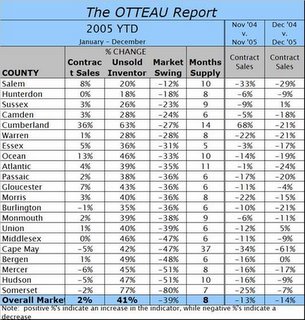

The Otteau Report - New Jersey Real Estate 2005 YTD

RESIDENTIAL MARKET REACHES SATURATION POINT

The deceleration in the New Jersey’s residential housing market continued in December as the number of buyers entering into a contract to purchase a home fell by 14% as compared to one year earlier. And although the number of homes being offered for sale actually declined from November by 521 homes statewide, overall inventory finished 2005 with an increase of 12,462 more homes than one year ago. These trends do not come as a surprise, but rather reflect an ongoing slowing of the residential market which began in September.

As indicated in the table at right, statewide contract-sales activity increased 2% for 2005, while the inventory of unsold homes increased by 41%. This imbalance indicates that the strength of the residential market declined by 39% over the past year, as reported in the Market Swing column. This information is also provided on a county basis, which those counties exhibiting the greatest loss of velocity appearing towards the bottom of the chart. The weakest county performance last year was Somerset, with a swing of -80% (note: percentages may appear slightly irregular due to rounding). As a general observation, note that those counties appearing in the bottom half of the list tend to have higher home prices. While this is not absolutely true, as evidenced by Cape May County, it is generally true and provides confirmation that the weakest segment of the housing market continues to be concentrated in the higher price ranges. This trend, which has been prevalent for several years now, is likely to worsen with time and holds the potential to reach a flash-point later in this decade as the anticipated exodus of aging-baby boomers out of their present homes and into a next-phase of their lifestyle builds to a crescendo.

Surprising numbers don't you all think? A 41% increase in inventory statewide? It's hard to believe an imbalance that large wouldn't put significant downward pressure on prices. We haven't even seen the bulk of the spring inventory either, which I'm predicting are going to be rather large.

The Hudson numbers will likely come to a surprise to many, not in that they weren't expected, but because many of us were looking for a confirmation of what we've seen anecdotally.

All data, text, and tables are copyright of the Otteau Group. More information can be found on their website: The Otteau Group

Caveat Emptor!

Grim

8 Comments:

So what is the dynamic here? That inventories are building and that buyers will start dropping prices?

Supply and demand. the realtors motto. This time supply is overwelming demand=price drops.

Otteau aren't predicting prices will go down, they wouldn't dare.

They are still biased. They are in service to the real estate industry. Can't bite the hand that feeds you.

I'm not sure how you could come to any other conclusion after taking a hard look at the numbers.

I may actually go to their Spring workshop. I'm sure I won't be well received there.

grim

Wow, Capemay at 37 months! I recall that 6 months is considered normal.

Just an observation. The rural areas or exurban counties have lower inventory while the shore counties have higher. Demographically they differ in that the shore counties tend to have more retirees while exurbans tend to have young families with kids.

The shore are has had a ton of age restricted housing built while everywhere in the state builders are met with local hostlility when regular housing is proposed.

Do you think this chart shows that kind of out of kilter building that has gone on in the state and do you think age restricted housing may be a failed endeavor.

Just one more thought. What happens if you build senior housing and noone wants it? Does it lose it's age restricted status or does it get bulldozed?

My opinion was based on:

As we look forward to Spring, the good news is that the real estate market will not collapse, and will likely see an overall increase in home prices during 2006 – although at a greatly reduced pace from prior years. However, the Spring market is likely to be “late and brief” as the anticipated increase in buying activity will be partly offset by an increase in homes being offered for sale.

grim

Given the most recent release of economic data this morning, and yesterday. I feel very strongly that we're going to see quarter point rate hikes out of Bernanke on his first and second meetings, pushing the rate to 5%.

Given the unemployment rate, jobs creation, and significant increase in wage pressures, a pause just doesn't seem at all likely any time soon. The prelim Q4 GDP numbers will be revised higher in the near future, the low numbers were certainly an anomaly.

While the ECB paused on a rate hike just recently, it is almost certain that they'll hike a quarter point in early March.

Yield on the 10Y is up to 4.6 this morning.

grim

grim:

that's right about the Fed

4.75% is a lock - 5% is now legitimately in play for mid-May

chicago

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home