New Home Sales Down 5.7%, Inventory Up 27%

Census department released the New Home Sales data earlier this morning, that data is available here:

NEW RESIDENTIAL SALES IN APRIL 2006

"Sales of new one-family houses in April 2006 were at a seasonally adjusted annual rate of 1,198,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.9 percent (±11.5%)* above the revised March rate of 1,142,000, but is 5.7 percent (±9.8%)* below the revised April 2005 estimate of 1,270,000."

"The median sales price of new houses sold in April 2006 was $238,500; the average sales price was $298,300. The seasonally adjusted estimate of new houses for sale at the end of April was 565,000. This represents a supply of 5.8 months at the current sales rate."

Keep in mind monthly revisions can be dramatic, March was revised downward dramatically, from 1213K to 1142K. Why is this important? Prior to the revision, April would have been down 1%, instead due to the revision, it's actually up 4.9%.

April median and average prices were below peak prices set in September of last year.

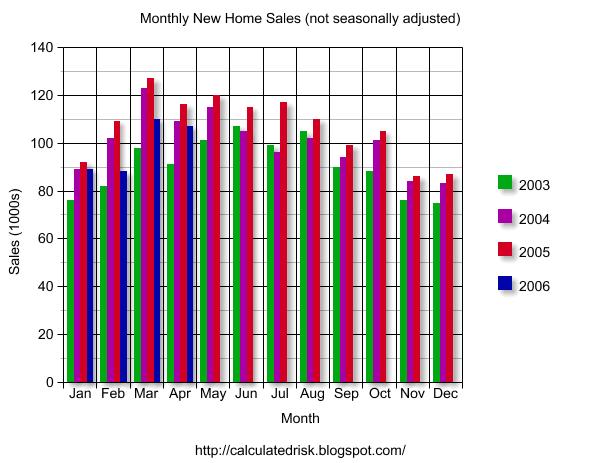

It's difficult to understand the trend when only talking about the monthly change, especially when the monthly changes can be somewhat volatile. The best way to view this data is visually, and Calculated Risk does a great job of graphing it out.

Calculated Risk - April New Home Sales

Year over year, sales for April were down 5.7% Nationwide. The Northeast saw the largest year over year decline (33.3%), followed by the Midwest (16.9%), and lastly with the West declining 12.5% YOY. The South saw an increase of 6.7%.

New Home Inventory is up 27% year over year in April with 565,000 units available, a new record.

Caveat Emptor!

Grim

NEW RESIDENTIAL SALES IN APRIL 2006

"Sales of new one-family houses in April 2006 were at a seasonally adjusted annual rate of 1,198,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.9 percent (±11.5%)* above the revised March rate of 1,142,000, but is 5.7 percent (±9.8%)* below the revised April 2005 estimate of 1,270,000."

"The median sales price of new houses sold in April 2006 was $238,500; the average sales price was $298,300. The seasonally adjusted estimate of new houses for sale at the end of April was 565,000. This represents a supply of 5.8 months at the current sales rate."

Keep in mind monthly revisions can be dramatic, March was revised downward dramatically, from 1213K to 1142K. Why is this important? Prior to the revision, April would have been down 1%, instead due to the revision, it's actually up 4.9%.

April median and average prices were below peak prices set in September of last year.

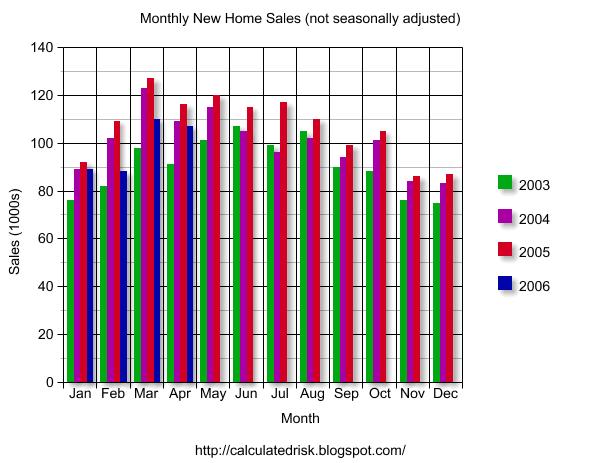

It's difficult to understand the trend when only talking about the monthly change, especially when the monthly changes can be somewhat volatile. The best way to view this data is visually, and Calculated Risk does a great job of graphing it out.

Calculated Risk - April New Home Sales

Year over year, sales for April were down 5.7% Nationwide. The Northeast saw the largest year over year decline (33.3%), followed by the Midwest (16.9%), and lastly with the West declining 12.5% YOY. The South saw an increase of 6.7%.

New Home Inventory is up 27% year over year in April with 565,000 units available, a new record.

Caveat Emptor!

Grim

34 Comments:

the suprisingly up new home sales spin... is just that... it's noise... this housing market is going nowhere... just follow the inventory and you'll see the direction of this market... eco 101 supply/demand curve: sales stay flat or decrease, supply increases, price follows the new market reality.

anon 12:33 "...it's noise... this housing market is going nowhere..."

We know, but this just encourages the greedy realtor and sellers that are already in denial out there. How can we get the truth when only lies are being released in the media?

Question: Are these sales that closed? If so, they could have been in the pipeline for 3-9 months. Homebuilders in Florida had a two year waiting list about 10 months ago.

Can someone clarify?

Anon @ 12:45,

From the Census Bureau:

Comparing New Home Sales and Existing Home Sales

New home sales and existing home sales are released each month at about the same time. Many comparisons are made between the two series, but before doing any comparisons, one must be aware of some definition differences that affect the timing of the statistics.

The Census Bureau collects new home sales based upon the following definition: "A sale of the new house occurs with the signing of a sales contract or the acceptance of a deposit." The house can be in any stage of construction: not yet started, under construction, or already completed. Typically about 25% of the houses are sold at the time of completion. The remaining 75% are evenly split between those not yet started and those under construction.

Existing home sales data are provided by the National Association of Realtors®. According to them, "the majority of transactions are reported when the sales contract is closed." Most transactions usually involve a mortgage which takes 30-60 days to close. Therefore an existing home sale (closing) most likely involves a sales contract that was signed a month or two prior.

Given the difference in definition, new home sales usually lead existing home sales regarding changes in the residential sales market by a month or two. For example, an existing home sale in January, was probably signed 30 to 45 days earlier which would have been in November or December. This is based on the usual time it takes to obtain and close a mortgage.

Effective with January 2005, the National Association of Realtors created a new monthly series to overcome the lagging effect of the existing home sales definition. This new series is called Pending Home Sales and is based on sales of existing homes where the contract has been signed but the transaction has not been closed, making it roughly equivalent to the new home sales definition. Monthly estimates are expressed as an index where the year 2001 has been set to equal 100.0.

Keep in mind these are based on contracts.

Homebuilders have seen a marked increase in contract cancellations recently.

grim

Businessweek Online: Real Estate: The Going Gets Tougher

Interest rates are rising and markets across the U.S. that have seen phenomonal growth are slowing or declining. What's an investor to do?

"MAKING A BUNDLE." That game is almost over, Kane says. For one thing, his bank has tightened lending standards, requiring at least 30% down in equity, up from just 10% a couple of years ago. Those buyers now have to come up with a larger percentage of cash for a more expensive home. Kane is predicting a decline of as much as 50% in sales of second homes. "The large scale appreciation, I don't think we're going to see it," he says.

who really cares what the media does or how it spins it... they're always late and behind the curve... the more important issue is inventory... there's a ton of it and it's still growing... the current absorption rate can't keep up with it... it will take years for the real estate market to work off this glut.... also, don't buy into that noise of -- "there are many buyers who are just waiting on the sidelines for prices to dip." That's total non-sense... there are just way too many sellers and not enough buyers.

Yesterday, according to Bob Toll, the inventory glut would be worked off in 6 months.

Who the hell would trust anything Bob Toll says at this point?! He's already made his position clear by his actions, not words.

Inventory piling up by the month as builders continue to build houses and will get caught holding the bag.

NO MAAS to Insane Ripoff House Prices and to greedy sellers/starving realtors

BOYCOTT HOUSES!

Booooooyaaaaaa

Bob

The sad part about the inconsistent news reporting regarding adjusted new home sales is that it serves to mask the timing of the impending recession.

Wealthy can then get out and leave midclass slobs holding the bag.

http://money.cnn.com/2006/05/24/news/economy/fed_yield_curve/index.htm

"10-year Treasury yield slips below fed funds rate for first time since last recession.."

"The condition, which occurs when long-term interest rates are lower than short-term rates in the Treasury bond market, was once seen as a pretty clear signal of a recession ahead."

"The 10-year yield dipped briefly below the fed funds rate Wednesday morning after a report showed a big drop in demand in April for cars, refrigerators and other big-ticket items known as durable goods.

But when a report on new home sales came in above forecasts 90 minutes later, the 10-year Treasury yield edged back above the 5 percent level."

Yeah, let's tell the dummies that everything's OK because housing is OK so we can move our money now.

Could anyone please help me with this listing to see whether it has any recent price reduction?

2276272

Original List Date:5/9

Original List Price: 789,900

Thanks, pal.

So they (seller and realtor) realize the house is overpriced. But do they think a mere 20K in listing makes a whole lot of differences?

keep coming down to a more reasonable level, then we will talk.

It seems they are willing to give up a little, but not much. It takes them 3 weeks to come down 20K, I guess it will take them 3 months to come down another price reduction.

How can I find if a listing had a price reduction and how many days on market?

The bullish media hype will change as time goes on. These monthly reports are fed to the general public by correspondents who are literally phoning them in.

Most people know that the party is over. Three people in my office have homes for sale- one in NNJ. He just lowered his price by $25,000 on advice by his realtor.

There is no new money coming into the market. First time buyers have been priced out of the market. Lately I've been looking for homes in Pennslyvania. My real estate agent tells me that business is very slow. He says that many signed contracts this spring are on the contingency that the buyer can sell their property.

In my opinion, for what that's worth, I think this market starts to drop significantly late this year and into 2007. I see price drops earlier buy some buyers being seduced by a false bottom at the beginning of this summer.

anon 3:52

I can't post it. I'll have to email it to you.

NJAR First Quarter Stats have been posted:

NJ 2006 Q1

Please hold back comments until I can open a new topic on this. It's going to take me an hour or two so mull over the data for a bit.

grim

BABABABABABABABABBA

BOYCOTT BIDDING ON HOUSES!

NO BIDS!

BOOOOOYAAAAAAAAAA

Bob

No interest NO BIds No NOTHING!

Just misery for starving realtors and greedy sellers trying to rip you off.

BOYCOTT BIDDING!

Booooyaaaaaaaaaa

Bob

Let'em them kiss your behind.

You waited you listened to the chatter NOW ITS PAYBACK time.

Payback time = Deep price cuts and concessions

Boycott Bidding!

Booooooyaaaaa

Bob

That's RIGHT!

Trying to RIP you OFF!

Misery index climbing.

You can sense the realtor frustration and seller desperation.

NO BIDS!

Booooooooyaaaaaaaa

Bob

Bob-

While I enjoy your boooyaaa interludes from time to time, I often wonder if you are holed up in a dark basement somewhere with a single uncovered light bulb and a 286 computer w/dial up tapping out your missives...

Keep up the good work...

JM

Bob,

You are being much too free with the "Booyah". It is a thing to be savored. To be used selectively. Used for maximum impact.

It's like a fine wine. Drink the Schlitz every day, but pull out the "Booyah" for the special occasion.

Jim Cramer was too free with his "Booyah", and what happened? Nobody takes him seriously anymore. Contrarians look to him for ideas on where not to go.

grim

I think Boooooyaaaaa Bob was an abused child.

B-Bob, seek professional help while there is time. As a psychoanalyst, I feel you have some deep issues regarding a lack of attention.

Bergen county is down 40% and morris county is down 11%... those are huge numbers... will the media or NJ newspapers, publishers, etc pick up on this? something tells me not..

Those sales numbers, down 40% and 11%, are for existing homes... not new homes...

Booooooooyaaaaaaaa

Bob

Its time we hear from you ....

hey JM

Thanks for your thoughtful insight.

As i bid u farewell.

BOYCOTT BIDDING!

Iiiiaaaaallll beeee baaaack!

Bob

It would be interesting to know the housing inventory for the NE and/or the tri-state area(E. PA could be thrown in for good measure) since these could all potentially compete for residents.

For instance, someone in Rockland could potentially work in NYC, NNJ, Westchester, or upstate. Someone with a job in NYC could live in Westchester, LI, Rockland, CT, or NNJ.

I know someone who works in NYC who started looking in Westchester and gave up and found a nice place in Chatham for much better price.

Just sort of wondering how downturn will impact NNJ inventory if other Tri-State areas start to drop significantly.

JM

I attended 2 open houses this weekend. One was a realtor who was selling her own house but pretending to be an objective realtor. She forgot to hide the family photos around the house. After the open house I checked the tax records to find she wanted some fool to make her $400,000.00 richer then when she purchased the house in 99. The best part of the day was my wife's comments to her about how poorly the house was furnished without seeing the photos. The look on the realtor's face was great. By the way we were the only names on the sign in sheet 2.5 hours into her open house. The realtor at the other open house admitted the price was high and his client wanted to know about any and all bids. Once again I left checked the tax records and found this person also wanted me to make them $400,000.00 richer. I am now a convert to the Tao of Bob. Boycott. Unless I want a good laugh at an open house.

"The best part of the day was my wife's comments to her about how poorly the house was furnished without seeing the photos."

Funny stuff, that's great!

As for researching a house, in the past, I would typically go to school on a house (tax records, prior sales, etc) before even driving past.

But for me, no more Open Houses until 2007 or later.

Tao of Bob... Love it! :)

I guess we can now expect to see specialized buy side realtors who will squeeze sellers since that's easier to do.

Post a Comment

<< Home