The funny thing about bubbles, is that you never know when they’re over.”

From the New York Times:

Read Between All Those For-Sale Signs

Read Between All Those For-Sale Signs

REAL bubbles pop. They are fully formed one moment and gone the next. Financial bubbles rarely meet with such a definitive end, which has always been the biggest problem with the metaphor. They let out their air in unpredictable bursts, and it’s usually impossible to figure out whether they have finished deflating or are just starting to.

Still, the latest housing numbers seem like they could be a turning point. A real estate crash might not be the most likely outcome, but it certainly seems legitimate to think about what one would look like.

...

The collapse of most bubbles does not have a single obvious starting point, like a bad corporate earnings report or an interest-rate rise. Instead, the psychology of buyers and sellers shifts, slowly at first and then sometimes in a cascade.

“It’s always mystified people about why these things turn,” said Robert J. Shiller, a Yale economist and author of “Irrational Exuberance,” a history of speculation. “People want something concrete.”

There seem to be three major paths that housing could follow over the next year: a soft landing, the start of a long slump, or a crash. A soft landing is the one predicted — and preferred — by most economists on Wall Street and at the Fed. A long slump is what many past real estate booms turned into. A crash is the outcome that a small group of analysts say is the only possible ending for the biggest housing boom of all.

...

But earlier booms have been followed by modest price declines in some cities that turned into long periods in which increases trailed inflation. After peaking in much of California and the Northeast in the late 1980’s, house values fell during the recession of 1990-91 and then drifted for years, often rising more slowly than the price of milk.

In inflation-adjusted terms, prices in the New York and Washington areas did not return to their late-80’s peak until 2002. In Boston, it didn’t happen until 2000, and in San Francisco, 1999.

28 Comments:

The bubble is bursting! The bubble is bursting!!

Ugh. I've read enough of these stories to last a lifetime. What I want to see is an actual decline in prices. Then I'll start to believe.

Until then, this subject has been talked to death. Enough already.

Anon @ 6:25

NAR confirmed that the year over year sale for July 2006 is almost zilch (0.9%). Negative if inflation or closing costs are taken into consideration.

Year to date gain is negative.

"What I want to see is an actual decline in prices. Then I'll start to believe."...

Me too - I'll look at a new listing and just laugh at the price. Homes are over priced in my area by 200,000 easily. Then they "reduce" 10-20k. That is peanuts when the asking price is 800k+.

“H&R Block Inc., parent of Option One Mortgage Corp. in Irvine, said late Thursday that it would take a $102-million charge when it reports earnings next week. H&R said it was being forced to buy back Option One loans from big investors.”

“As home prices shot up in recent years, the industry turned to riskier loans to keep business going. With housing now slowing sharply, mortgage companies have been firing thousands of employees and putting themselves up for sale.”

“Option One caters to riskier borrowers who must pay higher interest rates and fees because their credit is flawed or their income and equity levels aren’t high enough. The company and other so-called sub-prime lenders transfer the risks by selling loans or mortgage-backed securities to other firms and investors. But if the loans quickly fall into default, or if they have been misrepresented to borrowers or investors, the originators can be forced to repurchase them.”

“Several sub-prime lenders in addition to Option One have reported having to repurchase higher quantities of loans, Friedman, Billings, Ramsey Group Inc. analyst Scott Valentin noted in a recent report.”

“H&R’s statement indicated problems of another kind: borrowers failing to make even the first few payments. In addition to ‘an increase in early-payment delinquencies,’ it said loan buyers were becoming less tolerant of problems and quicker to demand repayment when something goes amiss, noted analyst Kelly Flynn at financial services firm UBS.”

“H&R’s statement indicated problems of another kind: borrowers failing to make even the first few payments.

The First few payments?

Holy Smokes

"reduce" 10-20k" is standard, who is going to drop 200,000 this early in the game. Give it 6 months.

That comment about how long it takes to get back to where it was in real terms is very telling. I remember seeing a chart on CR or somewhere recently showing Dallas prices since they peaked in 86.

They haven't gotten back there yet.

Lindsey

But it won't happen in the NYC metro area or anywhere north or Washington DC or east of the Delaware River or South of Albany (this encompases the NYC Metro area)...

Too many tranplants and very wealthy people who have been drinking the kool aid handed out by realtors, rental brokers & car dealers and willing to go into extreme debt for these things.

How is it that someone making $100,000 - $125,000 in their first job suddenly is able to purchase a one bedroom condo for $800,000 in Chelsea or Tribeca, or a $700,000 one bedroom 700 square foot condo on the Jersey City waterfront???

Prices ARE NOT falling by any sigficant amount especially in the 'other 4 boros' outside Manhattan where a one bedroom co-op in the far reaches of Queens starts near $300,000 when it sold for less than $150,000 in 2004.. Add in another $600 or so per month for maintenance + 25% down & board approval is required.

Well, in this area prices ARE NOT going down. Just a bunch of fucking arrogant realtors who think that the party of 2002-2005 is still going strong and that prices will continue to rise by 20% a year forever since 'Everyone wants to live in or near NYC'.

FYI - the memo says "show some patience"

cross off 2006

the false bottom is anon

do I hear cross of 2007?

given the precedent of past RE downturns, this one is transpiring at lightning speed

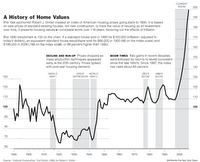

That chart is fabulous. Click for the larger view.

It's interesting how "superstar cities" like New York and San Francisco lost their allure time and again, as home prices plummeted again and again.

"Until then, this subject has been talked to death. Enough already."

Seems you're visiting the wrong blog, have you read the title? "Northern NJ Real Estate Bubble."

And prices are dropping, and have been for awhile. Here's a concrete example:

18 Meadowbrook Road, Short Hills

$795K

MLS 2299446

3 Bed, 2.5 Bath

http://www.realtor.com/Prop/1064548644

Been on the market since March 2006 (MLS 2253723) @ $875K (LOL!), tomorrow is the 8th open house. No greater fools signing up. It's been priced at $795K (still overpriced) for a long time.

This seller is in denial, and has paid dearly as the house sits vacant for many months.

But that's not the real story. The real story is the neighbor's new comp on the market (listed today), for $90K less:

8 Meadowbrook Road, Short Hills

$709K

MLS 2313131

3 Bed, 2.5 Bath

http://www.realtor.com/Prop/1066896525

Same street, same size house, $90K less. Sellers who continue to remain in denial are going to feel much pain -- "there's more coffee coming."

Anyone who can look at that chart and not see we were in a massive bubble, and believed those prices were 'maintainable,' is simply not rational, or has an agenda to fill.

And for anyone who might think the 8 Meadowbrook Road house is a "good deal" at $709K, note the prior sale price:

$585K in July 2004 (MLS 1688778)

The dreamer at 18 Meadowbrook closed at $755K in June 2004 (MLS 1671861) is just about underwater given closing and carry costs, and the house STILL isn't sold. Carry costs will continue to bleed him dry. Add the new competition @ $90K less into the mix, and this "owner" will indeed bring a check to the closing.

Fascinating stuff to observe, some valuable lessons to learn with just these two houses.

any tightening in lending standards and all bets are off. prices will come down.

im seeing about 8 out of 30 listings where people who bought 04-05 are going to walk away even if they get asking price. so they are only %8 or so over what they paid. and these houses are not moving.

we have reached affordability limits if we see credit crunch or local job loss. forget about it.

I agree, the housing slow down is "ahead of schedule".

I expect to see a fair amount of contract cancellations this week because of the recent news about fast paced slowdown.

"fast paced slow down" - oxymoron :)

I guess we can start calling it FastDown

People, people. Is not the only true decline in price one that shows not discounts off OLP but declines over previous sales of truly comparable houses? (OK, maybe we can throw in inflation and talk real dollars.) Many spring/summer '06 sellers overpriced badly, assuming they could easily get 10-15% or more over last years comps--it just ain't happening. But there is still a big difference between selling for less than you hoped for and selling for less than you would have last year (though that day has arrived for some markets). I think the biggest pinch here is that a 5-6% commission and original closing costs cannot be recouped by short term owners through home appreciation anymore; those folks will indeed be bringing checks to the table. One of the many reasons I am getting out of the RE market now is that transaction costs are so high and I am not ready to settle down for a 5-10 year stay.

--CJ Sell-out

Superstar schmuperstar. I can already move back into my old nabe for less than I sold for last year. Analysts can make these kinds of rosy statements because hard data in nyc are hidden by the RE industry.

But anecdotally, prices now are flat to falling, bidding wars are gone and buyers' lowball offers are being accepted. And still, inventory is ballooning.

And for those too young or too naive to remember, NYC was a supercrime city in the 70s and 80s - with huge fiscal problems due in large part to an eroding tax base.

If recession hits us, crime is gong to go up (it already has in some areas), and many blocks that looked attractive in boom times are going to get scary -- particularly in outer boros.

People coming to NYC now will be much more likely to rent than buy (which is why the rental market is up now), but eventually when sellers realize they can't get their pie in the sky prices, and all those condos being built turn into rentals amid a slumping economy, the rental market, too, will flatten and/or drop.

Well, I took a look

at the Real Estate Sections

Seems to me, many prices still

sky high.

My impression, you have shit boxes

selling for 700-800k, especially

in Bergen,.

I guess the sellers still don't get it, or they have the staying

power.

Of course your close to NYC, I guess

that makes the diff.

How about this one

for Closter. 549K, calling

all builders , sold as is.

So its a knock down for 549K, taxes

on that one. About what? 10k

Could anonymous 10:19 explain where the $300,000 1-bedroom co-ops are in the far reaches of Queens. In Forest Hills, Queens, co-op asking prices are dropping weekly and 1-bedrooms are well below $300,000.

cj said

"One of the many reasons I am getting out of the RE market now is that transaction costs are so high and I am not ready to settle down for a 5-10 year stay."

cj good luck getting out now hope your not too late to the dance. if your not ready to settle for another 5-10 why did you get in in the first place? and im just curious when did you get in? and i agree that sellers are 10%-15%-20%

higher priced then last year. i looked at comps from the fall of 05 and you could get much nicer then.

but remember nationaly prices went up .9% thats yoy and the northeast was down (-) thats negative 2.6% yoy so people people its already coming down.

the more negative press the public sees the more turned off buyers will become. its herd mentality and the pendulum has swung the other way

"reduce" 10-20k" is standard, who is going to drop 200,000 this early in the game. Give it 6 months. We will - we have already given it 12 months and it is getting frustration. Prices are still way out of control.

"already given it 12 months" What are you talking about, 12 months ago some houses were still selling. There is no "getting frustration" it takes time for the market to change, it is and will happen. We are in the "I still want my inflated price for my house" stage. Sellers will change, but It will take a few more months.

Richard, probably a typo, but the difference between the two houses is $86K, not $66K.

Interesting to watch the Greedy Grubbing sellers go down with the ship.

Just look at the chart!!!!!! If anybody thinks a 10% decline is an opportunity to get back in, please take another look!!!!!!!! Stop complaining that asking prices are still ridiculous. This will be like chinese water torture. Remember sellers are always one year behind the market. The H-builders topped out in 8/2005. Sellers are just getting it now. It will be a slow grind down process for the rest of 2006 and 2007, maybe part of 2008.

If you look at the chart you see 120 was a major resistance point for the past 110 years, up to the year 2000. The last 6 years look like a soybean chart, in the middle of a drought, not a real estate chart. This parobolic move represents a major blow off top. Make no mistake about this, this market will retrace back to it's 110 year resistance point,this will now become support, back to 120 and eventually to its norm, between 100-110. This represents a 40-50% downside move, remember prices always retrace to the norm/mean,it's the universal concept of pricing.

If you think you are getting a good deal now, just remember that this downside move is in its infancy. I will plan to get serious about this market when this same graph shows a # around 110. How long will that take, it's anybody's guess. You may make your decision to buy based on a 10% or a 20% drop. That's fine if it works for you. I will make my decision based on fundamental, no need to go into this, it has been disected many different ways on this site, and technical factors (like this chart). This is more important to me than a specific % drop off an asking price. Remember, the deal that you think you are getting today, may be a topic of discussion on this site if you are looking to sell in 3-5 years. It may even be a a part of lowball in 2009-2011!!!!!!!!!

Patience and more Patience,

BC Bob

My impression, you have shit boxes selling for 700-800k, especially in Bergen,.

Are they really selling for this much or are they just listing for this much?

okay... I'll stop pouting and wait a bit longer! :)

Birde, play nice. I bought twelve years ago, and saw my son through HS graduation. Too bad he wasn't Class of 2005 (we should have planned better.) I'll be fine, just a little less fine than I'd hoped; and yes, it took time to reconcile myself to the new market realities. I doubt I'll buy again any time soon because market uncertainty + personal uncertainty + high transaction costs make it a non-starter.

--CJ Sell-out

Post a Comment

<< Home