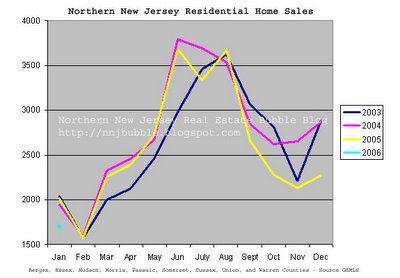

January Northern New Jersey Residential Home Sales Fall

We've finished gathering the January 2006 Residential Home Sales Data (from GSMLS). This data is ours, gathered by my team. As soon as the prior months statistics are available, we gather that data and compare it, YOY, with the 2003, 2004, and 2005 sales data to determine trends within the current real estate market.

(click to enlarge)

(click to enlarge)

The January numbers were slightly below even our preliminary estimates. Total sales for the counties monitored in January came in at 1705, approximately 15% under January 2005 and 25% under December 2005.

This data is not seasonally adjusted and consists of sales of GSMLS listed properties in Bergen, Essex, Hudson, Morris, Passaic, Somerset, Sussex, Union, and Warren counties. This data does not include sales from other listing services (NJMLS or Hudson MLS) nor does it contain FSBO sales. However, GSMLS is the largest MLS service in Northern NJ, thus we're confident that the data provided is representative of the market.

Caveat Emptor!

Grim

40 Comments:

I think for next month you may have to change the scale on that left margin! ;)

Grim,

Is this your list of NNJ. Just curious where you define the region. Is it where the counties are mostly above I-78? My line for SNJ is below I-195. Everything elso is central.

They will not. It's the same reason why Greenspan, the NAR, and other notable economists and politicians won't. Because what they say has the power to shift public sentiment.

Just because they aren't talking publically, doesn't mean they don't see it.

Public acknowledgement of the bubble by notable individuals will only serve to further exacerbate the problem. It would be like throwing gasoline on a fire.

During the Carter era, economist Alfred Kahn publically spoke out (and loudly so), about the recession. He comitted a cardinal sin, he actually used the word "recession". Carter and crew didn't like it one bit, he was forbidden to use the word publically. So instead, when asked about upcoming recession, he substituted the word "banana" for it.

Consumer Sentiment and the Media

Many economists realize the bubble. Look at the data, it screams out at you. However, they also realize what the ultimate outcome of a bubble collapse would be.

So there is no bubble.. It's just a pretty balloon.

grim

All we need is for Abbey Joseph Cohen to announce that she's selling some real estate investments... my theory is that her comments in March 2000 really created the bull market for stocks

Yes, my definition of Northern NJ includes:

Bergen

Essex

Hudson

Passaic

Morris

Somerset

Sussex

Union

Warren

It doesn't include Hunterdon or Middlesex. Many have asked and in retrospect I should have begun collecting data on those counties as well, but I didn't. I thought about increasing the scope of my definition, however, it would cause a signficant shift in many of the stats I've already collected. It would be a significant undertaking for me to recompile my data to include those counties..

grim

I was just curious. Those regions are fuzzy in NJ anyway. When I met my wife who is from Bergen she thought I was from South Jersey. I lived in Middlesex at the time. A former coworker of mine said his definition of NNJ versus SNJ is whether you have sand in your yard (I did).

It is an arbitrary delineation and something I have had a fascination with since I had a cultural geography course in college that focused on NJ and the various subtleties of the state. Your definition is good in my book.

Keep up the good work.

Grim,

Thanks for freely sharing your data.

I'm curious though. How would seasonally adjusting the data affect the comparisons?

I had thought that unadjusted data might overstate the slide in sales. But, considering the terrible weather last winter, to have sales lower than they were at the same point in 2005 would lead me to believe these unadjusted numbers do not reveal the extent of the slowdown in sales.

Speaking off the top of my head, if my speculation is true, it looks very grim indeed for the NNJ real estate market (pun intended).

denial and greed can harmful to one's financial position.

revising some of my comments

First lets talk about census error. The census numbers were off, but why? Likely because their estimates are based on history and predictable events. So what was so unpredictable between 1990 and 2000?

Well, for one, the technology bubble and the start of the housing bubble. The tech bubble was in swinging into full force in 1997 and the beginnings of the housing bubble were starting.

So how can we prove this? Well, lets look at building permits over the same period. Why? Because I believe it to be a good indicator due to the fact that the real estate market is relatively efficient. If there is demand, they will build.

I don't have the Hoboken permits numbers handy, so I'll just use what was posted in the other thread (Hoboken Pop) as well as Hudson Permits. I'm using both of these to illustrate trends, pay no attention to the actual numbers.

Year/Hoboken Pop/Hudson Permits

d1990 33,392 486

e1991 33,244 260

e1992 33,435 259

e1993 33,385 440

e1994 33,287 464

e1995 33,268 294

e1996 33,274 360

e1997 33,364 702

e1998 33,258 1788

e1999 33,413 1921

d2000 38,577 1338

Whoa.. Look at that. The census estimates were were in line with building permits from 1990 to 1996, but then something happened.

Exactly, something happened. So the census estimates were off due to an unexpected increase in population.

Which leads in to the second point. Net population change is a poor indicator of housing demand. Why? Demographics. The number we need to look at is household formation. Newborns don't buy homes, households do.

(to be cont.)

grim

grim ghost,

I'd live in one of the new buildings in Hoboken. The premium isn't bad all things considered. I've actually tossed around the idea of taking a contract position in NYC and moving to Hoboken. Would be able to get by with one less car, insurance, and fuel.

JC? Nah. Weehawken? Nope. Edgewater? No way. Hoboken? Perhaps. I've always liked Hoboken, one of the only areas of NJ with any real charm. I was at Stevens for 2 yrs.

But, there are two different things happening here. Increased demand on the NJ waterfront and the housing bubble. Simultaneous, but different.

grim

Hoboken Households

2000 19,418

1990 15,036

Net Household Increase (1990-2000) 4,382

Hoboken Housing Units(Vacancy Home/Rent)

2000 19,915 (0.6/1.7)

1990 17,421 (10.8/8.4)

Net Unit Increase (1990-2000) 2,494

Wow, certainly very strong growth into 2000. Very sudden and high demand, illustrated by the lag in permits and the significant drop in vacancy rates.

In 2000, Hoboken was certainly very, very hot. But that was 6 years ago, what about today?

Hoboken Population (Households)

2000 38,707 (19,418)

2001 39,325

2002 39,331

2003 39,560

2004 40,175 (~20,200, my estimate)

Net Pop Increase (2000-2004) 1,468

Est. Net Household Increase (2000-2004) 782

Hoboken Building Permits (Total Units)

2000 319

2001 269

2002 264

2003 555

2004 272

Units Increase (2000-2004) 1,679

476 additional units approved were in 2005.

Looks like builders have stepped up to meet the demand. Look like there were potentially double the units authorized as we had new household formation.

Data from the Census Dept & http://www.nj.gov/labor/lra/

"They will not. It's the same reason why Greenspan, the NAR, and other notable economists and politicians won't. Because what they say has the power to shift public sentiment."

Aww that's not a fair statement Grim! While, I certainly can't speak for all agents, I have been trying to inform my clients as well as my site visitors of the market changing.

If I go on a listing an appointment and give a seller "false hopes" so to speak, and they price their home according to what happened last year, their home will sit; which means I won't get paid. It really doesn't benefit me in any way.

If you consider the expenses of advertising a home, which is all out of pocket for an agent, and the home doesn't sell because its over priced etc, its a total financial loss. I'd rather not take the listing and save myself a lot of money.

Of course, I can't speak for all agents. But, when I go on a listing appointment I come armed with all the statistics and market trends for their town and their price range. Many times sellers do not like hearing what I have to say. So, if they end up choosing another agent because of it, I really don't care. I won't be wasting money trying to market their home.

Luckily, I deal with mostly relocation buyers. Since Im not primarily a listing agent, the change in the market will actually give most of my clients the upper hand (which Im very happy about). The last couple of years have been very tuff on buyers, with 8 - 10, sometimes 12 offer bidding wars.

The concern of course is for those looking to purchase and relocate again a few years from now. Quite a few of them are 100% financing home buyers. I can't predict the future I can only inform them of the trend that is taking place now and ask them to consider the "what ifs". I feel stuck between a rock and a hard place heh. What's an agent to do in these situations?

Thanks for your comments Roxanne, everyone here appreciates them.

You wouldn't happen to be realestaterox roxanne would you?

jb

yes it's the same one :) sorry for the confusion

Well, then you should introduce yourself..

For those who don't know Roxanne, her blog is:

Southern New Jersey Real Estate News

grim

Not only the DOM, but the price reductions as well..

$649,000 to $579,000.

Tsk tsk Debra from Burgdorf.

Purchased 8/2003 for $428,500 if anyone cares.

grim

Grim:

As long as some of this blog relates to Hoboken, let me throw in this item.

Off the top of my head - anyone please correct me - the high school enrollment in town has decreased dramatically over time. In the 1980's in used to be roughly 1200-1400, and now it is in the 800 range (vague recollection).

Also an anecdote - in 1999 my wife and I lived across the street from a 4 story walk-up that was all rentals. The owner of the building converted the apartments to condos and sold off the units one by one after overhauling each unit. The building probably had 5 or 6 families each with 2 or 3 kids. The replacements in most every instance were two single young professionals.

The overall population numbers do not necessarily do justice to the population and socio-econimic mix in Hoboken over the last 20 years.

chicago

chicago,

1990 Census

2.17 pers/household (Hoboken)

2.70 pers/household (NJ)

2000 Census

1.92 pers/household (Hoboken)

2.68 pers/household (NJ)

Throw in the 6mo bill at 4.67% for good measure..

"another re-list under a new MLS and reduction. what's the matter sellers, 130 days on the market didn't look good on the property sheet?"

I had actually seen that listing a week ago, and thought it looked interesting, but with no backyard.

Anyone know that area at all? Schools? Crime? Etc...

Address on MLS listing is:

41 Murray Hill Square

New Providence, NJ 07974

But Google maps only recognizes "41 Murray Hill Blvd" which doesn't seem to be the same property.

I think it's located very near Floral Ave, and appears 1 block from the train station?

Anyone familiar with the area where this property is located?

http://listings.gsmls.com/SearchDetail/Scripts/PrtBuyFul/PrtBuyFul.asp?prp=Mls&MlsNumList=2111428

"it's obvious to anyone that has spent time in hoboken what's going on there. it's full of 20-something singles living with roommates who mostly work in NYC. convenient. the new hi-rise buildings are attracting newly married couples and in certain cases those with young kids. still the 'family with kids' demographic is small and getting smaller."

I don't agree. The last 5 years has been a change. I would say that there are kids of professionals as old as 10-12 years old. There really aren't many good options for middle schools, so you can delay leaving town for an extra 4-8 years. There are also more empty nester types and the usual cadre of DINKS.

The area north of 10th and east of Park is just too expensive for 20-somethings. All the restaurants that have appeared in the last 5 years reflect that fact. The adults dine until 10PM, the youngsters only go to drink and close the place down.

chicago

Just noticed Richard's post on the New Providence townhouse.

Thanks for the info -- looks like a sucker's bet.

That maint is insane.

Saw this piece posted up over at the BusinessWeek Hot Properties blog as well as housing panic. Great look into the past. I might just need to see if I can get out of work early and dig up some old Jersey articles from the last real estate bust.

THE DAY LOS ANGELES'S BUBBLE BURST

By BENJAMIN STEIN ; BENJAMIN STEIN'S LATEST BOOK IS ''FINANCIAL PASSAGES.''

Published: December 8, 1984

My pal Jerry P. just bought a condominium in Century City, in Beverly Hills, for 60 percent of what it sold for in 1980. Down the street from me here in the Hollywood hills, four houses have been on the market since 1981. The asking prices now are about one-third less than they were three years ago. Up and down Sunset Boulevard in West Hollywood, apartment houses that were converted to condos lie empty, boarded up, not one unit sold, in bankruptcy, with banks holding title.

The Southern California residential real estate boom began in about 1974. It was not just a boom. It was a superboom, with miserable bungalows in Santa Monica running up from $40,000 in 1974 to $400,000 by 1980. Two-story colonials in Beverly Hills went from $200,000 to $800,000 and then over a million. One-bedroom condos in Hollywood were built and sold for $100,000 - what a house in Beverly Hills had been five years before. Every day, home buyers would look at the prices and say, ''It can't go on.'' But every day, for five years, it did go on. Middle-class families were priced out of the market, and the brokers said, ''But the rich will always be able to buy.'' Ordinary rich people were squeezed out of the market in some areas, but the brokers said, ''Never mind, the music business people will buy anything.'' The music business fell into a depression in 1979, and the brokers said, ''The foreigners are buying. Compared with Paris or Teheran, real estate in Holmby Hills is a bargain.''

Everyone wanted to get in to the game, get the down payment on a house, somehow struggle with the payments for a year, then sell out and get rich quick. Inflation pushed housing prices into the stratosphere. But even when inflation stopped, brokers said, ''The prices have nothing to do with inflation. Everyone on earth wants to live in L.A. The price will go up forever here, no matter what else happens in the rest of the country.''

Then the music stopped, some afternoon in 1980. As if a spell had fallen over the city, suddenly things began to stay on the market for three months, six months, a year, two years. Buyers disappeared. Asking prices stayed high, but nothing sold.

The great Southern California real estate boom was over. Prices had gotten so high that they could no longer be justified by inflationary expectations, or the influx of foreigners, or the climate, or for any other reason.

Now, four years later, those brokers who are still in the game tell sellers to expect that their houses will be on the market for two years. Other brokers have sold their BMW's and are now working as ''financial planners'' or public-relations people, dreaming of the days when they worked for 6 percent of infinity.

How quickly we all forget the past.. Or just choose not to remember, all the while telling ourselves "it's different this time."

Caveat Emptor

Another one..

HOUSING BOOM GOES BUST IN LOS ANGELES

By BENJAMIN J. STEIN

Published: August 17, 1981

Thanks for the additonal info on New Providence, and that specific townhouse.

Does anyone know what the MLS "Status" codes mean?

So far, I thinhk I've figured these out:

W - Withdrawn

S - Sold, already closed

P - Sold, pending close

A - Active

A* - Attorney review???

Are these assumptions correct? Did I miss any other MLS codes?

Thanks Richard. I also just noticed a "T" code? I know the property has been pulled off the market.

Any ideas on that one?

X - expired?

Those early 1980's articles about housing bubbles should scare the hell out of no money down leveraged buyers and sellers.

This bubble is much bigger.

It is going to get ugly.

NJGAL

Where did you find that on craigslist? I have been looking on the NJ listings and can't find that one.

TKS, just figured out how to do that... Are you looking in Ridgewood?

FYI

I came across a property that the original listing was withdrawn and then relisted under a different mls number.

Please excuse that fact that I don't know how to add the link into this post but it's on the GSMLS system.

Withdrawn Original Listing#2078496 on the market for about 180 days LP $215,600

Relisting#2241237 on the market for about 10day with reduced price $205,600

Same property, different price. I guess this realtor is trying a different marketing approach??

"I came across a property that the original listing was withdrawn and then relisted under a different mls number. ... ame property, different [lower] price. I guess this realtor is trying a different marketing approach??"

This is standard procedure, as deceptive as it seems.

Oddly enough, any realtor (such as a buyer agent) can just search by the address, and see all prior listing info for the property, so there's virtually zero strategic advantage to changing the MLS # when dropping the price, except that the property might rise to the top of some reports as a "new" listing, where it will take 3 seconds to realize it's the same old listing.

Seems foolish.

NJGAL - OK, just wondering. I'm looking in Bergen too, same general area.

Thanks for all the tools to search.

Heard another recent horror story with someone in over their head.

You would think making $180k should shield you from finanical troubles. Not so.

This is going to be really ugly. just feel it.

Rewatch Said...

Remember the days of buyer bidding wars...?? I've got a great new concept. Have my realtor go out to say five houses I am definitely interested in buying within the same price point. Tell the sellers that I want THIER best and final offer on my desk by 2:00 Sunday (maybe to include a famiy photo and bio on how desparate they are to get out of the market) House with the lowest price/best value I'll buy. :)

I love the idea. I think if things get real bad, I will try that approach. From the Realtors mind, they are thinking they should get at least one out of the five. Could be a win-win!

Just posted up a new piece.

I ask that everyone please take the time to read it.

grim

Going to squeeze every last penny out of these sellers when the time comes. Lets see how they like the BS in reverse!

Another MLS staus code is "UC" for Under Contract. A no-brainer, but should be added for completeness.

X - Cancelled (no re-listing)

W - Withdrawn (possibly re-listed)

UC - Under Contract

T - Contract terminated??

S - Sold, already closed

P - Sold, pending close

A - Active

A* - Attorney review???

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home