More on the 40-Year

From the NY Times:

Payments That Last a Lifetime

WITH the recent climb in housing prices, more buyers than ever have been faced with a dilemma: swallow a monstrous monthly payment and risk financial ruin, or settle for a less desirable, more affordable home.

But bankers say homeowners need not face that choice as long as they are prepared for the possibility of spending their retirements paying off their mortgages.

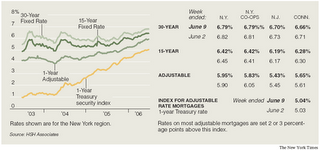

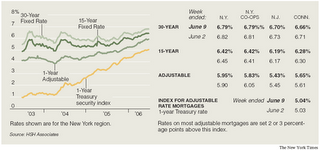

The 40-year mortgage, often a cameo player during real estate booms, is once again on stage, as middle-income families look to cut a few extra dollars from their monthly outlay. For many, the prospect of such a protracted payment schedule is less daunting than an adjustable mortgage, which in a climate of rising interest rates can be scary.

...

Month to month, the difference between 30- and 40-year fixed mortgages can be significant on a tight budget. A $300,000 loan at 6.5 percent, amortized over 30 years, costs about $1,896 per month, while the payment for a 40-year loan is $1,756.

But since rates on 40-year mortgages generally run one-eighth to one-quarter of a percentage point higher, recalculating that 40-year loan on the same property at a more realistic 6.75 percent results in a monthly payment of $1,810.

2 Comments:

What a waste of time just to save $50 a month.

10-20 EXTRA YEARS of mortgage-debt SLAVERY !!

Post a Comment

<< Home