Land Value Increases In Japan, First Time In 15 Years

I think that everyone should give this piece some thought. Don't just glance over it. Don't try to rationalize it away by saying "We're not Japan". If there is one place in the world that there is a lack of land (and they aren't making any more of it), it's most certainly Japan. Japan real estate prices declined by double digit percentages and have remained stagnant for 15 years. For the first time in 15 years land values rose.

If the U.S. real estate market mimics the decline and stagnation seen in Japan, it's very likely that many of us may never see prices this high, ever again, in our lifetimes.

From the Asian Times:

Land value finally rises

"In a sign that Japan is emerging from asset deflation, the total value of land in the country rose 1.4% on the year as of January 1, the first increase in 15 years, according to calculations by the Bank of Japan. "

"In March, the Land Ministry released government appraisals of land values, which shows the year-on-year change in nationwide land prices through a simple average of prices changes at reference sites throughout the country. This study revealed that land prices fell 2.8%, a decline for the 15th straight year. "

"While the price for residential land slipped 0.9% even for the weighted average, commercial land prices climbed 4% on the back of solid demand for office space in and around the large cties, causing the overall price of land to rise."

"The rise in land prices is also attributed to more residents moving back to city centers. Using a weighted average, land prices in Tokyo started rising ahead of other regions, gaining 0.5% in 2005. In 2006, prices in Tokyo jumped 5.5%, much more than the rest of the country. "

From Standard and Poors:

Battle Over Japan's Mortgage Market

Caveat Emptor!

Grim

If the U.S. real estate market mimics the decline and stagnation seen in Japan, it's very likely that many of us may never see prices this high, ever again, in our lifetimes.

From the Asian Times:

Land value finally rises

"In a sign that Japan is emerging from asset deflation, the total value of land in the country rose 1.4% on the year as of January 1, the first increase in 15 years, according to calculations by the Bank of Japan. "

"In March, the Land Ministry released government appraisals of land values, which shows the year-on-year change in nationwide land prices through a simple average of prices changes at reference sites throughout the country. This study revealed that land prices fell 2.8%, a decline for the 15th straight year. "

"While the price for residential land slipped 0.9% even for the weighted average, commercial land prices climbed 4% on the back of solid demand for office space in and around the large cties, causing the overall price of land to rise."

"The rise in land prices is also attributed to more residents moving back to city centers. Using a weighted average, land prices in Tokyo started rising ahead of other regions, gaining 0.5% in 2005. In 2006, prices in Tokyo jumped 5.5%, much more than the rest of the country. "

From Standard and Poors:

Battle Over Japan's Mortgage Market

Caveat Emptor!

Grim

28 Comments:

GSML House Listings

3/06/06 24,111 houses for sale

4/12/06 26,582 houses for sale

5/8/06 28,471 Houses for sale

This does not Include the huge supply of FSBO.

Ba ba ba ba ba ba ba BOYCOTT HOUSES!

Boooooyaaaaaa

Bob

Where were you 15 years ago?

when NNJ real estate went down 25% for houses and 50% for condos. Co-ops in NYC went down 50%.

Take off the rose colored beer goggles.

Deny deny deny.

"or it won't be leader in next 10 years."

Shailesh - don't get caught up in the hype. India and China are forces with which to be reckoned. However, you are underestimating the level of cultural upheaval that has to be digested. There will certainly be a backlash against everything happening in both these countries, and it certainly will take a generation for the populations to fully accept and embrace everyhting happening - not 10 years.

This is just the tip of the iceberg for these countries.

Once they go through a recession, you will see the true face of these societies come to the forefront. Everything is easy for now.

chicago

Shailesh

I agree with your assessment. Wages here have been stagnant to going down because a huge number of phd's and mba's are coming from India. They are intelligent and can put downward pressure on wages....thus the lowering of US standard of living. House prices here are not supported by the economic fundamentals. many will be underwater for years paying these bloated prices.

28,471 houses for sale!

And the bubbleheads say there is a shortage of housing.

The only shortage is AFFORDABLE housing.

Prices are way to high.... need to come down alot.

"In my opinion, high cost of living, reduces US's ability to compete effectively.."

Very good point.

This is why house prices and standard of living in US will go down for years to come.

Of course our standard of livjng is very very good. so house prices go down alot.

If you didn't leverage up and buy at the top no problem. If you don't save any money outside your house then tough going.

Either way, those that make prudent rational financial decisions will be rewarded in the future.

Good point about huge FSBO inventory, as there are 891 FSBO homes near Summit alone, according to this single website which doesn't even contan all FSBOs on the market:

http://www.forsalebyowner.com/searchResults.php?iPropTypeCode=0&iPerPage=25&szStateCode=ZIP&iRadius=25&szZip=07901&submit.x=10&submit.y=11&submit=Find

(triple-click to select long links)

There are probably 50-100% more FSBOs on the market!

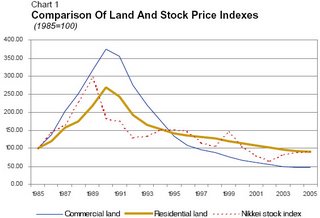

So it looks like the bulk of the drop took place from 1990-1995.

This is with a japanese consumer flush with cash and investments. Cash rich where the US consumer in gneral is cash poor and credit card/debt levered. Real esttae peaked in summer 2005 so tail end of 2006 start 2007 should look rather ugly for home prices.

"Now many folks want restrictions on such things. I am of different opinion. Rather than restrictions, why not compete fair & square in world market."

Interesting how you want govt intervention for real estate, but not for jobs?

There is no "fair and square" when people in China are getting paid $20 a month to inhale toxic fumes for 12 hours a day assembling sneakers for Nike. Same goes for India.

And for the high tech jobs, wait until China gets on board, and wipes out India as the low cost alternative.

A "free market" is not free when one side has regulations and worker protections, and the other side has essentially slave/child labor without regulations.

Buffett: Real estate slowdown ahead

The Oracle of Omaha expects the housing market to see "significant downward adjustments," and warns on mortgage financing.

http://money.cnn.com/2006/05/05/news/newsmaker

s/buffett_050606/index.htm

Buffett thinks that a "significant downward adjustment" i.e. a crash, is a real possibility for real estate prices.

Housing bubbleocrats should not dismiss Buffet's opinions without due consideration. Buffet's Berkshire Hathaway has numerous businesses that give him a direct eye into housing markets. These businesses include manufactured home builder Clayton Homes, paint producer Benjamin Moore, roofing and insulation manufacturer Johns Manville, furniture makers Nebraska Furniture Mart and Jordans Furniture and crucially real estate brokerage, mortgage, title and homeowner's insurance firm HomeServices of

America. Buffet's companies are widely exposed to housing and the operations of these companies have benefited from the rise of housing prices and consequently will suffer as prices drop. Buffet then has no negative axe to grind in the continuing national debate regarding housing prices.

According to reports the "higher end" house prices are expected to drop. Then I hear realtors saying the mid-range (550k-750k) is not going to see drastic drops. How does that make sense? If a million dollar house drops to 800k then the shouldn't mid range housing prices come down too? Too many lies and denial out there.

Shailesh, it doesn't seem you've given much thought to your proposals.

Also, your response doesn't really address the issues raised in my post.

US labor cannot compete with third world labor, since the playing field is not level.

The government you want to motivate is the one in China, and also in India. Stop exploitation of children and slave labor in those countries.

No American worker can compete with an 11-year-old girl sniffing toxic fumes for 12 hours a day, and making $20 a month.

Perhaps the US should cease or reduce trade with such nations until they implement fair worker regulations -- that's a US government program I'll get behind.

Unrealtor said: No American worker can compete with an 11-year-old girl sniffing toxic fumes for 12 hours a day, and making $20 a month.

What are you smoking mate. Manufacturing is not the only industry you need to think about. There's a lot more involved in Clinical Trials, Information technologies etc than just sniffing toxic fumes.

Time to stop sniffing whatever fumes are you sniffing, its making us all wonder :)

More funny money going away.

Downpayment Assistance Faces IRS Scrutiny

The Internal Revenue Service is cracking down on non-profit organizations that fund downpayment assistance programs through contributions from sellers and builders and it is threatening to revoke their tax-exempt charitable status. The IRS is examining 185 nonprofits to see if there is a direct correlation between the amounts of downpayment assistance provided to homebuyers and the payments nonprofits receive from the sellers. Nearly a third of Federal House Administration single-family loans are originated with downpayment assistance and the defaults are generally twice as high as other FHA loans. IRS noted that DA loans not only perform badly; the cost of the house is generally increased to cover the seller's contribution. "So-called charities that manipulate the system do more than mislead honest homebuyers and ultimately jack up the cost of the home. They also damage the image of honest, legitimate charities," IRS commissioner Mark Everson said.

To Unrealtor:

I'm not an economist, nor do I fully understand global economic forces, but you seem to miss the point completely.

All wage imbalances aren't caused by slave/child labor.

A tech or factory worker making $15000 a year in India or China isn't being oppressed. Those are povery wages in the US but in those countries it's enough to live a comfortable middle class lifestyle.

I'll key in on all this outsourcing, India/China talk. Shailesh you're dreaming when it comes down to it workers in the US are still more efficient and even in areas not like NYC, LA, SF the infrastructure is better. Doing business in China and India is a royal pain, it is rarely if not ever as straight foward as in the US.

Both China and India also enjoy the benefits of no worker regulations and environmental responsibility. Generally we are talking about countries involved in reckless growth. Additionally China manipulates the market but holding their currency down thus making the market more attractive. This is where the stupid politicians have to concentrate. If we are going to be global lets at least start on a level playing field.

Now even at the current condition it really is not that favorable to outsource engineers or comp sci people, or finance people. Consider the Indian salary for base jobs is 10-15k USD per year. The American salary averages 70k USD in a middle market city not NYC,LA,SF. So the delta is 55k per employee a fair sum. Now class A office space in the cheapest suburban indian markets is 7 USD psf, but now add in the occupying costs and it doubles to 14 USD. Now in the US occupying costs and rents are pretty close Clevland, OH will run about 18 USD psf, markets closer to home Jersey City waterfront for large office space we are at 27 USD psf, surrounding areas we are at 22 USD psf. So now there is a small advantage in RE costs and a large advantage in labor costs. Now heres the kicker Indian costs are increasing across the board by 20% a year, JC, NJ costs have been flat and in clevland, OH rents have been dropping by 8% a year and salaries have been falling by 2%. Now we will ad the fun fact of being in a different time zone, not speaking the exact same language, having our work force be thousands of miles away from management and customers, and oh yeah those "Highly Trained, Intellegent workers" are not always what they claim to be. I am not trying to be jinoguistic(sp) but it is the truth hiring practices in India do not spot the loafer as well as in the US and while I admit there are many very intelligent workers there are also many dolts.

When you come right down to it the US is still an attractive place to do business. It will remain in a leadership position for a long time to come. I am sick of all of the doomsdayers who predict the downfall. We are about to hit a recession in the US but guess what, our economy is so global in scope it will trigger recessions in other countries!!! Like India, China, Mexico, we are the largest consumers on earth and are fueling many markets, when we fall... they stumble. Currently we are victims of our own growth and with economic trama we will return stronger than ever.

"What are you smoking mate. Manufacturing is not the only industry you need to think about. There's a lot more involved in Clinical Trials, Information technologies etc than just sniffing toxic fumes."

Exactly, and when communist China comes online with high tech, India will get blown out of the water, as will the US and Europe.

No level of efficiency in 'modern' countries can compete with slave labor.

"All wage imbalances aren't caused by slave/child labor. A tech or factory worker making $15000 a year in India or China isn't being oppressed."

If those markets ceased child and slave labor, they would be forced to raise taxes on the "$15K" white collar set, which would improve conditions in that country, while increasing the burden on those workers (as in the US), necessitate an increased gross wage for those workers, and help to level the playing field.

To expect a US worker to compete with someone making a small fraction of the pay, is folly.

The high-tech outsourcing troubles described above will diminish over time.

Take a look at Fortune 500 hiring practives -- they have slowed hiring US workers, and many new tech employees are from another country (India now, China later).

Add in attrition of existing US employees, the fact that US colleges are seeing massive drop offs in computer science majors (students see the writing on the wall and don't want a dead-end job), and in 10 years, you'll see a disastrous effect on the US job market.

Solutions are hard to come by, but many people are still in denial about the scope of the problem.

Unrealtor -

"Perhaps the US should cease or reduce trade with such nations until they implement fair worker regulations -- that's a US government program I'll get behind."

Sonds lovely but you are forgetting that the US economy is driven in large part by consumerism - consuming cheap foreign made goods. The cat is already out of the bag on that one unless we all stop shopping in Walmart and Target and buy only $10 a pound American grown and picked fruit. We now have to wait for the standard and cost of living in places such as China and India to rise to the point where they can afford American made goods.

Lishoosh, the US economy functioned pretty well a few decades ago.

I agree that the cat is out of the bag, but the problem (e.g., Walmart, outsourcing) is like an economic Trojan Horse.

There may be consequences in reducing the massive influx of cheap goods and cheap labor, but there are also consequences with letting these continue unabated.

Which is a greater consequence? I'd say the latter; and it will get worse over time.

I think a solution to the problem is not easy, and may be painful. But the current approach (by ALL politicians) is to ignore the problem, which allows it to grow worse each day.

Yes NJ has serious issues, yes there is a bubble market but it is not inclusive of the entire country. In NJ lower housing prices are probably coming. The bigger issue is our budget deficit and the lack of quality job creation. In many part of NNJ that doesn't count all that much as wages are dictated by NYC. Now before I hear NYC is too expensive it will lose out to India. WRONG, other comparable cities world wide have large costs. Hell Mumbai is ludacrisly expensive. But yes suburban nj has its issues.

As for the cat being out of the bag, we need to take care of the chinese and Indians the way we handled Mexico. Hook them on american brands and goods sell them the items they created but with our own profit. Sell them our designer brands, high technology products, and entertainment. Oh yeah they don't respect IP so we are the suckers at the end of the day. The truth is the gov't and major corps are allowing the chinese to rape us for short term profit gains.

To hook other countries on U.S. brands, those countries first need to drop the high tariffs on U.S. imports. Other countries play by mafia rules and tax foreign competitors out of their local market, or dump their products into U.S. markets below cost (Japan did so for years with cars, and probably other products) to wipe out the competition.

I think its simple, the houses are overvalued based on the fact that you can barely cover your expenses if you buy one, meaning that the total rent you can get from a house is barely enough to cover your monthly mortgage bill, add that up with all your other expenses, and you may barely make it, but then calculate the risk of bad tenants, no tenants, and other costs, and all of a sudden, putting down 100K and making 1% each year on the purchase doesn't make sense. Especially when you realize that the house will be worth the same or less in the future years to come.

Another thing to look at, during the late's 90's stock market boom, stocks traded with a P/E ratio of 200-300, whereas a fair value is around 35, (adjust up and down depending on several factors), so stocks kept going up and up and up, people kept buying...etc, and then all of a sudden, everybody looks at their stocks and says, these companies are not worth @#$@#!

So same thing for houses! Years ago you bought a house and it covered your mortgage (and a normal mortgage, not no stupid negative amortization ones), and you made some profit at the end of the year, and when the next real estate bubble came along you sold at great profit, found houses in areas that had not been hit by the bubble, buy them up and sell them in the bubble.

(that's hindsigh speaking though...question is, whats next?)

I personally don't think it's the stock market, but either way, it doesn't bother me, because I stick to fundamentals, I am currently looking into fixed income.

You guys can debate US vs. India/China/etc until the cows come home but I can assure you that the outsourcing is going on and will continue. I may agree with you but I know my company is doing it (& helps others do it) and my friend's companies are doing it...and this isn't only IT or call centers, but engineering, finance, supply chain, and HR. The $/hr rate differential is a major factor. You can debate competition but the companies don't care, it will continue. I don't like it any more than you do.

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home