New Jersey Still Waiting The For Spring Market

The Otteau Report for February was released last Friday. The full text is as follows:

STILL! Waiting for the Spring Market

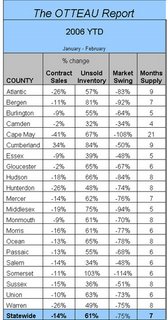

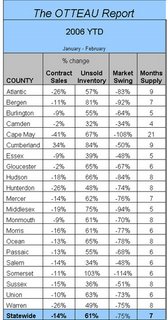

Although buying activity in February registered a 15% increase over January’s level, it is currently running well behind last years pace confirming the slowdown in the residential market is continuing into 2006. Year-to-date buying activity is currently running 14% less than last year’s pace while the inventory of unsold homes on the market is 61% higher than a year ago. By combining these indicators the resulting Market Swing of -75% indicates that the 2006 market has lost 75% of its strength as compared to last year at this time. While considerable demand still exists from the buying side of the housing equation, declining housing affordability will continue to dictate the “mood of the market”. From the seller’s perspective, more aggressive marketing and pricing strategies will be essential to restore the buyer’s ‘sense of urgency’ that was prevalent in 2005.

Caveat Emptor!

Grim

STILL! Waiting for the Spring Market

Although buying activity in February registered a 15% increase over January’s level, it is currently running well behind last years pace confirming the slowdown in the residential market is continuing into 2006. Year-to-date buying activity is currently running 14% less than last year’s pace while the inventory of unsold homes on the market is 61% higher than a year ago. By combining these indicators the resulting Market Swing of -75% indicates that the 2006 market has lost 75% of its strength as compared to last year at this time. While considerable demand still exists from the buying side of the housing equation, declining housing affordability will continue to dictate the “mood of the market”. From the seller’s perspective, more aggressive marketing and pricing strategies will be essential to restore the buyer’s ‘sense of urgency’ that was prevalent in 2005.

Caveat Emptor!

Grim

52 Comments:

From the seller’s perspective, more aggressive marketing and pricing strategies will be essential to restore the buyer’s ‘sense of urgency’ that was prevalent in 2005.

Seems like everyone is pressuring sellers to reduce prices..

Brokerages pushing owners to lower prices

Looking to head off a sustained dip in the real estate market, some of Pittsburgh's largest real estate agencies are asking home sellers to do something that will mean less money for them and their agents: reduce their asking prices.

"Ninety-nine percent of the Realtors are doing that right now," said Ron Croushore, CEO of Prudential Preferred Realty and president of the West Penn Multi-List and the Realtors Association of Metropolitan Pittsburgh. "Inventory's beginning to build.

grim

While considerable demand still exists from the buying side of the housing equation, declining housing affordability will continue to dictate the “mood of the market”......

I thought demand was a function of supply. In this case supply of affordable housing. How many bubble sitters are there?

Last I saw about 70% of households own their home. So are we to deduce that the other 30% are wanting to buy? Are they capable of buying? I don't think so.

When the resets hit there will not be the hoards of people waiting to buy IMO.

Lowered asking price by $15k and they are motivated??

What a laugh.

Great board for new buyers.

You wouldn't know any of this on real world reporting.

Months supply and inventory growing.

NICE!

AC

AC,

Grim and his blog are a valuable resource. The RE biz would undoubtedly prefer that we did not know alot of the things grim brings to light. Thank you grim for your contribution here.

Grim,

Excellent information as usual. This is more evidence that my wife and i have made the right decision, which is to hold-off on buying a house. We have a month-to-month rental and are quite happy with it too. Good luck to everyone.

I went to open-houses in Glen Rock and Ridgewood yesterday. Just by looking at the list price, most sellers are still in denial of the market. Some people are looking around partially due to the nice weather. No seriousness observed.

These ultra-high listing prices are pure imaginary numbers of the owners and realtors that try to please the owner to get their agency.

The open houses we visited were for entertainment only.

Interestingly, this was first time that a realtor filled out the sign in sheet for us. I can't remember that ever happening before.

grim

Note: SoCalMtnGuy has a new post up:

http://www.housingbubblecasualty.com

He's been MIA for a few weeks -- got a new job outside the mortgage industry.

Since many of you have suggested that I send my kids to private school instead of buying in a better town (and doubling my mortgage payment) . . . . .

can you all weigh in on the topic of Catholic vs. Public for grammar school?

Thanks,

Karen

Is this a joke or are you serious?

Looks like we've been joined by a Bitter Realtor™

Best approach: ignore.

So tempting to issue a scathing response...but I will ignore.

Reinvestor101,

IMHO, it is not possible to be both anti-bush AND anti-American.

Peace.

"IMHO, it is not possible to be both anti-bush AND anti-American."

Anti-Americans are near uniformly anti-Bush.

(Sorry for feeding the trolls)

I'm a buyer(looking to buy in and around Edison area) waiting on the sidelines . All my freinds and colleagues in office own their dwellings. Each time the topic of real estate comes up, these folks say that home prices will not drop in the area I'm considering to buy. The argument they make is that homeowners in this area are mostly affluent (well to do folks) who have the financial wherewital to weather any forseeable real estate downturn and that prices will not be falling by more than 15 to 10 %.

What facts to state to counter their argument. Appreciate any comments.

I'm a buyer(looking to buy in and around Edison area) waiting on the sidelines . All my freinds and colleagues in office own their dwellings. Each time the topic of real estate comes up, these folks say that home prices will not drop in the area I'm considering to buy. The argument they make is that homeowners in this area are mostly affluent (well to do folks) who have the financial wherewital to weather any forseeable real estate downturn and that prices will not be falling by more than 15 to 10 %.

What facts to state to counter their argument. Appreciate any comments.

NJGal, if a college is bigoted against Catholic school students, perhaps consider another college. Why send kids into an environment of bigots?

Grim, if I may suggest a new feature:

The Brazen Seller Award

MLS 2261641

2BR (yes 2), 2.5 BA

$840,000

277 Forest Drive South, Short Hills

http://www.realtor.com/Prop/1057139135

Owner paid $735,000 at market peak in July 2005, made no improvements, now wants $105,000 because this 2 bedroom ranch now comes with "architects preliminary drawings for a 4 bedroom, 2 1/2 bath colonial."

Brazen baby!

"All my freinds and colleagues in office own their dwellings"

"these folks say that home prices will not drop in the area I'm considering to buy" Anon 5:11

Dear Sir/Madam,

1. If you can read and do simple arithmetic, you will find your answer.

2. If you don't want to do suggestion #1, than I suggest you buy as much house as you can afford, using a negative amortizing-interest only loan.

ps: use a stated income/ no doc. application, we wouldn't want you to miss out vis a vis some banking limit nonsense.

Sincerely,

Someone who doesn't give a r#ts a## about lazy people.

I have spotted an interesting article in USA Today regarding the ARM.

sEE THE LINK BELOW

http://news.yahoo.com/s/usatoday/20060403/bs_usatoday/somehomeownersstruggletokeepupwithadjustablerates;_ylt=AhR3LFL20O.LxHkOLn1Lqq.s0NUE;_ylu=X3oDMTA3ODdxdHBhBHNlYwM5NjQ-

101

I am not anti Bush and I am very pro American. I am also one the believes that there is a bubble.

In fact I am pro Bush but also think that more regs are needed to keep the bad loans from hitting the market.

Oops the other link was cut off. Here is the link.

Article in USA today

Some homeowners struggle to keep up with adjustable rates

Grim

This one is worth commenting

Cliffy

reinvestor101,

Why do the work of the terrorists and communists?

Man, you've really got it bad!

What else does Rush tell you to think?

Reinvestor101, I suggest you contact a professional psychiatrist ASAP.

http://www.find-a-psychiatrist.com

It is my responsibility as a patriot and a citizen of a democracy to stand up and speak out about this problem.

grim

From the Daily Reckoning:

Turbulence? We remind readers that real property prices in central Baltimore declined for 75 years, after peaking in the mid-‘20s. Farmland in western Kansas peaked in the 1880s, and has never recovered. Looking ahead, we suspect that suburban property on both coasts is now reaching an epochal high. We may never see such high prices again in our lifetimes.

grim

Reinvestor101

This is a capitalist country and there is nothing wrong with making money. If everyone is making money, why do some people want to stop that?

You are hilarious reinvestor101. Don't forget this is also a free country. Please look up the first amendment and then get back to us.

My guess is that reinvestor101 is terrified because he knows there is a bubble and fears once the masses find out everyone will head for the exit.

Maybe you would be better off in China where information is controlled and you're only told what the government wants you to hear.

Good luck selling your overpriced property(ies).

reinvestor101

Are you for real? You seriously need a professional help. Grim, I think you could sue this guy for calling you a terrorist.

It’s people like you who are un-patriotic. By spreading the BS of wonders of RE and that it always goes up – you made many people to believe that’s true and they are in debt up to their eyeballs. And it’s not just regular citizens but the country itself is in tremendous debt which we will be paying off for couple of next generations – if we are lucky to pay it back at all.

So, lets go and tell everybody to borrow more money and leverage themselves even more so you can make few more $$ of them. I hope you can sleep at night. But on the other hand – I’m sure you do….

Stop the crying re investor. The free markets are working the way they should.

Correcting excesses in the economy and letting capital flow to the best opportunties.

Right now Money is leaving re in droves because it is overpriced.

This REAL ESTATE BUBBLE is a text book Bubble case. Do a little research and you will see past irrational periods in hisotry looked very similar. This one is no different. he only thing is that this maybe the largest biggest leveraged bubble in history.

Batte down the hatches folks cuz the correction is here and is is going to be deep.

Well In China, they popped their RE bubble by forcing buyers to put down 30% instead of 20%. They did the right thing.

The lunatics running the FED think they can paper over any problem and recessions are a thing of the past solved by the $ printing presses.

Guys, "reinvestor101" has come on here with the aim of getting a rise out of people, and drawing attention.

He's succeeding.

Best approach: ignore.

-Karen

I don't agree with nigal at all. Those statements are absolutely and completely false. First of all, my opinion is that depending on what town you live in, the grammer school may not be so bad. For example, Morristown has a horrible high school, but some of the grammer schools aren't bad. I don't think Catholic grammer school is worth the money. HOWEVER, Catholic high school on the other hand is extremely beneficial. I am not sure what colleges you would be interested in your children attending, but some of the top universities (below ivy league) are Jesuit/Catholic. For that reason alone, Nigal's comments don't make any sense. For example, Fordham, Fairfield University, Loyola, University of Scranton, etc are all excellent schools, and they are all Catholic. Most Priests and Nuns at Catholic high schools have connections at these universities. Also, many Catholic high schools are respected even more than public high schools. I can't tell you enough how I completely disagree with the above statements. My husband attending St. Peter's prep in Jersey City, which is a highly competitive school, and the majority of the alumni are extremely successful. In addition, I attended Paramus Catholic, and I still keep in touch with many of my classmates who are all college graduates and successful.

In Summary, save your money for grammer school, because not much is that different at that level. High school is where you should spend the money. It will ultimately make the main difference.

-Christine

Yes, but which fine institution taught you how to spell "grammar"?

Just sayin'...

;-)

101,

Do your part first. Borrow a million and buy. BTW, I am Chinese!

reinvestor101,

"and as long as the asset inflates or the economy grows, we don't have a problem."

Just listen to yourself - you're delusional.

a bit off the topic of this thread... but i had to share this with you if you havent read it already

From the Star Ledger Sunday 04/02/06

So what do you with a contaminated tank farm in Jersey City? Bury a dead mobster, perhaps.

Or build the world's most exclusive golf course.

Beginning July Fourth, that course will be found at Liberty National. Here, on a reclaimed ex panse of toxic ground, the ripples from New York Harbor already lap against the wetlands 30 feet below the 14th hole -- a 149-yard par three in the spirit of Pebble Beach on California's Monterey Peninsula. A few hundred yards into the bay, Lady Liberty takes in the action from an elevated, island gallery.

Beyond the statue, the glass- and-stone skyline of Lower Manhattan looms. There, if the owners of this club have it right, people will be willing to fork over a $400,000 initiation fee to play on one of the most expensive golf courses ever built. Rudy Giuliani has already signed on as a charter member. So has New England Patriots owner Robert Kraft.

rest of story:

bobby

"Look, I'm sorry to inform you that the sky is not falling. There is no real estate bubble to be burst as long as the negative talk stops and the fed chair stops raising rates. Both of these will kill a good investment market if you don't stop it."

Sophisticated stock investors know it is a sign of trouble when management blames "short sellers" for a share price decline.

In a similar vein, it's a bad sign for RE bulls when they complain about "the media" creating a bearish mindset in the public.

A "good market"--good for whom? Those who borrow from the future to pay for today's consumption, and hope to pay off in cheaper nominal dollars? Those who profit from inflation, including the govt. the bankers, Wall Street, and the spendthrifts we all know and love to hate, do benefit from the easy money.

The inflation you profit from certainly doesn't help the poor, the unemployed, or those starting out in life.

We have the worst of both worlds. Global competition (which is a long run good thing) is limitting wage increases for U.S. workers.

This wouldn't normally be a problem, but all sorts of structural factors (ie. govt. regulations), make it difficult for unemployed labor to shift to where it is needed most. So people remain unemployed.

Yet, easy money and govt. deficits are increasing the cost of certain essential goods and services--housing, health care, and to some extent, energy.

Things cannot inflate for ever. Debt and deficits do matter, despite what you wrote.

Should our foreign lenders, who have been ever so kind to lend at such low rates, lose faith in the dollar, your dollar gains in real-estate will be worth less (perhaps worthless), because those who have the goods and services you want will either demand boatloads of dollars, or might simply refuse to accept a dollar as payment.

The Fed can't permit that to happen. It's mandate is to keep "price stability" which is essentially a euphamism for confidence in the dollar.

What is amazing is how rotten the U.S. govt. is acting towards our foreign lenders. That nitwit Chuck Schumer "threatens" China with tariffs that will only hurt U.S. consumers (likely on the lower end of the income scale).

It will do nothing to bring back U.S. jobs, nor will it reduce our account deficit with China.

Then they nix the acquisition of U.S. ports by the UAE company, which despite the claims of opponents, posed no risk to national security.

Should the U.S govt. continue to restrict the things foreigners can do with dollars in the U.S., do you think they will continue to buy Treasuries at such low rates?

If all they can do is continue to buy Treasuries, and will receive grief if they try to buy any other U.S. asset, you can bet money that the dollar will fall, and interest rates will rise.

And there will be absolutely NOTHING the Fed, or the Federal Govt., could do to alleviate the misery such a scenario would cause.

Here's how builders can crush anyone's hopes of buying a 'fixer upper' in a nice town:

6 Knollwood Rd, Short Hills

Closed Nov 2004 @ $910,000

House torn down.

New house built.

Asking price for new house: $2,575,000

http://www.realtor.com/Prop/1056803317

Mere mortals need a miracle to buy in that environment.

Though this was built last year, and the party ended in August 2005.

Mr. Ryley,

Excellent comment.

jb

"This is the liberal position to worry about how China and others feel. We are the guys with the big stick and if anything, we just let them know what we want and let them fiqure out how high to jump. This is what I love about the Bush adminstration; they're bulls when they need to be."

Reinvestor,

Your thinking is black and white. Keep in mind, I'm no "liberal" unless you mean libertarian.

The idea we can tell our creditors what to do, and when to do it, is absurd. The world is a big place, and there are other places to invest.

Should the U.S. attempt to intimidate the rest of the world into lending it money, rest assured that this will only encourage other countries to cooperate against the U.S. interests. The U.S. is no match for the entire globe.

The wealthy Middle East, many of whom are U.S. allies, are going to funnel their dollars somewhere else, thanks to the nitwits who are arguing for protectionism.

Read a little about history. Leading up to the Great Depression, the U.S. was in the same position that China and Japan is now.

England was jawboning the U.S. to keep rates low, devalue the dollar, so the pound would not fall in value. Germany, France, and England owed billions to the U.S. for loans during WW I.

The only way those countries could remain affloat is by continued U.S. loans. Failure to loan would result in massive losses for the U.S. treasury, and U.S. investors.

Guess what, despite continued loans, the Depression happened anyway.

The financial parallels between the 20's and now are striking, and frightening. History doesn't repeat, but it does rhyme.

Chinese official: Beijing should sell U.S. bonds

HONG KONG - China should stop buying U.S. Treasuries and take steps to reduce its holdings in those bonds, a Hong Kong newspaper on Tuesday quoted a high-ranking Chinese official as saying.

...

Analysts estimate that China invests about three-quarters of its foreign currency reserves — which last year rose to $818.9 billion — in U.S. Treasuries.

grim

OH I see reinvestor

So when the Heli-Fed pushed rates to 1% that was okay, but when they raise rates due to insane speculation it's bad?

Good luck to you fellow. Denial will wiipe you out.

Interesting discussion. Also civil, which is an added bonus.

My $0.02. Always consider the MARGINAL effect of any actor in the marketplace. As an example, the USD is the reserve currency, but if oil producers are offput by the alarmist rejection of the ports deal, they can dump 5% of U.S. stocks positions, they can sell some U.S. real estate holdings, and they can sell 10% of their U.S. Treasuries and hold more Euros and Yen for diversification. Any of these actions would be damaging to U.S. market conditions.

China holds our debt, they are not our friends, they are ominous, but we have to respect them. The flip side is that they are undergoing a massive economic and cultural upheaval that will take a generation to digest, but where will we be in 2030?

The U.S. can be the world's policeman, but part of the reason that Germany and Japan have remained so docile in the last 60 years is that the U.S. has been a good partner. If you alienate everyone outside our shores, action becomes that much more expensive when we have to foot the entire bill. Also, you run the risk of China, India, Japan and Germany asserting or re-asserting themselves on the world's stage. Russia is always out there as well.

I don't think that the U.S. is going to be the premier country in the world by the end of this century. If you don't see the warning signs, then you aren't really considering all of the relevant facts.

chicago

Also, it is anti-bush and anti-america for all of you to be talking this way while we're at war.

You're calling for people to do the work of terrorists and the communists.

I've always enjoyed the reasoned, intellect inspired discussions on this blog but now it seems that we're just "terrorists and communists". Perhaps Reinvest101 would like that "ugly" 1954 split-level in Summit posted elsewhere on this blog. That way he could easily revel in the accomplishments of Joseph McCarthy who succeeded in squelching much dissent by labeling dissenters as communists.

Reinvest101, your posts would be much better received here if they were based less on emotion and more on real data that supports your position. You are way out of line to suggest that anyone on this blog supports communism or terrorism based on our opinions regarding the housing bubble (yes, there is a great deal of economic data to support a bubble, and you can find most, if not all of it on this site).

"That way he could easily revel in the accomplishments of Joseph McCarthy who succeeded in squelching much dissent by labeling dissenters as communists."

While I think reinvestor101 is completely off his rocker, it's important to get history straight. McCarthy was correct, and was proven so when the Venona Project was declassified in 1995:

http://www.nsa.gov/venona

McCarthy was not about attacking "dissenters" but about unmasking Soviet agents who were undermining the United States from within:

Nova (PBS Television)

February 5, 2002

"Secrets, Lies, and Atomic Spies"

In 1995, the U.S. National Security Agency broke a half century of silence by releasing translations of Soviet cables decrypted back in the 1940s by the Venona Project. Venona was a top-secret U.S. effort to gather and decrypt messages sent in the 1940s by agents of what is now called the KGB and the GRU, the Soviet military intelligence agency. The cables revealed the identities of numerous Americans who were spies for the Soviet Union.

Ultimately the code breakers found cover names for more than 300 Americans who spied for the Soviets in World War Two.

One who had the cover name "Quantum," provided the Soviets at a very early stage, the actual scientific formula for separating U-235 from U-238, which is a very key step in developing a working atomic bomb.

American counterintelligence was able to identify only about 100 of these Soviet agents.

But even this incomplete list is remarkable: Harry Dexter White, Assistant Secretary of the Treasury, cover name "Lawyer;" Larry Duggan, Chief of the Division of American Republics at the State Department, cover name "Prince;" Lauchlin Currie, Senior Administrative Assistant to President Roosevelt, cover name "Page."

There was not a single agency of the American government that the Soviets had not infiltrated, ranging from the OSS--the forerunner of the CIA--to the Justice Department, to the Treasury Department, to the State Department, to all of the wartime defense agencies.

http://www.pbs.org/wgbh/nova/transcripts/2904_venona.html

That's right, including the White House and "all of the wartime defense agencies."

All through college, and certinaly in the 'mainstream' media and Hollywood, McCarthy has been wrongly demonized, when in fact he was doing the right thing.

I'd wager that few here have ever heard the word "Venona" until now and you'll certainly never see a Hollywood movie about Venona (or a movie about mass murderers Stalin or Mao, for that matter).

Further, the editors of NY Times wrote an OpEd last year defending convicted and executed Soviet agents, as if the Venona documents re-confirming their guilt had never been released.

It's Orwellian how the 'mainstream' media and Hollywood continue to perpetuate the "McCarthyism" demonization, and simply bury the facts revealed in Venona. Why that is, and why hollywood will never make a movie about Stalin, is food for thought.

Unrealtor,

Thanks for posting that. I was about to put something up about McCarthy, but you beat me to it. I have a book on Venona that I have to get through, but you are 100% correct. McCarthy has gotten a bad rap.

Unrealtor, the fact that McCarthy may have been correct about communist spies infiltrating the government, is beside the point. His methods are the issue. This man systematically made accusations against people with little or no evidence and it is well documented that he associated the democratic party with communist sympathizers. Those who criticized him at the time were also accused by him of being associated or sympathizing with communists.

The fact that he may have later been proven right is beside the point in my book. If you accuse enough people of something, sooner or later you'll find some whose behavior deserves the accusation. But so what? Does that mean it's right to this in the first place? To make accusations without evidence? Interestingly few if any convictions resulted from these investigations.

"This man systematically made accusations against people with little or no evidence and it is well documented that he associated the democratic party with communist sympathizers."

Well, there certainly were a lot more communist sympathisers in the Democratic party as compared to the Republican party. Hell, there were even some Soviet spies in FDR's cabinet.

What is a guy supposed to do when he sees enemies of his country take over the governmenal apparatus? Play nice?

Rob Ryley,

"Well, there certainly were a lot more communist sympathisers in the Democratic party as compared to the Republican party. Hell, there were even some Soviet spies in FDR's cabinet."

Since no one was convicted of any wrong-doing in these witchhunts, you can not conclude that anyone was doing anything wrong---that's the American system---individuals are innocent until proven guilty.

"What is a guy supposed to do when he sees enemies of his country take over the governmenal apparatus? Play nice?"

How about play according to the rules of the constitution? That's what makes America, America. The point is that McCarthy didn't actually see or have evidence of enemies infiltrating the government---these were merely wild accusations.

We probably shouldn't keep this discussion up. It's off the topic and I'm to blame for bringing it up in first place! Sorry. :-(

"Well, there certainly were a lot more communist sympathisers in the Democratic party as compared to the Republican party. Hell, there were even some Soviet spies in FDR's cabinet. What is a guy supposed to do when he sees enemies of his country take over the governmenal apparatus? Play nice"

This conversation is interesting, particularly in light of the recent relevations about warrantless eavesdropping on e-mail and telephones. To be sure, there may be a few terrorists around, but does that mean that it's correct to eavesdrop on citizens?

The fact of the matter is that McCarthy would be right at home with the current administration in its witchhunting and selective leaks that were apparently authorized by Bush himself.

california real estate Discover The 4 Step Secret To Becoming A Master Real Estate Professional

As a Real Estate Professional, ask yourself this question. . .what do you like best about your career. . .is it:

The "roller coaster" income cycles?

Wasting your weekend sitting at an open house where no one shows up?

What about manning a table at the mall or a home show for hours on end?

Chances are none of the above are the reason you became a Realtor in the first place.

Well, that's about to change. Learn how countless numbers of realtors are working less and making more.

How do they do it? Are they super duper closers? Surely they aren't any smarter than you?

Their common denominator is that they have a relentless, methodical, tireless home selling tool working for them alone.

Discover how they use that tool in 4 simple steps to generate sale after sale.

No Weekends! No Open Houses! No Floor Time!

Just make sale, after sale, after sale.

It's simple, once you have the tool.

Learn How To Get It Here. california real estate

Post a Comment

<< Home