A Look At Mortgage Resets

From the New York Times:

Re-Refinancing, and Putting Off Mortgage

By VIKAS BAJAJ and RON NIXON

It is the latest twist in the gravity-defying world of the high housing prices and exotic low-rate mortgages: As monthly payments on adjustable-rate mortgages are starting to balloon, many Americans have found a way to put off the day of reckoning.

They are refinancing with new adjustable-rate mortgages that keep monthly payments low — for now, that is, though their payments will likely rise even higher in the future.

“Some people would say I am a little crazy,” acknowledged R. Lance Perry, 42, of Danville, Calif., one of the new breed of people refinancing their mortgages. But faced with a sharp increase in his monthly payments and a need to take cash out of his home, he refinanced earlier this year to keep his payments the same.

By the time the rate goes up, he figures, his income will have increased enough to cover the higher payments, he will have refinanced again or he will have moved.

...

Now, the first big wave of the mortgage boom is cresting as more than $400 billion worth of adjustable-rate mortgages, or about 5 percent of all outstanding mortgage debt, will readjust this year for the first time, according to Loan Performance, a research firm. Next year, another $1 trillion in loans will readjust.

...

But the refinancing also represents a doubling-down on a bet that housing prices will continue to rise on the West and East Coasts and in other hot markets. If the value of the home falls closer to the amount of the loan, that could curb the ability to refinance, and may prompt the homeowner to either invest more in the home or to sell it.

...

Though they have been around for decades, the use of adjustable-rate mortgages has soared in the last several years, helping fuel the housing boom by letting people borrow more than they might have been able to. For buyers who do not intend to stay in their homes for long, they can cost a lot less than 30-year, fixed-rate mortgages.

...

“Before you see a distress sign, you have to have distress,” said Susan M. Wachter, a professor of real estate and finance at the Wharton School of the University of Pennsylvania. “And the distress will be higher unemployment and declining home values.”

Re-Refinancing, and Putting Off Mortgage

By VIKAS BAJAJ and RON NIXON

It is the latest twist in the gravity-defying world of the high housing prices and exotic low-rate mortgages: As monthly payments on adjustable-rate mortgages are starting to balloon, many Americans have found a way to put off the day of reckoning.

They are refinancing with new adjustable-rate mortgages that keep monthly payments low — for now, that is, though their payments will likely rise even higher in the future.

“Some people would say I am a little crazy,” acknowledged R. Lance Perry, 42, of Danville, Calif., one of the new breed of people refinancing their mortgages. But faced with a sharp increase in his monthly payments and a need to take cash out of his home, he refinanced earlier this year to keep his payments the same.

By the time the rate goes up, he figures, his income will have increased enough to cover the higher payments, he will have refinanced again or he will have moved.

...

Now, the first big wave of the mortgage boom is cresting as more than $400 billion worth of adjustable-rate mortgages, or about 5 percent of all outstanding mortgage debt, will readjust this year for the first time, according to Loan Performance, a research firm. Next year, another $1 trillion in loans will readjust.

...

But the refinancing also represents a doubling-down on a bet that housing prices will continue to rise on the West and East Coasts and in other hot markets. If the value of the home falls closer to the amount of the loan, that could curb the ability to refinance, and may prompt the homeowner to either invest more in the home or to sell it.

...

Though they have been around for decades, the use of adjustable-rate mortgages has soared in the last several years, helping fuel the housing boom by letting people borrow more than they might have been able to. For buyers who do not intend to stay in their homes for long, they can cost a lot less than 30-year, fixed-rate mortgages.

...

“Before you see a distress sign, you have to have distress,” said Susan M. Wachter, a professor of real estate and finance at the Wharton School of the University of Pennsylvania. “And the distress will be higher unemployment and declining home values.”

30 Comments:

But of course this doesn't matter in the NYC metro area where according to the NY Times or NY Magazine, everyone is a six figure white, white collar collar corporate professional who is more concerned about how trendy a neighborhood is rather than price.

And the biggest news on Marketwatch & Cnnfn is 'Back to School' Shopping. In spite of all this, most families will spend an average of $600 per child on back to school clothing (but more like $3,000 in the NYC / LI area). Seems like everyone still has a ton of cash left over after paying higher mortgage payments, utilities, taxes & insurance rates

My first thought on this was that the re-refinancers were the same as the people who think you can win in Vegas by doubling down after your losing bet.

I actually think its worse. Since you're playing a game with a knowable outcome in Vegas (the odds are the same on both bets), some people can actually come out even. I don't think that's the case here.

I would imagine there is a small percentage of people who will be able to make this work, but most of them are digging a hole they will not be able to get out of.

This is the micro version of the macro global imbalances that are now running rampant. The longer you put off the rebalancing, the larger the correction must be.

Lindsey

This isn't much of a problem in the NYC area where these exotic ARM, Interest Only & Option ARMS are a much smaller percentage of the total.

One of the reasons is that many people purchase co-ops & condos which typically do a full review of the buyers finances and doesn't allow these types of financing options. Usuaully 20% down or more is the minimum required to purchase a co-op or condo.

NO PAIN = NO PAIN

the only way this charade gets shut down is a recession where people lose jobs

banks and mortgage finance companies then have to confront huge write-offs

when you see an article of this type, it is a last gasp

write off 2006

Tues. morn. we have the NAR #'s

should be interesting.

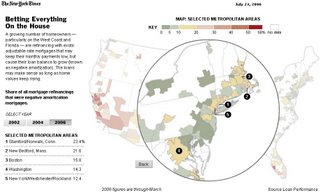

Interesting from the graph that the highest rate of negative amoratizing loans (10-20%) in Jersey are in Bergen and Somerset/Middlesex county, some of the areas with the quickest run ups in prices. And of course, that doesn't include all of the other ARMs. Seems like our area has a lot of speculation.

Anon 9:29, I wish it were so but check out the NYC map -we have just as many bozos getting risky loans as many other bubble areas-not as bad as calif and fla, but not good either.

Whaddya think only superrich folks live here? The boros are busting at the seams with working class people who've been scammed by these loans.

Gasoline prices top $3 gallon, hit 25-year high 47 minutes ago

The average retail price of a gallon of gasoline topped $3 in the United States last week, the highest price in 25 years, according to the latest nationwide Lundberg survey released on Sunday.

The national average for self-serve, regular unleaded gas was $3.0150 per gallon on July 21, a rise of almost 2 cents per gallon from two weeks ago when the average was $2.9952, the survey of about 7,000 gas stations said.

Last week's national average exceeds by one-third cent a high set last year after Hurricane Katrina caused a gasoline shortage, but was still short of an inflation-adjusted peak of $3.16 set in March 1981, survey author Trilby Lundberg said.

Prices were unlikely to go higher, she said.

"This price increase does not portend more price increases, unless there is a deepened threat to world oil supplies or a force majeure event," she said.

Although there are some refinery capacity problems, demand is not growing and probably is shrinking with gas at more than $3 a gallon, Lundberg said.

The highest price for gasoline was found in San Diego at an average $3.28 a gallon, and the lowest regional average was in Charleston, South Carolina, at $2.77 a gallon, she said.

anon 9:29,

You are at least partially mistaken about the quality of loans in NYC. Condos do not have the power to set financing standards for buyers. Their only option is to exercise their first right of refusal and buy it themselves at the same price. I sold my condo on the upper West Side a year ago to a lawyer. He didn't put anything down.

Co-ops have more power to set financing standards. Indeed co-ops can refuse a sale for no reason at all and without having to buy it themselves. That's one reason why co-ops are such a bad ownershipd structure that they are virtually unknown outside of NYC.

Although co-ops can set borrowing standards for buyers, this power does not imply that they use following sound financing practices themselves. Co-ops always finance major improvements so they always pay interest. Most condos fund improvements by assessments which, while unpopular, at least avoid interest.

Gold May Rise on Speculation Fed to Struggle Curbing Inflation

July 24 (Bloomberg) -- Gold may resume its rally on speculation that the Federal Reserve will halt interest-rate increases too soon to curb inflation, as fuel costs remain near record highs.

Eighteen of 42 traders, investors and analysts from Sydney to Chicago surveyed by Bloomberg News on July 20 and July 21 advised buying gold, which fell 7.2 percent to $620.20 an ounce in New York last week. Fifteen respondents said to sell and nine were neutral.

Gold jumped 46 percent in the past year, partly on signs of accelerating inflation. Fed Chairman Ben S. Bernanke said last week economic growth is slowing and hinted the central bank may halt two years of rate increases, even after oil rose to a record $78.40 a barrel this month.

``Rising inflation is in the cards with $70-plus crude oil,'' said James Turk, founder of GoldMoney.com, which stores gold for investors and is based in Jersey, British Channel Islands. ``The Fed is losing grip of its attempt to control inflationary expectations. Gold is probably going to trade in a $600 to $700 range until September.''

Gold futures for August delivery on the Comex division of the New York Mercantile Exchange lost $47.80 last week, the biggest percentage drop since May 19. The decline surprised the majority of analysts who expected a gain when surveyed July 13 and July 14. The Bloomberg survey has accurately forecast prices in 72 of 117 weeks, or 62 percent of the time.

Inflation Hedge

Some investors buy gold to preserve purchasing power in times of accelerating inflation. Gold futures surged to $873 in 1980, when a jump in the cost of oil led to a 13 percent annual rise in U.S. consumer prices.

Oil prices are up 22 percent this year, fueling a 36 percent increase in U.S. retail gasoline prices, to near $3 a gallon. Gold is up 20 percent during the same period.

Consumer prices excluding food and energy rose 2.6 percent from June 2005, the biggest year-over-year rise since 2002, the Labor Department said last week.

The Fed raised its inflation forecast on July 19. Its preferred price gauge, which excludes food and energy, will rise by 2.25 percent to 2.5 percent in the fourth quarter from a year earlier, the central bank said in its semi-annual report to Congress. Its previous forecast was a 2 percent gain.

Spot gold may rise about 8 percent to $670 this week, said Peter Schiff, president of Darien, Connecticut-based brokerage Euro Pacific Capital Inc.

Fed `In a Box'

``The short-term outlook for gold is good,'' Schiff said. ``What's driving gold is inflation. The economy, in fact, is slowing but inflation is accelerating and the Fed is in a box. A weaker economy is going to hurt the dollar,'' boosting the appeal of gold, he said.

Manufacturing growth in the Philadelphia area decelerated this month more than economists estimated. The Federal Reserve Bank of Philadelphia's general economic index fell to 6 in July from 13.1 in June. Economists had expected a decline to 12, the median forecast in a Bloomberg News survey. Ford Motor Co., the world's No. 2 automaker, said it will cut output after an unexpected second-quarter loss.

Bernanke told U.S. lawmakers last week that there is ``moderation in economic growth,'' after 17 straight Fed rate increases since June 2004. The housing market's slowdown this year has so far been ``orderly,'' though central bankers are monitoring the situation ``very carefully'' for the economic effects, he said.

Not Too Tight

The Fed raised its key lending rate to 5.25 percent from a four-decade low of 1 percent in June 2004 to curb inflation. Sales of new U.S. homes probably fell to an annual rate of 1.16 million in June from 1.234 million, according to the median forecast of 53 economists in a separate survey. The Commerce Department is scheduled to release the report on July 27.

Since Bernanke told Congress last week that policy makers don't want to ``tighten too much,'' traders of interest-rate futures have more than halved bets the Fed will raise rates at its Aug. 8 meeting.

Fed funds futures show traders see a 41 percent chance the central bank will lift its lending rate a quarter-percentage point to 5.5 percent on Aug. 8, down from a 90 percent chance before Bernanke spoke.

Hedge-fund managers and other large speculators increased their holdings of Comex gold futures in the week ended July 18, government figures show. Speculative net-long positions, or bets that gold will rise, increased 5.3 percent to 107,374 contracts, the highest since the week ended May 23, the government said.

Mideast Violence

Gold also may get a boost from Israeli-Hezbollah clashes in Lebanon. Some investors buy gold as a hedge against declines in other investments in times of political unrest.

``With the escalation in the Middle East tension and with the market thinking perhaps the Fed is going to stop raising rates, gold will go higher,'' said Leonard Kaplan, president of Prospector Asset Management in Evanston, Illinois. ``It looks like Israel is preparing for a ground war.''

To contact the reporter on this story:

Choy Leng Yeong in Seattle at clyeong@bloomberg.net

-------

When I was in Saigon during the war, I brought back alot of gold and silver (and a few bullet holes in the thigh too). Then the bull market of the metals came in the mid 70s, this is how I got my financial start. It enabled me to pay for my college education at Tuck buisness school. I am a big believer in the meteal, because history is about to repeat itself.....in my opinion....

SAS

But things are rosier than ever for the average household according to the NY Times, NY Magazine, CNNFN, & Marketwatch.

The focus is now on Back to School shopping and how most people will be spending more (substantially) than last year. Spending $3,000- $5,000 or $10,000 or more just on Fall Clothing is average for many people in this area.

Job growth & income growth are still driving the economy of this region. It seems like everyone is making $150,000 or more while rents continue to spiral higher each month.

Condo sales price gained may have slowed, but rents are booming higher. You cannot find a decent one bedroom in Bergen or Hudson county for less than $2,000 a month. And remember, Heat/Hot Water & Parking are never included...

"Spiraling rents"? My rent went up $45 this year, hardly a financial burden compared to the $5,000/month needed to buy a decent home.

"Some people would say I am a little crazy,” acknowledged R. Lance Perry, 42, of Danville, Calif., one of the new breed of people refinancing their mortgages. But faced with a sharp increase in his monthly payments and a need to take cash out of his home, he refinanced earlier this year to keep his payments the same. "

just my opinion... but someone doing a refi "earlier this year"... and going for one within the past couple of months or now... huge difference... completely different market... to get a refi, the house must appraise.

my rent went up $50 this year... and my apartment includes heat and hot water... Also, i was just at a friend's house this evening and they told me that last winter they spent $850 per month on heat...

Big week on the economic front.

Tuesday

Consumer Confidence

Existing Home Sales

Wednesday

Fed Beige Book

Thursday

New Home Sales

Friday

Q2 GDP

grim:

If you were a person, say someone very high up in a political administration, and you decided it was time to turn a bunch of bulls in a market, how would you do it? For the time being, let's say that the players are smart, monied, and use the internet.

Let's say your problem is that you think you are going to need a bunch of bodies in 2 to 4+ years. Bodies who need $$$ bad. Bodies already in debt. Maybe for something like a draft. And you plan to offer them really nice parting gifts in return for their enthusiasm. Maybe even loan forgiveness.

Let's say that the market in question provided 50% of all job growth during a Repub. administration, and let's say there wasn't really anything in the hopper to replace all those jobs if that particular market took a dive.

Would you ever consider a staged rollout of blogs?

Maybe in those areas with the biggest appreciation "bubbles" first? Like CA, AZ, FL, NNJ, MA?

Oops! Why, that's where the bloggers are, isn't is?

But we have all those illegal immigrants around, working in housing, so maybe we need a news blowup in '05 to clear out that issue, too.

I think what was bothering me was how the person would determine the exact time to turn the bulls.

Maybe was AG's last project.

Dunno.

{{ "Spiraling rents"? My rent went up $45 this year, hardly a financial burden compared to the $5,000/month needed to buy a decent home.}}

You must not be from Queens, Brooklyn or any of the 'other 4 boros' outside Manhattan. Rents are spiraling higher at rates not seen in the past 25 years not to mention the cost of groceries, gas, insurance, or any type of entertainment. Too bad I don't make over $150,000 a year and can afford Whole Foods or be able to eat out every night.

Its amazing how much income you need for even the most basic standard of living in this area. Meanwhile people just out of college are living it up. If you are single and make less than $100,000, it is very hard with todays cost of living even well outside Manhattan.

You cannot touch a one bedroom anywhere in northern Queens (Now Yuppie Central) for less than $1,500 and you must put down 6 months rent upfront and pay some exorbitant brokers fee.

Jersey City is also way overrated. Drove around the last few weekends and can't see why this is now the hottest part of the NYC metro region outside of Soho & Tribeca.

{{{ "Spiraling rents"? My rent went up $45 this year, hardly a financial burden compared to the $5,000/month needed to buy a decent home.}}}

And $1,800 a month and a $100,000 a year income (per person) is what you need to rent (and qualify) a decent apartment anywhere in the metro area with less than a 2 hour commute to midtown Manhattan.

One bedroom apartments in the dogiest, dingiest AKA 'Up and Coming' parts of Jersey City Heights or Greenville Start a $1,800 a month. Of course Heat, HW, Gas and parking are NEVER included so its another $200 a month for those 'luxuries'

One bedroom apartments in the dogiest, dingiest AKA 'Up and Coming' parts of Jersey City Heights or Greenville Start a $1,800 a month. Of course Heat, HW, Gas and parking are NEVER included so its another $200 a month for those 'luxuries'

Hmmmm....here's an ad for a one br in Hoboken for $1600/mo.

http://www.libertyrealestate.com/public/listingSingle.do?listing.listingID=140006

So I guess you don't know what you're talking about.

Either that or I missed the sarcasm of a reverse troll.

"And $1,800 a month and a $100,000 a year income (per person) is what you need to rent (and qualify) a decent apartment anywhere in the metro area with less than a 2 hour commute to midtown Manhattan."

Nonsense. There are many nice apartments in Summit in the $1,200 range.

Nice town, top schools, commute in under an hour.

This brings up an interesing question. As ARM mortgage rates increase, and more people default on their loans, how do you all feel about getting a house in pre-forclosure or foreclosure?

JWR

JWR touched on a subject that is close to my heart. How do you go about getting a home in pre-foreclosure? Do you sign up to realty-trac and try to get the info from there and start cold calling people? Do you get to know the loan officers at small local banks? How do you get in before the vultures? I'm sure I'm not the only one who has noticed the signs going up "We Buy Houses - Close in Less than 7 Days, and get CASH". How do I get to people before they do, especially considering they have the finances to get in and scoop up these houses?

Anon 7/23/2006 10:51:43 PM

I think you forgot your medication. Remember you get paranoid without it.

Stop listening to BAI!

Who in their right mind would

continue to live in hoboken?

What a shithole. overpriced,

$300 jeans (the guys)

Finance guys who think they know

it all.

and the gals who want a sugar

daddy.

Everyone's got an mba,and

still can't afford a house,

a car (they lease).

Makes me sick.

{{Everyone's got an mba,and

still can't afford a house,

a car (they lease).}}

Because both the guys & girls spend $3,000 - $5,000 on clothes in addition to rent. Got to have those $300 dress shirts & those $300 jeans.

Life is all about shopping and dining out.

Anonymous said...

Who in their right mind would

continue to live in hoboken?

What a shithole. overpriced,

$300 jeans (the guys)

Finance guys who think they know

it all.

and the gals who want a sugar

daddy.

Everyone's got an mba,and

still can't afford a house,

a car (they lease).

Makes me sick.

7/24/2006 02:31:26 PM

Doh! :(

I wear $506 jeans.

Right metro?

;)

lees-

Banks have lists of houses that are in some state of foreclosure. You don't have to buy them. Just have to persistent with the manager/head of loan department.

JM

The $300 JeanQueen is back! Where have you been? We've missed you!

NOT!

And by the way, I live in Jersey City (same place for the past 14 years) and my rent did not go up at all this year. The JeanQueen stated earlier or in another thread that it wasn't possible to live in JC and not experience a rent increase. I'm living proof that he/she is wrong---as he/she is on everything that comes out of his/her fingers.

It's actually not easy to find Levis 501 jeans these days. $36.

RE: foreclosures

From what I've picked up, most good deals are before the house gets auctioned off, and once it's auctioned off, the heavy hitters are on the court house steps with bags of cash to wipe out the average Joe bidders.

Post a Comment

<< Home