble.

Since it sounds like you are an 'insider', would you like to provide me with that information? Are you an agent in Hudson?

Current Hudson County listings via MLSGuide are currently approximately 1700 (single family, condo, and coop only). The seasonal drop we've seen puts todays numbers back to where we were in late October. Current GSMLS listings are over 11000.

I really don't believe the addition of Hudson county data would make a significant impact on the trends we're seeing. If I plot the data I have for each individual county, the trend is largely the same, which leads me to believe that the current trends are not confined to smaller markets, but does indeed describe all of "Northern NJ".

grim

Anonymous said, "Japan's real estate market took 13 years to bottom out". In japanese culture, it is uncommon to sell the house you live in. Once you buy a house, you stay. That is probably why it took 13 years. It is different story here in U.S. at least for residential market.

Landgrab,

It would be wise for you to include an adjustment for inflation as part of your calculations. If you purchase a home today for $500,000 and in 10 years you find it worth $500,000, you've lost a significant amount of money.

Compare that to someone who waited. Perhaps they purchased the same home for $375,000, 25% less than you did. When ten years pass they may not have made a fortune, but they've at least hedged against inflation and didn't lose money.

Many people need to sell their homes, however, absolutely no one needs to buy a home.

Landgrab, I think come August you may find that your outlook has changed dramatically.

Caveat Emptor!

grim

" In japanese culture, it is uncommon to sell the house you live in. Once you buy a house, you stay. That is probably why it took 13 years. It is different story here in U.S. at least for residential market. "

-if the US housing market had similar declines of 60% in value it will become just as unusual to sell the house you live in regardless of our culture....because just like in Japan most wouldn't be able to....Who would be in a position to cover a 100 to 300k loss?

re. the question "who can cover a 100-300k loss?" Let's remember, a lot of those fine folks who are trying to sell for 750 bought their houses 10 years ago for 250. the price could drop to 350 and they'd be fine, just not magically wealthy off of an overappreciated market.

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home