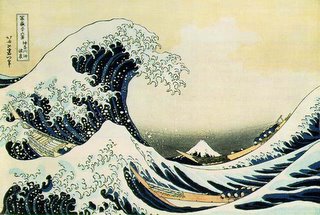

The Tsunami Effect

One of the telltale signs of a tsunami is when the ocean quickly receeds far into the distance from the shore. This occurs when the leading edge of the Tsunami is a trough. Often times, curious onlookers will head down to the shoreline to investigate the curious phenomenon, unaware of the quickly approaching Tsunami. Unfortunately, when the onlookers see the wave quickly approaching, it's much too late. Many are swept away in the quickly rising floodwaters.

Active listings in Northern New Jersey on the GSMLS began a similar recession beginning in mid-November of last year. Listings quickly fell from near 13,000 (GSMLS Active Listings for Bergen, Essex, Hudson, Passaic, Morris, Somerset, Sussex, Union and Warren Counties) in mid-November to a low near 11,000 in late December, a decline of approximately 15%.

Like the curious phenomenon of the receeding ocean, the drop in active listings is often described as a healthy sign of demand in our current market. A sign that demand is still high and supply low. However, how many of these listings were removed only temporarily, to be relisted in the near future?

I dub this the Tsunami Effect, when levels of supply are reduced temporarily by a large group of individuals in hopes of bringing that supply back to a healthier market. But this huge influx of supply causes the market to collapse. Now, I'm sure the economists in the house are saying, "Grim, you've gone out of your way to explain a known phenomenon called supply shock." Yes, but with a subtle difference. The temporary reduction that preceeds the supply shock. This temporary reduction is similar to the curiosity of the receeding ocean that draws in curious observers.

Many market analysts expected inventory to decrease through the early spring until February, when listings would begin to increase again. Mostly a reiteration of what we've seen in the Northern New Jersey market historically. However, quite curiously, it appears that analysts may have underestimated the public.

January GSMLS Inventory

January 3 - 11010

January 4 - 11047

January 5 - 11107

January 6 - 11127

An increase of over 1% in 4 days. The last time we saw an increase this significant over a 4 day period was at the height of the speculative market in early September. In a period where active listings would normally be declining, an increase of 1% may just be the precursor to the Tsunami.

Don't be lured to curiosity by the receding waters.

Caveat Emptor,

Grim

5 Comments:

Grim:

Excellent original piece of analysis.

Instinctively I assumed that sellers and their agents would try to jump back into the market over the course of January, instead of waiting until March.

I've stated this opinion before. I think the real face of this market will be seen in the period of February 15th to March 15th.

When February numbers get reported, along with corrected Janaury numbers, that is either when a collective sigh or relief or mass panic will happen.

Just my $0.02.

chicago

By the way, my stock market investments are going absolutely berserk.

I wonder where all that Wall Street bonus money is being allocated? :)

What a great description of the disaster about to hit the unsuspecting.

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Hey Fellow, you have a top-notch blog here!

If you have a moment, please have a look at my arizona job search site.

Good luck!

Post a Comment

<< Home