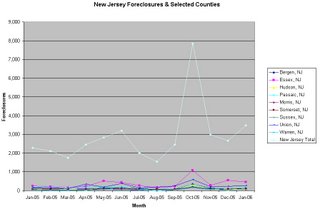

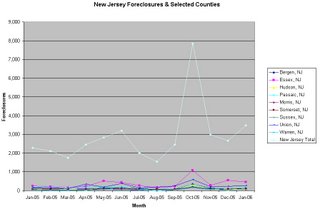

Northern New Jersey Foreclosure Statistics

Rick and team at RealtyTrac were kind enough to provide us with the foreclosure data on a county level for Northern New Jersey. A big thanks to RealtyTrac for going out of their way to get this for us. Please take the time to visit their site if you are interested in learning more about foreclosures.

Click to enlarge

I had asked the folks at RealtyTrac if they could prove me with county data on a month-by-month basis for the past year in order to determine if there was any obvious trend developing. While there seems to be a slight overall rise for the year, it is likely too premature to judge. The spike in October is a bit concerning, however it may likely have something to do with the bankrupcy laws that went into effect that month. I'll be keeping close tabs on the foreclosure numbers in the upcoming months.

If anyone has any more questions about the data or foreclosures, just post them up and I'll see if I can get someone from RealtyTrac to answer.

Caveat Emptor!

Grim

9 Comments:

It looks like the other 12 counties are in worse shape! The bulk of NJ's Population falls within NNJ yet it appears that they are underrepresented among the foreclosures.

Bergen, Essex, Hudson, Passaic, Morris, Somerset, Sussex, Union, and Warren counties constitute roughly 40-45% of the total NJ foreclosures.

For January '06 the 9 county total was 1,416, the New Jersey total was 3,474

For 2004, the 9 county total was 14,678, the New Jersey total was 34,103

Essex takes the lead in raw count with 4,352 in 2005 (1.446% of households in foreclosure).

Sussex takes the lead in household percentage with 1.601% of households in foreclosure in 2005.

Looking at Jan 05 versus Jan 06

County/Jan 05/Jan 06

Bergen/131/123

Essex/252/458

Hudson/102/92

Passaic/164/179

Morris/67/53

Somerset/61/118

Sussex/66/61

Union/143/267

Warren/22/65

grim

Big day tomorrow on the data front..

Building Permits

CPI

Housing Starts

Initial Claims

Philly Fed

grim

Most of my foreclosure calls come from Essex and portions of Morris Co. Although NNJ sees a lot of foreclosure filings, they end up selling them at market and never going to the Sheriff Sale.

Just wait, once the banks become deluged with foreclosures and actual repossessions then all you guys can pick up nice properties for cheap.

Tom

"D"igital Breakfast

Grim,

In the 2000 census the 9 NNJ counties represented 51.25% of the state population. As was pointed out Essex takes the lions share.

are the RealtyTrac links broken?

Yes, the RealtyTrac links were broken. They've been fixed now.

This blog is quickly outgrowing Blogger.

grim

Grim,

This is from the MSN RE site. My access is blocked but this is the gist. (got this from planetizen.com)

A new study shows that the number of households entering some stage of foreclosure is up 45% over this time last year -- one for every 1,117 U.S. households.

"The number of foreclosures is still low on a historical basis, but it has been rising steadily over the past year, RealtyTrac reported. Job losses in some regions were to blame, but so, too, were risky borrowing practices that left homeowners little wiggle room on their mortgage payments. And with the pace of appreciation stalling and interest rates rising, many economists and industry observers expect the pace of foreclosures to accelerate this year."

"In the last few years, many buyers took out interest-only, variable-rate loans, and in some cases put no money down to afford a house, said Frank Nothaft, chief economist with government-chartered mortgage giant Freddie Mac. He estimates one out of every three loans issued in 2005 was an adjustable rate mortgage. Now that we've seen 14 consecutive interest-rate increases since June 30, 2004, many of these loan rates are bumping up, increasing the size of mortgage payments."

Source: MSN Real Estate, Mar 14, 2006

Full Story: More Americans are losing their homes

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home