Don't buy stuff you cannot afford

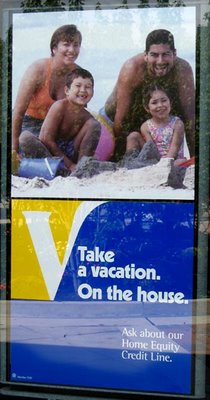

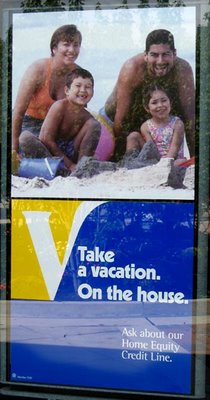

Came across this poster in the window of a Valley National Bank this morning. What ever happened to paying for things with... money? When did the line between buying and borrowing get so blurred?

A little primer for those who think borrowing against your home to take a vacation is a good idea.

Caveat Emptor,

Grim

A little primer for those who think borrowing against your home to take a vacation is a good idea.

Caveat Emptor,

Grim

14 Comments:

Oh My look Gluts of dream priced inventory piling up daily

Welcome to the new home of Garden State MLS’ public search engine. Currently, there are 32,222 properties advertised for sale in NJ on our site.

Lots of sellers but No buyers. Bad news realtors. Oh but the NAR says the market is back to normal. Righto!

“‘The brakes went on — boom! — it stopped,’ said local builder Bart DeRosso. ‘It’s definitely, definitely dried up.’”

Hello!

wakeup!

‘If you want to know where the market’s going, you look at inventory,’ said Denny Grimes, a Realtor

This is absolute insanity. Shame on you Valley National.

He already has dropped the price because potential buyers have been few and far between.”

10:1 sellers to buyers deck is stacked against the grubbers.

No money No problema. $99 and a job you can buy a car!

Society has lost all sense of value.

Bleed'em dry!

Whatcha going to do when the IO ARM readjusts,Dummies?

My wife and I had a closing yesterday. Unfortunately, only the twelfth this year, and we are running out of year. The story of this transaction tells much about what is happening in Atlanta real estate. We have known Paul and Denise for years. They called us in late April to come list their home. The market in April here had really just started to cool. We did our market analysis and recommended they list at $550,000, which they did. By June we had no offers and reduced to $$535,000. By now our market was cooling and everyone even here was starting to become aware of the very big price drops taking place in the hot markets elsewhere. We reduced once more to $525,000 in early August and took our first offer a week later for $490,000. We countered at $512,000, trying to meet them in the middle. They held firm at $490,000. We countered at $499,000 but still no deal. We went under contract at $490,000, the buyer's original offer price. If you have your calculator out, that's 11% below the original list price. Paul and Denise's home was in perfect condition in a sought after neighborhood. It's been that kind of year. Our best listings sell while the rest do not.

Anyway, so there we are at the closing table. The closing attorney hands out the HUD-1 closing statements. She starts at the top on the seller's side with the $490,000 contract price. Then the attorney starts down the page deducting the first mortgage, a small second, the real estate commission, pro-rated taxes and all the rest. There, at the bottom, the amount due the seller. Only this time, surprise, the seller owes $1,040. Paul laughs and says, “Is this a great country or what? You sell a house and owe money.” Everyone laughs. Paul and Denise have done well over the years. I doubt if this really hurt them, but I do think they sold for less than they would have thought just a few months ago. In a year like this, there are most likely many sellers bringing checks to the closing.

I remember that skit. People are so stupid. Instant gratification is not a necessity.

Please cite sources and give credit where appropriate.

The text above is from Mish's blog:

Global Economic Analysis

grim

from cnn

Help! Home for sale - the Eatons

It's big, beautiful and a bargain but this Illinois home is sitting on the market.

Welcome to the Monthly Payment society. No savings, no equity, no net worth - only Monthly Payment.

Chaka Chong

Love that Steve Martin skit!

The deeper issue is exactly that--instant gratification. And the creation of a false sense of security and wealth. Property, entitlement, "heritage," the American Family. And it's propped up with crippling debt.

Now, whose purposes would that serve?

Even though it's presented as a joke, I think the Steve Martin skit advocates true American values, unlike the patriotic debt slavery of the White Picket Fence.

We have mistaken style for substance, and been encouraged to persist in our mistake for the short-term profit of a few...financially and I daresay politically.

Will we learn?

Thriftily yours!

'

Post a Comment

<< Home