Real Estate Like The Dot Coms - Jim Cramer

Always an optimist, he nevertheless believes that the real estate bubble is about to burst.

“I think real estate is very similar right now to what the dotcoms were like in 2000. Everybody thinks you can’t miss with real estate. Actually I shouldn't say that. In the last five months, I think it's starting to dawn on people that real estate can go wrong,” says Cramer.

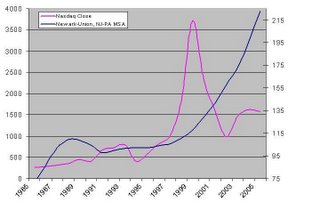

His comment got me wondering, just how similar is the trend seen in the Nasdaq circa 2000 to the housing bubble today? I plotted the closing price of the Nasdaq index from 1985 to 2005 on one scale, on the other I plotted the Newark-Union, NJ-PA MSA house price index data (This is the same dataset RentingInNJ used in a piece a few weeks back). Please note the scales are adjusted to that the peaks and troughs of the trends fall at similar levels. However, the trends do point to an interesting relationship. How much of our local housing bubble was due to the run up in the Nasdaq beginning in the late 90s? Wages were tremendous in Northern NJ/NYC during the dot com era and many portfolios were bulging at the seams. However, the graph clearly shows (again), how steeply prices have increased in a relatively short period of time.

Please note the scales are adjusted to that the peaks and troughs of the trends fall at similar levels. However, the trends do point to an interesting relationship. How much of our local housing bubble was due to the run up in the Nasdaq beginning in the late 90s? Wages were tremendous in Northern NJ/NYC during the dot com era and many portfolios were bulging at the seams. However, the graph clearly shows (again), how steeply prices have increased in a relatively short period of time.

Caveat Emptor,

James

12 Comments:

Ahh...white background, the blog is much easier to read now.

I have been renting until the market "adjust". WHEN would I know it's time to buy? How long would it take for the market to bottom out? In Japan, the market kept sinking for 14 years.... Any thoughts?

Anon,

It's easy to know when it is the optimal time to buy, but you need to be able to judge the psychology of the market to do it. It will be when the market has a distaste for real estate as an investment.

If I came up to you on the street, out of nowhere, and said I had a 'sure thing' stock pick. What would you say? What if I continued to say that the company was called petstuffonline.com (fake) that sold all sorts of pet goods online? What if I kept ranting and raving about the 'new economy'? You would kindly tell me to go on with my business and walk away.

I bet you if you walk up to an average person on the street and tell them you've got a whopper of a real estate deal for them, they'd stop and listen.

Japan didn't sink very much after the initial collapse of the market. In roughly 2 years it fell two thirds of the total drop. The remaining third took more than ten years.

grim

More proof from WSJ:

Housing Market Shows Further Signs of Cooling --- Gap Between Buyers, Sellers Is Widening, Realtors Say; Welcome Trend for the Fed

J000000020051115e1bf00037

By James R. Hagerty and Ruth Simon

1542 Words

15 November 2005

The Wall Street Journal

A1

English

(Copyright (c) 2005, Dow Jones & Company, Inc.)

The pace of U.S. home sales is showing further signs of slowing, amid a widening gap between sellers' asking prices and the amount skittish buyers are prepared to offer, according to an industry survey, real-estate brokerage firms and housing economists.

Rising mortgage rates, higher energy costs, widespread talk about the risk of a "bubble" in housing and a surge in the number of homes on the market are among the factors behind the apparent slowdown. They have combined to make home shoppers more cautious, economists and real-estate brokers say. Buyers are taking their time to look for bargains, while many sellers have put unrealistically high price tags on their homes. That leads to a standoff, causing the number of sales to drop -- a classic ending to a period of unusually rapid house-price increases.

In a survey conducted last week, real-estate consulting firm Real Trends found that the number of home-purchase contracts signed last month dropped 8% from a year earlier at 48 of the nation's large real-estate brokerage firms. Those brokers responded to an email poll sent to 80 brokerage firms.

To be sure, home sales remain strong by historical standards, and prices in most of the country are at or near records. But even some of the biggest boosters of housing agree that the market has finally moved out of the boom phase that has raised prices nationwide an average of more than 50% in the past five years and more than doubled home values in many cities. "The air is coming out of the balloons," says David Lereah, chief economist at the National Association of Realtors, the nation's leading real-estate trade group.

The $2 trillion housing market has been the primary driver of consumer spending in recent years and accounts for about one-third of households' net worth. There hasn't been a sustained drop in housing prices in any major part of the U.S. in a decade or more, and housing has become a vital barometer for the financial, retail and homebuilding industries.

"The [house-buying] frenzy is over," says Steve Murray, president of Real Trends, Littleton, Colo. Mr. Murray says it may take six to eight months before sellers accept that the market has softened and reduce their asking prices. He said some of the brokers surveyed were surprised at how rapidly the market seemed to be cooling in recent weeks.

"We believe the market has peaked," says Doug Duncan, chief economist of the Mortgage Bankers Association. Because of brisk sales earlier this year, he expects sales of new and previously occupied homes to reach a record 8.3 million in 2005, up 4% from 2004. But he believes sales will decline 3.5% next year, ending a four-year streak of record-setting totals.

A cooling of the market is likely to be welcomed by the Federal Reserve, which has worried that home prices have become frothy and banks' mortgage underwriting standards have slipped. For the past few years, fast-rising home prices have allowed people to borrow more against their home equity, fueling a spending boom. Last month, Fed governor Donald Kohn, citing "some indications that housing markets are cooling off," said this would force consumers, who are not saving any of their current income, to save more to build wealth, restoring balance to the U.S. economy.

A slowdown in home-price appreciation would probably restrain economic growth, and perhaps encourage the Fed to stop raising interest rates. However, absent a significant decline in prices, the Fed would be unlikely to cut rates to cushion housing. Ben Bernanke, chairman of President Bush's Council of Economic Advisers and nominee to succeed Fed Chairman Alan Greenspan in February, said last month that "a moderate cooling in the housing market, should one occur, would not be inconsistent with the economy continuing to grow at or near" its long-term trend next year.

Mr. Lereah of the National Association of Realtors still expects the housing market to have a soft landing. He predicts that median home prices will rise about 5% in 2006 after leaping 12% this year. In September, the national median stood at $212,000, according to the Realtors.

Others fear that the slowdown will be more painful, particularly in areas where prices have soared the most. In a report issued earlier this month, analysts at the New York office of Swiss bank UBS AG said the current upswing in home prices has now matched the unusual surge seen in the aftermath of World War II. Because price increases have been unusually swift and prolonged, the report said, "the odds of a soft landing seem smaller than if the cycle had peaked earlier."

In Westchester County, N.Y., just north of New York City, Greg Rand, managing partner of Prudential Rand Realty in White Plains, says he expects prices to fall by around 3% next year.

David P. D'Ausilio, operating partner of Keller Williams CT Realty in Monroe, Conn., points to a 14% rise from a year earlier in the number of homes put on the market in Fairfield County, Conn., also near New York, in the first 10 months of 2005. "There's a newfound sense of urgency among sellers to get out while the getting is good," Mr. D'Ausilio says. He expects prices to fall 5% to 10% in his area over the next 12 months.

Maxine Golden of Re/Max Real Estate Services in Newport Beach, Calif., says that in contrast to this spring buyers are shying away from bidding wars. "They don't want to get involved if someone else is interested," she says. "They are taking a wait-and-see attitude even if it's something they want. They think there will be other things on the market."

The survey by Real Trends found that last month's decline in home-purchase contracts was particularly sharp in the West Coast region, down 14%. It found declines of 7% in the Northeast and 8% in the Mid-Atlantic states, while the Southeast was down just 1.5% and the Southwest showed a 1% increase. Though the survey is far from definitive, the trend is clear, Mr. Murray says, particularly because the brokers polled have large local market shares.

A more comprehensive look at the market is due Dec. 6, when the National Association of Realtors plans to release its monthly index of pending home sales. The NAR reported earlier this month that the index based on contracts signed in September was up 3.3% from a year earlier. Sales are considered pending when a contract has been signed but the transaction isn't yet complete.

"There is a definite change" in supply and demand, says Jacelyn Botti, a senior vice president at Weichert Realtors, a big chain based in Morris Plains, N.J. Along much of the East Coast, she says, inventories of homes available for sale have bloated to a supply sufficient to last five to eight months at current sales rates, compared with three or four months a year ago.

With sales slowing, condominium developers in San Diego are appealing to buyers with an array of incentives, says Robert Griswold, owner of Griswold Real Estate Management. "The market has definitely turned," says Mr. Griswold, noting that fliers offering condo buyers a car were being handed out at a recent Rolling Stones concert. "When you see that kind of advertising and promotion, they are clearly getting desperate."

While many sellers of single-family homes are stubborn in resisting price cuts, some are starting to compromise. Ken Baris, president of Jordan Baris Inc., a real-estate brokerage in West Orange, N.J., says he received an email on Friday from a client suggesting that the firm reduce the price on his five-bedroom home to $829,900 from $849,900. The house has been sitting on the market for 90 days. "It was an unsolicited price adjustment," says Mr. Baris. "I haven't seen that in a very long time."

Until recently, unusually low interest rates and flexible lending standards were helping Americans keep paying more for houses, despite slow growth in personal income. But that's changing. The average rate on a 30-year fixed-rate mortgage is about 6.5%, the highest level in more than two years, according to HSH Associates in Pompton Plains, N.J. That's up from about 5.2% in June 2003, which was the lowest in more than four decades.

The cost of adjustable-rate mortgages also has been rising, and some lenders have become more reluctant to grant loans that allow borrowers to minimize payments in the early years. The rising cost of credit makes it hard for people who already were stretched to buy homes. Mr. Duncan of the Mortgage Bankers expects mortgage rates to continue rising, reaching about 6.75% for a 30-year fixed-rate loan by the end of next year.

The WSJ was a real estate cheerleader for quite a long time. It's rather significant that they've changed their tune. They seem to share the flip-flop mentality with Cramer, pump while the sector is hot, and dump when sentiment changes.

-jb

Report: Housing market cooling

The Wall Street Journal, reporting on the results of a survey of real estate brokers as well as comments from brokers and real estate economists, reported Tuesday that there are numerous signs of a slowdown in what has been a white-hot home market.

Heck, even CNN thinks the WSJ piece is important enough to report on it.

jb

CRAMER IS AN JERK LEADING THE HERD TO SLAUGHTER.

WHAT ABOUT HIS LANDBANK BS??????

HE IS A DANGEROUS FELLOW CUZ HE HAS THE PLATFORM NATIONAL TO TOUT HIS VIEWS. MANY MORONS BOUGHT ON ACCOUNT OF HIS BULLISH LANDBANK CALL.

HE GOT KILLED ON TECH STOCKS THAT HE LOVED AT THE TOP!

Housing is going to plunge.

watch.

It is so irrational that the last of the Bonbeheads bought in. Now the buyers will demand cuts of 35% before biddding or just put in bids 35% lower.

Condos do NOT bidon. 50% drops in store for these basketcases.

DO NOT BE AN IDIOT AND RUSH INTO BIDDING. MARKETS TAKE A LITTLE WHILE TO GRIND THE DENIAL OUT OF THE PAST WINNNERS. 12-18 MONTHS WILL GRIND THESE GREEDY LOSERS INTO SUBMISSION.

Unfortunately one bogus article like the Star Ledger which claimed that the most prices can fall is 13% will be read more widely in NJ than the WSJ.

How do you know when to buy? Well, if your mortgage + int (+ maintenance) comes out to less than (or perhaps equal) your rent...then go ahead and buy.

great advices on when to buy a home. seems for mortgage payment to be less than rent, the market has to go down by 50% in my area. is that possible?

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home