Lowball! 8/22 - 9/4 (Sussex, Somerset, Union)

Welcome to another edition of Lowball!

Lowball! takes a look at home sales from a different perspective. For those new to Lowball!, a lowball offer is when a buyer offers a significantly lower bid than asking in hopes that the seller accepts the offer. We take a list of home sales from the past month and pick out the sales that have the highest percentage difference between list price and selling price.

The purpose of Lowball! is to show buyers that the market has changed and buyers now have considerably more leverage than sellers. Just a short time ago, Lowball! offers would have been laughed at and discarded, however, not any more. The fact that so many under-asking offers are being accepted is clear proof that the market is changing.The list does not contain all sales, I hand-pick the most interesting sales from the list. These listings might be the highest dollar drops, biggest percentage reductions, or sales in towns that are thought to still be 'hot'. Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Here are the lowball sales for Sussex, Somerset, and Union Counties from 8/22 through 9/4. Sorry, but I'm a bit pressed for time this morning, so counties were combined and presented as images.

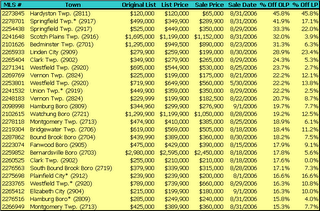

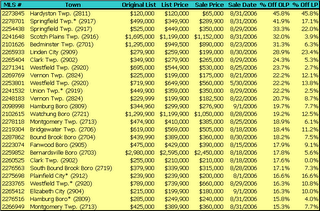

Lowball! Greater than 15%

(Click to enlarge)

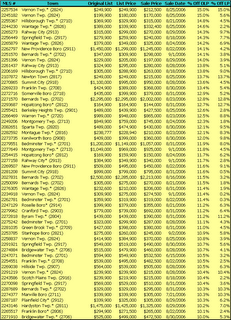

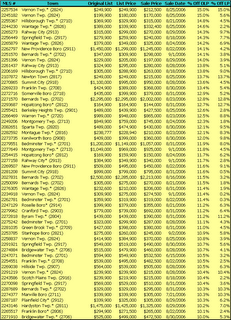

Lowball! 10% to 15%

(Click to enlarge)

Lowball! takes a look at home sales from a different perspective. For those new to Lowball!, a lowball offer is when a buyer offers a significantly lower bid than asking in hopes that the seller accepts the offer. We take a list of home sales from the past month and pick out the sales that have the highest percentage difference between list price and selling price.

The purpose of Lowball! is to show buyers that the market has changed and buyers now have considerably more leverage than sellers. Just a short time ago, Lowball! offers would have been laughed at and discarded, however, not any more. The fact that so many under-asking offers are being accepted is clear proof that the market is changing.The list does not contain all sales, I hand-pick the most interesting sales from the list. These listings might be the highest dollar drops, biggest percentage reductions, or sales in towns that are thought to still be 'hot'. Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Here are the lowball sales for Sussex, Somerset, and Union Counties from 8/22 through 9/4. Sorry, but I'm a bit pressed for time this morning, so counties were combined and presented as images.

Lowball! Greater than 15%

(Click to enlarge)

Lowball! 10% to 15%

(Click to enlarge)

14 Comments:

Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Hi,

Does anyone know how many houses were sold between 8/22 and 9/4 in somerset?

thanks

regards

http://flippersintrouble.blogspot.com/

Starving grubbing realtors said what?

anyone have experience with this?

http://www.ahamembership.com/property_tax/index.cfm

Well, maybe it's not about incomes then.

1) There is a greatest transfer of wealth from the boomers. Maybe people get (several?) 100k as "house" wedding gifts from their parents.

2) Many 914 people live home (or with roommates) until age 30ish. Most people in the new generation have 6-fig bank accounts

3) and 6-fig salaries.

4) Add dual income,

and house prices are not a big deal.

CONSERVATIVELY....

$100k from guy's parents.

$100k from gal's parents.

$50k wedding profit

$100k saved by the guy.

$100k saved by the gal.

$50k profit from gal's apt.

$50k profit from guy's apt.

Please. That's $550k CASH right there, for an AVERAGE couple...

Oh, and even a $75k salary can get $200k mortgage. So, that's ANOTHER $400k in buying power.

That's $950k avail. to plow into a house....for a typical $75k couple

interesting link

http://www.realestatedecline.com

SAS

Please. That's $550k CASH right there, for an AVERAGE couple...

Do you honestly think this is average?

Admittedly, I don't travel in Wall Street circles. I don't know anyone who has been given 200K for a house by their parents. Maybe 10K, but not 200.

"$50k wedding profit"

I have been married 5 times.

Didn't get a dime each time.

I really don't know where this fellow got these numbers? Perhaps he/she may need to reevaluate them.

yes?

;)

SAS

Admittedly, I don't travel in Wall Street circles. I don't know anyone who has been given 200K for a house by their parents. Maybe 10K, but not 200.

9/04/2006 03:58:36 PM

Well among other things, it would trigger gift taxes, so I'd like to think that people with such money would be talking to a professional before making such a stunning wealth transfer for a modest reason.

Kind of injects a little dubiousness into the veracity of the post.

Perhaps all the immigrants will get the same amount of cash as our basement dwelling GenX-ers? It as if having a place to live has suffered a shortage and has put people into paranoia about missing out on real estate windfalls to be made. Real estate is cyclic. Unfortunately, interest in owning a home wanes when it looks like a buyer in this market will end up owning a depreciating asset.

Lowball is a great slice of data you provide and it is much appreciated. One additional piece of information that could help in determining how close we are to returning to the median is knowing what the previous sale price was for these homes. Especially if the previous sale occured in the mid-90's.

Does the NJ Tax Assessors website only update once a quarter? I see a lot of towns have had no updated info since beg. of July.

ARMS .....SHWARM...

There are HUNDREDS of other places to "find" money, without putting Lassie to sleep (Which would cost $300 as well)

Cut out:

Starbucks. $100/mo

Gym membership $100/mo,.

Some new Clothes: $100/mo

Increase deductible(s): $100/mo

Abort Whole Foods: $100/mo

Buy generic grocery stuff: $100/mo.

Share a cell phone: $50/mo

Cancel cable: $50/mo

Lower the heat: $50/mo.

Cancel vacation: $300/mo

List is endless. That's just $1000/mo. off the top of my head.

People will be find.

Put the crash helmets away.

Anonymous said...

People will be fin[e].

Put the crash helmets away.

9/04/2006 08:55:06 PM

Isn't that what Big Ben Rothleisberger said?

Warning, Fisking of a realwhore ahead:

>Starbucks. $100/mo

$5/day x 20 working days a month? Maybe for the caffiene addict, not for most. Maybe $24/mo

>Gym membership $100/mo,.

I pay $13/mo for Bally's; few are more than $30.

>Some new Clothes: $100/mo

how much was the person spending on clothing to begin with? Unfounded assumption.

>Increase deductible(s): $100/mo

Increasing deductible to $1k saves TOPS 25% a year and ONLY on the collision portion (not liability, PIP, etc.) If its $100 a month savings, then it was $400 a month to begin with. In the reality-based world this saves $25/month.

>Abort Whole Foods: $100/mo

Who the hell shops there anyway? 'Organic' is how a farmer sells his scrawny vegtables for 30% more markup.

>Buy generic grocery stuff: $100/mo.

I barely spend $250 a month for a family of 3 buying name brands. Again, in the reality-based world, 9 cents per can is not going to add up to $100/mons unless you're running a hostel.

>Share a cell phone: $50/mo

Having to share a cell phone kind of defeats the purpose of having the cell phone. You probably chain your laptop to the office desk for security too. besides, I've never spent more than $50/mo for my OWN cell phone. Who's spending $100/mo that sharing can cut $50? Another wild-a$$ed inflated and unfounded (WAIU) number...

>Cancel cable: $50/mo

You're probably low her at $50/mo, but even a stopped clock is right twice a day.

>Lower the heat: $50/mo.

WAUI, see above...

>Cancel vacation: $300/mo

I may agree with you in the short term, but you're talking about cancelling the vacation to make the payments for the next 50 years? I guess you can splurge an take the train out to the Hamptons after you retire at 75, right?

In short, you're been disarmed like the Monty Python's Black Knight. Now I will leave you to wail about how it's only a flesh wound....

Post a Comment

<< Home