Real Estate Slump Turns Painful

From the Wall Street Journal (via Moneyweb):

Housing slump proves painful for some owners and builders

'Hard landing' on the coasts jolts those who must sell.

Housing slump proves painful for some owners and builders

'Hard landing' on the coasts jolts those who must sell.

For years, real-estate brokers and home builders promised that the soaring property market eventually would glide to a soft landing. These optimists predicted that home prices, which had more than doubled in parts of the country between 2000 and 2005, would continue to rise, but at a more normal pace of 5% or 6% a year.

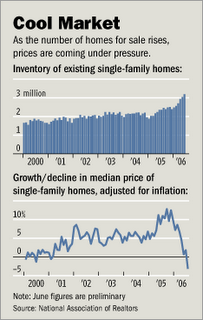

It isn't working out that way. The rapid deterioration of the market over the past 12 months has caught many homeowners and builders off guard. Some are being forced to cut prices far below what their homes could have fetched a year ago. It's too early to say how hard the landing will be, but at a minimum it will be bumpy for many people who need to sell homes. And the economy as a whole, buoyed in recent years by the housing frenzy, could suffer.

The pain that homeowners and home builders are now feeling follows a raging national house party. As Americans soured on the stock market after the tech bubble burst in 2000, they poured money into real estate, spurred on by the lowest interest rates in four decades and looser lending standards. Surging demand created home shortages in California, Florida and the Northeast. Over the five years ending Dec. 31, average U.S. home prices jumped by 58%, according to a federal housing index.

But mortgage rates began rising and surging inventories of homes for sale finally caught up with demand. Though economists had been predicting a slowdown in housing for years, many homeowners and builders were surprised by how fast the market changed. "It's just like somebody flipped a switch," says Lynn Gardner, a real-estate auctioneer who works in Northern Virginia.

...

In much of the country, property markets began cooling rapidly in the second half of last year. Home builders were still turning out houses at a rapid clip, and the surge of new and previously occupied homes on the market convinced buyers there was no need to hurry. Over the past year, the number of previously occupied homes listed for sale nationwide has risen nearly 40%. In some metropolitan areas, including Orlando and Phoenix, the supply has quadrupled.

...

The resulting slump, thus far, is being felt mainly on the East and West coasts and in Florida, where home prices had soared beyond the average working family's ability to pay. In California's San Diego County, the median home-sale price was $487,000 in July, down 1.8% from a year earlier, according to DataQuick Information Systems, a research firm in San Diego. Prices in the Northern Virginia counties of Fairfax and Arlington and in nearby towns, near Washington, averaged $537,731 in July, down 3.9% from a year earlier, according to the Northern Virginia Association of Realtors.

14 Comments:

Existing Home Sales for July to be released at 10:00am EST today.

grim

this is only the start. once lenders start to tighten it will be a train wreck. the credit crunch is the key

From Forbes this morning:

Dodging A Bullet

Softening home prices in Miami and Las Vegas. Double-digit drops in monthly sales volume in Detroit and San Francisco. A bump in foreclosures during the first quarter among borrowers nationwide with adjustable-rate mortgages. And Wednesday morning, more figures showing the housing bubble's burst.

Yes, the real estate boom looks, finally, to be over. So investors are preoccupied with determining which housing related companies--which builders, mortgage lenders and banks--could be hurt in a bust.

...

The Washington-tea leaves don't look so good for mortgage lenders, however. A band of five government regulating agencies led by the Comptroller of the Currency, appear likely in the next 60 days or so to pour cold water on the hot--and lucrative--nontraditional mortgage loan market adored by banks and mortgage brokers. These include the popular, but deadly interest only and pay-option adjustable rate, in which borrowers decide each month how much to repay.

The proposed guidelines--meant to be used by bank examiners--will address high loan-to-value, low documentation and other underwriting criteria perceived as too risky by regulators and even some industry participants. That means lenders would need to explain the loan more carefully, require higher down payments and better scrutinize borrowers’ income.

Mortgage insurers are egging on regulators to finalize language "in part because the most recent market trends show alarming signs of ongoing undue risk-taking that puts both lenders and consumers at risk," Suzanne C. Hutchinson, executive vice president of the Mortgage Insurance Companies of America, wrote in a July letter to regulators. Hutchinson cited first quarter data that indicate interest-only and pay-option mortgage products now account for 26% of loan originations, "a sharp increase from last year," she noted.

Non-traditional mortgage products are most popular in states with the strongest home price growth, according to data collected by the FDIC. Little surprise then that investors (speculators, really) comprise 15% of the borrowers in this niche market. While some on this playing field may be financially savvy borrowers with low credit risk, regulators have concluded "lenders have targeted a wider spectrum of consumers, who may not fully understand the embedded risks but use the loans to close the affordability gap."

...

Sure, industry rarely welcomes enhanced regulation. But bankers' resistance ignores another political risk of a damaging drop in housing. In addition to high-risk mortgages creating potential credit losses, Laperriere foresees a "significant political backlash as consumers blame the lenders for deceiving them about the risk of those loans."

Mortgage purchase applications fall 1% this week. From Reuters:

Mortgage applications up: MBA

U.S. mortgage applications rose for a third straight week as homeowners with adjustable loans took advantage of falling interest rates, data from the industry's main trade group showed on Wednesday.

...

The MBA's index of refinancing activity climbed 1.3 percent to 1,608.5, its highest level since March 31. Refinancings accounted for 40.6 percent of all activity in the week, up from 39.6 percent in the prior period.

The seasonally adjusted purchase mortgage index declined 1 percent to 382.2 from 385.9, suggesting housing demand continued to soften.

As usual, Calculated Risk does a fantastic job of presenting the MBA mortgage statistics:

Calculated Risk

The YOY Percent Change by Month graph is surprising, but a good illustration of how quickly the market is shifting.

grim

DO NOT TRUST REALTORS.

“Max Bazerman, a Harvard Business School professor and an author, warned against using brokers as advisers at all. ‘The broker’s most important goal is to close the deal, and that’s not necessarily your goal as a buyer or seller because you care more about the quality of the deal,’ he said.”

“Since brokers are naturally biased, he added, they also should never be told exactly how high or how low you’ll go because they might use that information against you.”

“Bazerman had one final piece of advice. ‘You should always be able to walk away from a deal,’ he said. ‘Fall in love with three houses, not just one, because if you have to have it, you’re going to pay for it.’”

Anonymous said...

this is only the start. once lenders start to tighten it will be a train wreck. the credit crunch is the key

8/23/2006 06:27:14 AM

You toss in a recession, and this goes so bad, it's off the charts.

cross off 2006?

add an extra line and "X" off 2006!

That graph is a thing of beauty.

"The resulting slump, thus far, is being felt mainly on the East and West coasts and in Florida,"

Ummmm, no...

Take a look at the NAR report for the second quarter. If you read to the bottom of the release you will see that home prices in the midwest declined by 2 percent while they were still rising (not much, but up is up) in the NE, S, and W.

The bubble areas are actually trailing the "non-bubble" areas in uh, cooling, declining, landing, crashing, collapsing, imploding, whatever you want to call it.

Bad, and nationwide.

Lindsey

Adding...

This is the link:

http://www.realtor.org/PublicAffairsWeb.nsf/Pages/2ndQtrMetros06?OpenDocument

the release is titled: "Metro Home Prices Transition in Second Quarter"

Lindsey

It's because most people don't understand the difference between inflation and appreciation.

grim

Just the pure overvalue of houses based upon comparison to rental prices is enough to cause a crash.

That's why it doesn't matter all that much what the Fed does. It's all going down anyway.

Oh, oh! Here's the next milestone to watch for: some housing crash article where the bereft homeowner says, "This is America. How could this happen?".

Right? Am I right?

jayb said, "I can't think of a single other thing you buy that you expect to appreciate, except maybe jewelry or some rare collection like comics, stamps, cars. None of those you use on a regular basis, yet you expect a 50 yr old used house you just bought to appreciate..."

It's like I said a week ago, a house is better seen as a durable good rather than an asset.

My stocks, savings, and other assets never need a boiler. Or "Garden State Brickface." They are never assessed to pay for schools where I have no voice in the curriculum. Double-glazing is not an issue. Home Depot? I wave as I drive by on Route 17.

My partner and I watch all the 'house and home' shows on cable. We howl with laughter at the home flippers: raspy-voiced women who think they're in charge ("I just picked out the colors for the kitchen, it's totally time for a margarita"); imploding men who have to do all the shit work (and never say a word and never get a margarita, or water); absurd dreams of aristocracy written on every face....it's a scream. (A scream of humor, and a scream of horror.)

Is that really how real people live? What a godsend to be nobody.

To followers of the DC market, the crash is not just in Northern Virginia as in this article. It is also across the river in Montgomery County, Maryland as in this link. http://www.washingtonpost.com/wp-dyn/content/article/2006/08/22/AR2006082201345.html

Post a Comment

<< Home