Northern New Jersey Residential Home Sales Fall In February

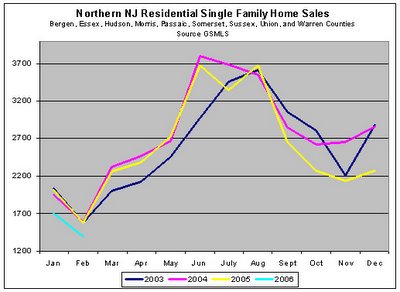

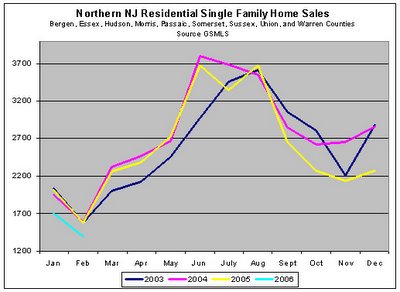

Residential Single Family Home Sales fell in again in February. This drop marks the sixth consecutive monthly decline seen in the Northern New Jersey region, a trend which began late last summer. Home sales this February (1395 Sales) were down 12% from February of 2005 (1578 Sales), and down 18% from January (1705 Sales). The February sales numbers were in line with our previously reported estimates. February traditionally marks the lowest point of the Northern NJ sales season, so we should see sales volume pick up from this point forward, however it's likely the trend will continue with volume being approximately 15% lower than what has been seen over the past 3 years.

This data is not seasonally adjusted and consists of sales of GSMLS listed properties in Bergen, Essex, Hudson, Morris, Passaic, Somerset, Sussex, Union, and Warren counties. This data does not include sales from other listing services (NJMLS or Hudson MLS) nor does it contain FSBO sales. However, GSMLS is the largest MLS service in Northern NJ, thus we're confident that the data provided is representative of the market.

Caveat Emptor!

Grim

This data is not seasonally adjusted and consists of sales of GSMLS listed properties in Bergen, Essex, Hudson, Morris, Passaic, Somerset, Sussex, Union, and Warren counties. This data does not include sales from other listing services (NJMLS or Hudson MLS) nor does it contain FSBO sales. However, GSMLS is the largest MLS service in Northern NJ, thus we're confident that the data provided is representative of the market.

Caveat Emptor!

Grim

77 Comments:

The next two months should be really telltale.

I just got off the phone with my sister in law. She and her husband just yesterday overbid on a house on the Main Line which was listed at $1.599.

The seller came back with a counter offer of $1.799!!!!!!!!!!!!!!!!!!!!!!!!!!

???????????????

Yes that's right - list was $1.599, their offer was in the $1.6s, and they were COUNTERED with $1.799!!!

What is going on on Philly's Main Line that these $1.3M+ houses are in such high demand?????

It clearly seems to be a pretty different market than NNJ.

For those who suggested that the scale of my graph would need to change in February, you were correct, I changed the lower bound from 1500 to 1200.

grim

Price drops for Northern NJ!

$15,000 price drop:

MLS#: 2238841

79 Tulip Street, Summit

$675,000 => $659,000

Days on Market: 41

$20,000 price drop:

MLS#: 2205176

4 Brainerd Road, Summit

$689,000 => $669,000

Days on Market: 141

$40,000 price drop:

MLS: 2233189

90 Woodland Rd, Chatham

$589,000 => $549,000

Days on Market: 60

$40,000 price drop:

MLS 2240267

6 Bodwell Terrace, Millburn

$639,000 => $599,000

Days on Market: 34

40,000 price drop:

MLS: 2241229

372 Wastena Terrace, Ridgewood

$839,000 => $799,900

90,000 price drop:

MLS: 2105705

365 Meeker Street, West Orange

$549,000 => $459,000

Days on Market: 179

$25,000 price drop:

MLS#: 2204937

14 University Avenue, Chatham

$499,900 => $475,000

Days on Market: 143

$14,000 price drop:

MLS#: 2243567

120 Center Avenue, Chatham

$589,000 => $575,000

Days on Market: 30

$25,000 prce drop

MLS: 2250321

12 Mountainside Dr, Chatham

$750,000 => $724,990

Days on Market: 60+ days

$50,000 price drop:

MLS: 2230238

9 Midland Terrace, Summit

$899,000 => $849,000

Days on Market: 60+ days

$30,000 price drop

MLS: 2238517

32 Ridgedale Ave, Summit

$829,000 => $799,000

Days on Market: 60+ days

$25,000 price drop:

MLS: 2110639

15 Morris Avenue, Summit

$675,000 => $650,000

Days on Market: 158 days

$84,000 price drop:

MLS: 2104955

10 Gates Avenue, Summit

$639,000 => $554,900

Days on Market: 153 days

Here's an interesting comment from an email I received from my realtor:

We had our yearly sales meeting and as opposed to last years theme - "let them pay up," this years focus was -"any offer is a good offer."

Here's an interesting comment from an email I received from my realtor:

We had our yearly sales meeting and as opposed to last years theme - "let them pay up," this years focus was -"any offer is a good offer."

Here's this year's theme from buyers to Realtors™ and crazy sellers: "Let Them Rot."

"We had our yearly sales meeting..."

Which company was that, by the way? Weichert?

Last month Burgdorff held a mandatory meeting where they told the sales-droids that 2006 will be 'almost as good as last year.'

Grim:

This comment is splitting hairs, but your graph reflects activity that is relative to some of the strongest real estate years on record. You would add credibility and context if you plot an average of the last 10 years, so some boom and bust years could yield what could be considered a "median" plot. Otherwise, great stuff. I'm am so interested to see how March and APril appear.

chicago

The truth be seen. lets see what the spinmeisters say about this.

Things are really getting ugly.

Do not look or buy a house.

BOYCOTT.

Then let the greedy sellers and realtors sit their while their ego's deflate.

Watch the harassment level when visiting open houses. Realtors will be getting very desperate in the coming months.No sales = no income.

How come the chart ends December 2005 at over 2,200 sales and begins January 2006 at less than 1,700? For continuity's sake shouldn't January 2006 start where December 2005 ends?

And I agree with Chicago that showing this data against last few years which were exceptional doesn't tell us much except that sales are down from peak years. How does the current trend compare to the decline in the early 1990s? As the NYTimes magazine article on Amsterdam housing markets shows, the long term cycle is much more relevant than short term volatility for those concerned with housing as an investment vs. simply shelter.

Look it is only the beginning of the fallout.

You think this thing just plunges next week.

We have lots of greedy folks out their who are imbeciles. So it takes a while for a collapse to sink in.

chicago,

I'll see what I can do, but I really doubt I'm going to be able to find data back 10 years.

jb

grim:

I vaguely recollect that you mentioned weeks ago that such data was difficult to track down.

Nothing worse than a customer that asks for the world and pays nothing.

Lo siento.

chicago

"I would like you where did you get those price drop information (address/days on market/ price drop)."

They're all from MLS. The actual numbers are a bit worse for several of the addresses, as some have re-listed after the price drop with a new MLS #.

When Realtor™ scum drop the price $90K and re-list with a new MLS #, and the house sells at that lowered price, the NAR/Realtor™ scum can falsely claim in their reports that homes are selling @ "98% of asking price," even though they may have actually sold only after a tremendous price drop (i.e., well below original asking price).

"They're all from MLS. The actual numbers are a bit worse for several of the addresses, as some have re-listed after the price drop with a new MLS #."

I like the info. I'm a novice, so please bare with me if this is obvious, but I am interested in how you are compiling / tracking this data on NJMLS when they change the MLS #? Is there some sort of report you can run from the website?

Thanks!

Chicago,

Looks like I might be able to get data back to 2000/2001. I'll see if I can put it through the ringer and come up with what you are asking.

But, in the interim, you all might be interested to know that February data looks like what could possibly be a new 5 year low (or greater, need more data).

I'll have that info by tomorrow morning.

jb

Guys:

No offence ment - but a coin has 2 sides.

I am in the market looking for a house in NNJ (Bergen). I can see the inventory growing but I dont see a great reduction in prices unless the seller is desperate to move out. I see sellers listing houses - if they sit on the market a long time they simply delist and relist again after sometime. I have even seen houses that are sitting on the market for a loooong time but at the same price.

So as I said if buyers dont care - sellers dont too.

"how you are compiling / tracking this data on NJMLS when they change the MLS #? Is there some sort of report you can run from the website?"

No, I'm just familiar with various neighborhoods. I watch them come on the market, and then watch the prices drop.

$66,000 price drop:

MLS#: 2200791

2 Deerfield Rd, Short Hills

$785,000 => $719,000

Days on Market: 140

$30,000 price drop:

MLS#: 2237332

17 Mt Ararat Road, Short Hills

$759,000 => $728,888

Days on Market: 38

"I have even seen houses that are sitting on the market for a loooong time but at the same price.

So as I said if buyers dont care - sellers dont too."

But you've just confirmed the market has changed. Buyers have stopped buying. What happens next should be obvious.

$50,000 price drop:

MLS#: 2108164

14 South Terrace, Short Hills

$729,000 => $679,000

Days on Market: 200

Can't imagine what these POS's look like. $20k - 50K price drops are laughable.

Only a fool would bite on these scams.

But sellers who have to sell dictate price trends. Just like FOOLS buuyying with option ARMs dictated on upside it will happen on downside.

It's coming. Put the pacifiers back in for a while.

Buyers Strike. You keep looking at houses it is a waste of time. You give these greedy thieves hope. No activity will demoralize them.Then you abuse them when the pendulum swings the other way.

Put the pacifiers back in for a while longer.

$25,000 price drop:

MLS: 2224327

108 Beekman Rd, Summit

$769,000 => $745,000

Days on Market: 66

"Can't imagine what these POS's look like. $20k - 50K price drops are laughable."

Many of these homes are quite nice.

"Can't imagine what these POS's look like. $20k - 50K price drops are laughable."

If you want to see what the houses look like, just go to realtor.com and enter the MLS #.

Click "More Search Options" at the main page and then scroll all the way to the bottom of the search form.

Rewatch, I hear you.

Check out this poster here at NNJ Bubble (about 8 posts up from the bottom):

http://www.blogger.com/comment.g?blogID=15532093&postID=114149140922374826

They bought in San Fran for $500K, just sold that for $1 million, then took that million and dumped it into a McMansion in Morristown!

Unbelievable! Throwing away $500K in liquid! At market peak!

$25,000 price drop:

MLS: 2110985

60 Milton Street, Millburn

$549,900 => $524,000

Days on Market: 98

Some possible new Star Ledger serious news stories..

"Cindy Sheehan provides an objective look at US politics."

"David Duke on today's race relations."

"A Merrill Lynch registered rep tells us why no-load funds are a terrible idea."

"Why ex-girlfriends make excellent job references."

"The Internet: where you'll only find the truth."

"The defendant's mom is the only voice that counts."

"John Gotti provides convincing evidence that the mob doesn't exist. (back by popular demand)"

"An auto service shop explains why you should ignore your car's owners manual and use their maintenace schedule."

Friends & Compatriots:

Please don't jump the gun on the bubble bursting. No pain, no gain.

As in - if owners and investors feel no pain, the buyers will not benefit from "price reduction" gain.

There is not enough friction in the system yet. We have a tremendous amount of supply coming to market, and some buyers wading into the waters.

However, what needs to happen is that a large group of buyers needs to be shut out of the market because they can’t get a mortgage. A large group of owners need to have their hands forced to sell, dropping supply into a weak market. Developers need to complete existing projects and have no one available to buy.

Is this happening?

No.

What needs to happen?

The “R” word - RECESSION

Many look back at the summer of 2005 as the Pinnacle.

Well people will look back at spring 2006 as "the time when the warning signs were there, and I should have unloaded, but didn't."

This process is a long haul one. Don't look for the NASDAQ March 2000-2001.

chicago "the bloviator"

I think the 'spring market' will reveal all. In 8-12 weeks, if houses sit, the media will be forced to kick into overdrive on the 'bursting bubble,' perceptions will change, sellers will run for the exits. Repeat as necessary.

Chicago, from the reports that have been floating around the past few weeks, inventories are rising fast (37,000 in Phoenix up from 3,000!), banks will tighten loan standards, houses are sitting longer, prices are coming down, and salaries are too far out of whack with home prices.

These sites have a ton of info on the mortgage aspect -- the 'credit bubble':

http://www.housingbubblecasualty.com

http://thehousingbubbleblog.com

Daily reads along with NNJ RE Bubble here!

Get a load of these jokers:

18 Meadowbrook Road, Short Hills

Closed $755,000 on June 14, 2004

A year later, they expect to make $124,000:

18 Meadowbrook Road, Short Hills

Price: $879,000

http://www.realtor.com/Prop/1056372665

Oh, and on that Short Hills house @ $879K, you'll notice the huge shopping center looming directly behind the house (visible in the photo to the right of the chimney).

Location, location, location!

"Convenient to shopping" -- just reach over the back fence!

Skeptic, seems NJ "starter homes" are now located in the Poconos!

$60,000 FSBO price drop:

100 Meadowbrook Road

Short Hills

http://www.forsalebyowner.com/show-listing.php?currentlySearching=1&iListingID=20586724

Three weeks ago, the price was $979K with "Flexibility: Price is firm."

Today, it's dropped $60,000 to $919,500 with "Flexibility: Willing to negotiate."

This house was bought in March 2003 for $585K.

And check out the left side of the picture for 100 Meadowbrook Road -- yes, that's a shopping center right in the back yard.

Hey anon 6"04:

Why don't you STFU about things you know nothing about? Our house is NOT a McMansion, it's an architectural masterpiece built in 1958 that represents the best of the International Style and mid-century modern.

i didn't make $750K+ clean profit in real estate in the last 6 years on 2 homes because I'm an idiot. I HAVE FOUR DOGS AND COULD NOT FIND A RENTAL DESPITE MONTHS OF LOOKING AND BOUGHT A HOUSE TO LIVE IN FOR THE LONG TERM, NOT FOR AN INVESTMENT.

What do you NOT understand?

grim,

I am on vacation. I will be back by saturday.

That article is from Aug. 2005...

"Why don't you STFU about things you know nothing about? Our house is NOT a McMansion, it's an architectural masterpiece built in 1958 that represents the best of the International Style and mid-century modern."

Touchy, eh?

I suppose it's worth pissing away over $500K in liquid to buy an 'architectural masterpiece' at market peak. Gotta have standards.

"i didn't make $750K+ clean profit in real estate in the last 6 years on 2 homes because I'm an idiot."

No, you've made that $750K because there's a speculative real estate bubble, and you've now turned those real profits, into real debt.

A stone would have made money in real estate these past 5 years, and what you apparently fail to realize, is that you were incredibly lucky to cash out at the right time. And when you did cash out, you took your lucky windfall and turned it into debt...

I wish you the best, but being less greedy/materialistic, and having more of that bubble windfall in the bank, would have been a smart move -- turning it all into debt at bubble peak, not smart.

"I HAVE FOUR DOGS AND COULD NOT FIND A RENTAL DESPITE MONTHS OF LOOKING"

Pissing away $750,000 in liquid, would clock those dogs in at $187,000 each.

Here's updated info from PMI, we're ranked 7 out of 10.

http://tinyurl.com/qqu5h

The problem that I see with the 500-600 market is not that people are willing to buy in that range, but there is lack of inventory in that range.

I am desperate, well not so desperate after reading this blog for months now, to find something decent in that range. But there's nothing but small POS houses that the realtors price too high and then sellers actually believe they can get that price. That's the real problem here, the stupid realtors who pull these numbers out of the air and make the sellers actually think they're going to get it.

I had a great laugh last night on the way home; Bloomberg aired an advertisement by the NAR about realtor ethics and how they had to undergo ethics training to pass their course!

I heard the ethics commercial on the radio last night as well.

Advertising the fact that you are ethical? Sorry, I don't buy it. When someone advertises something like that, it's often because they are not.

grim

We put down an amount in the mid $300s leaving us cash for other investments. And yes, I'm touchy about someone badmouthing me for buying a mcmansion when nothing could be further from the truth.

If I wanted a boring house I would NOT have bought into the market now. I've looked at countless houses for over a year and there are none I have ever seen anywhere near my price range like the one I bought --- anywhere in the tri-state area.

The previous investments I made were not from sheer luck and they both outpaced the local market growth significantly. I carefully planned our exit from our last house and just spent 5+ months living with my parents until we found the next right move - which did not turn out to be a rental. Living in with my parents to ride out the market until it hits its low is not an attractive option, especially given the 2+ hour each way commute my husband had to endure.

I was told by MANY people in 01 in Cali following the tech bubble bursting that I was stupid to buy at what many felt to be "the peak of the market". Over half a million dollars in profit later on that transaction I have to laugh.

I'm a marketer. Most realtors are idiots when it comes to marketing. In 01 it took the agent over a YEAR to sell the house I bought, so my lowball offer was gladly accepted. It took me ONE WEEK on the same house with next to no renovations to get multiple offers due to the right marketing - cover of the real estate section, proper positioning, the right story and descriptors. I made a smart investment and sold it smartly, and although the market grew in the town in which we sold the average appreciation was more like 25% than the 100% we realized. It was not in a desirable town.

It's really a moot point; it's a conflict of visions. I'm willing to pay $960K to live in a fabulous house right now and take the possible risk - it's NOT a given - that the market will decline a tremendous amount. (I believe it will decline for sure, just don't know how much). I'm not putting my life on hold so that I don't lose equity. We have a nice stash of money, we're earning more every day, and I get to live in an amazing place while doing it, with our dogs who are like children to us (but much less expensive, even at the faulty calculation of $187K each).

By the way, how is having a place to live in that I enjoy immensely more "materialistic/greedy" than having a wad of cash to invest? I don't own this home to show it off, I own it because I love it and I love being here.

i didn't make $750K+ clean profit in real estate in the last 6 years on 2 homes because I'm an idiot.

An old quote "Never confuse genius with a bull market". Stock indexes make money in a rising market, but no one assumes they're intelligent because of that. Similarly, anyone with a pulse made money in coastal California real estate over the last few years. With a very few exceptions, it was largely market trends.

One doesn't have to be a genius to make money in a rising market, just as one doesn't have to be an idiot to lose money in a declining market.

Sure a rising tide raises all ships but I outpaced the market 3:1 in both of those transactions, tripling the first investment in 2 years and doubling the second one in 3.

Would you classify the buyer of your $1M San Francisco home as a smart buyer?

Here's another 'smart' homeowner:

Bought in 2000 for $345K, now selling for $725K:

http://www.realtor.com/Prop/1056145456

People are confusing luck with skill.

What you've done is the equivalent of selling $500K worth of Cisco stock at $100/share in 2000, then turning right around and buying $500K of Yahoo stock at $100/share, because you're in it "for the long term."

Yahoo is now trading @ $31/share...

Being fortunate enough to cash in on the real estate speculation madness at market peak, and then dump that windfall right back into real estate speculation at market peak, boggles the mind.

Best of luck, and hope things go well for you. But you shouldn't be too surprised by the reaction here, you didn't really expect people to say 'smart move' did you?

I see some geniuses boasting about their successes.

I made a ton buying at the depths of the early 1990's housing contraction. Do not hold anything now but primary residence. Anyone paying these insane housing prices now is asking for trouble and will lose their easy gains.

Best Realtor™ scum quote ever:

Q: We've seen the real-estate market in Orlando and Florida cool from last year's record pace. Is it going to continue to slow?

A: Continue to slow? I think what may happen, I don't think you'll see a reduction in value; let's put it that way. Value and price are different things. You probably won't see a reduction in value, but maybe in prices, meaning you can pay less but it's worth more.

http://www.orlandosentinel.com/business/orl-talking0706mar07,0,4341446.story?coll=orl-business-headlines

Priceless!

realtors ethical?

In my years of looking investing and buying real estate, I have met 2 realtors that have been honest and ethical. The countless others i dealt with were worth dog$h!t.

Michelle:

"I was told by MANY people in 01 in Cali following the tech bubble bursting that I was stupid to buy at what many felt to be "the peak of the market". Over half a million dollars in profit later on that transaction I have to laugh."

First congratulations on what sounds like a wonderful home. I'm jealous.

In term of laughing at others, here's a little anecdote -

I was having just a terrible night at Atlantic City a few years ago. I sat down at a Blackjack table next to someone who was on a good run. The dealer dealt himself a "6" up, and everyone had a garbage hand, so the logical strategy is for everyone to hold, and hope the dealer will bust. The dealer went past everyone, and finally to Mr. Good Luck. He had a K and a 2, and had bet $100. What did he do? He said "well I should double down because the dealer has a "6". I gave him a terse WTF look, but said nothing. He doubled down, received a "9", the dealer had "16", dealt himself a "5" and everyone on the table lost. Mr. Good Luck wouldn't shut up and laughed at everyone else at the table.

Sceptic, Michelle has posted that she's 30 years old, and not a boomer.

Have people been too hard on her? Perhaps. Perhaps not.

Anonymous at 8:41 said: "A stone would have made money in real estate these past 5 years"

Apparently most on this blog did not make money on real estate these past 5 years because they are "mad as hell" that they have been shut out. Based on his tone, seems that Anon at 8:41 is also one of those bitter angry ones .... and to take out his venom on someone who lucked out. What a creep!

Anon 12:22PM:

I agree that rudeness should not be tolerated.

However, I can rationalize that a bitter renter could seethe in the face of someone who in the renter's eyes is "part of the problem".

Let's give people the benefit of the doubt. Sometimes items written look stark and cold in black and white.

Sure a rising tide raises all ships but I outpaced the market 3:1 in both of those transactions, tripling the first investment in 2 years and doubling the second one in 3.

A double in the last 3 years in many SF neighborhoods is hardly beating the market 3-1. REal estate is all local. If you bought in 2001, it was probably in the dip after the dot-com crash (NJ had a similar dip after 911). That you were able to sell it well may be a reflection of your marketing skills, it may equally well be a reflection of a much hotter market. Personally, I don't think marketing skills beyond the obvious (present the house well, do open houses, advertise) add much to residential housing prices except at the very high end (or if you're selling a tract of houses).

I made a ton of money in 2002-2004 because I happened to work for a company whose stock did well despite the general bear trend for tech companies, but I wouldn't say that points to my skill in picking an employer.

In any case, did you buy in December, I think its a good time to buy in most years, you can sometimes pick up real deals.

t. Based on his tone, seems that Anon at 8:41 is also one of those bitter angry ones .... and to take out his venom on someone who lucked out.

I agree that that is pretty ridiculous and bitter. Michelle should buy what she wants and if she enjoys it, good luck.

However, I find her ascribing her double or tripe to excellent investment and marketing skills to be somewhat arrogant and probably incorrect.

I'm going to ask that everyone please stop the attacks and insults. I don't want to have to moderate comments because of this. I'm asking nicely. Please.

If anyone needs an outlet for their anger, please email me and I can provide you with a list of individuals (i.e. David Lereah, certain local Realtors, politicians, journalists, and "economists") to direct that energy towards.

jb

Apparently most on this blog did not make money on real estate these past 5 years because they are "mad as hell" that they have been shut out.

Actually many here own a home. However, is there anyone who has owned a home for 5 years, and didn't see substantial paper gains?

"Based on his tone, seems that Anon at 8:41 is also one of those bitter angry ones .... and to take out his venom on someone who lucked out. What a creep!"

I didn't see any "venom", simply an acknowledgement of the misguided.

Someone who turns $500K profit into $500K debt has "lucked out" only as much as someone who bought $500K of dotcom stocks in 2000.

I would hope that people can deal with an honest discussion of the facts, and not get wrapped up in emotions.

It's OK to make an crazy move, if it feels good to you, but don't get too upset when people think you're acting crazy.

Sigh.

Firstly, Grim, sorry to have your excellent and fact-filled blog get bogged down in this.

Let me just say folks, that I'm not saying that we're smart for buying now. I'm saying that we have our own subjective reasons for buying that outweigh the investment value of our home to us in our current state.

I email my sister postings from this blog all the time and have advised her to not get into the market now as she's thinking about looking for any ol' starter home in the $2-300Ks. It would be ridiulous for her to buy now.

But for someone with our needs, wants, and dislikes (I'd rather live in a cardboard box than a center hall colonial), and yes, our means, we made the right choice by buying a splendid place that had just about everything we could want at a price we were comfortable paying (and as my husband says, he would have paid signifincantly more for this place because it's worth that much to him).

BTW, I'm 32. And I did get into the game young, with $10K borrowed from my boyfriend's mom in 1999 to buy a TIC (tenancy in common) which we converted to a condo. This was largely driven by the fact that as a dog owner, I was constantly nervous about getting evicted due to barky dogs.

As for marketing: Marketing absolutely plays a part in selling a home. My 2nd house in Cali (in a lousy school district) was listed for sale as a "2Br/1Ba, LR, DR, Partial Basement, 2 Car Gar, Large Lot, $640,000" in 2001. A coupla lines in the paper. When I put it on the market, I made the realtor take out a front page full color ad in the real estate section listing the house for what it was: "2.75 Acre Gated Estate overlooking San Francisco Bay. Main house has a spacious master suite; detached cottage with full guest quarters is perfect for your visitors. Abundant wildlife, surrounded by open space preserve on 3 sides, giant coastal oaks, subdivision possible..." etc etc etc. We were swamped with interest and had multiple offers and sold above asking. Nothing in my description was false in the least - it's just presenting things in a better way - one that generated much more interest. I'm not being arrogant to say that; it's the truth. I see so many listings from agents who can't even take a decent picture; the pictures of our current place that were online were atrocious!!!

Someone asked if I think the buyers were stupid for buying my last house - Nope. It's impossible to find land, privacy, and a heck of a nice house on it in the Bay Area, almost regardless of price. A childless couple bought it (so the BRs and schools weren't an issue). It was a RARE property, like the one I bought this time, so the marketing is more important than anything. And rare is almost always worth more. Run of the mill properties that are a dime a dozen are always going to be prone to more severe declines as buyers have choices. If you're looking for acreage coupled with a decent commute, choices are severely limited.

Anyway, I wasn't trying to brag about my past experience and profits. I know the intricate details of each transaction and am happy with the money and choices I've made. Sure we could be living debt free in North Carolina right now, but we want to live near a big city and close to family, in a house we love. Sorry to not act according to your boycott plan; to some people there are more important things than a big nest egg. I did do my part to make the sellers see that the market was turning, as we lowballed and got the place for 20% under asking. So we're not just drinking the kool aid.

Well, this has been a nice diversion from unpacking! :-)

BTW, I mentioned it in another thread but not this one: the insurance company won't let us insure this house for under $1.2M because they said they cannot rebuild it for that. We have no choice but to carry at least that amount of replacement value only (not including contents or anything else). That value doesn't even include the land. It's based solely on square footage, contruction type and finishes, and it's already almost a quarter of a million more than we paid. Do I think we could turn around and sell it for that right now? No, but it does make me think that at least we got what we paid for and maybe even more.

And to Anon 1:45, yes, we went into contract in December, between Christmas and New Year's. I think that helped quite a bit.

The point is Michelle will NOT lose 50% on her house if she stays there for ten years or more (as she plans to) unless the whole regional economy tanks and if that happens, everyone will have a lot more serious problems on their hands to worry about. And at least she'll have her home.

As we can see, people have complex reasons for buying and for selling, and calculate their profits and losses accordingly.

GG,

You're absolutely right. It has to be rare AND desirable to enough people. A tough find but not an impossible one, and when marketed for sale the net needs to be cast cretively far and wide.

That house on Speedwell Lake (that we looked at as well) was in dire need of maintenance and was virtually on a cliff with 1.5 unusable acres. It was cute though and I was disappointed it was in such rough shape.

Very interesting about the gourmet kitchen in BH - the way the shelter mags talk, way bigger is way better. I wouldn't have thought that would be a negative at all.

Michelle,

I'm serious when I ask, would you be willing to write my home description for me?

K

Interesting. There was an add in the NYT for I think the Corcoran Grouop this weekend that specially spoke about large kitchens - but for NYC that has a different meaning from what you saw in BH for sure!

The house we looked at in MP was on Ames Street (or place, or drive or something)right on Speedwell Lake. We tried to walk down to the lake but actually could not negotiate the hill while vertical, and we has somewhere else to go afterwards so we couldn't crabwalk down. Stairs would have made it much better; it was a really steep hill (but yes, "cliff" was hyperbole).

My husband is a woodworker by hobby and noticed serious splits in the ceiling beams and window casings and nasty rot in a number of other places. In his opinion these were structural, not cosmetic, issues.

It was a lovely location though, but I hope the buyer was told about the pending new development on the other side of the lake.

Great thread...just read the whole thing. Thanks to Michelle (people buying at top of market), sellers continue to make windfall profits. As a recent seller myself, I thank people like her!

That is what is so funny about this real estate boom. Housewives with nothing to do think they are RE experts. It is comedy. Reminds me of the daytraders in San Francisco years back...where are they now? Hmmm...it seems they may be buying overpriced houses on the outskirts of Morristown. Cheers. Keep it up!

I have a feeling you're the same "anon" who's enjoying giving me grief in this thread and others. Knock yourself out.

Feel free to question my purchase; it's a valid question for which I feel I have a valid explanation, but get your facts straight at least before you hurl your insults my way.

I've mentioned multiple times that I work and that I make i nthe low 6 figures. I'm the Vice President of Sales and Marketing for an international company, not a housewife (not that there's anything wrong with that).

Maybe if more women were housewives and stayed home with their kids to love and nurture them they wouldn't end up being jealous, bitter, know-it-all jerks like yourself.

Nope. It was my first posting, but it is fun.

I have to admit that I am jealous. I did not know you could get paid for sitting around in sweats all day (probably eating ice cream and fried foods), picking up dog poop, blogging and congratulating yourself for your "genius". Have to give you props for that. Perhaps you should switch locations to Mo'town's best restaurant....Bennigans.

Thou dost protest too much Michelle!

Anyway, I respect this blog too much to clog it up anymore with this silliness. Salute.

Ha! I'm in the fine wine and food business. It's funny - every time you post you peg me further and further off my mark.

I'm wasting my precious time off on you and I agree, this blog is excellent and shouldn't be reduced to an outlet for whatever axe you have to grind.

For those who are here to understand the market and why it doesn't respond strictly to fundamentals, I've offered my story as to why at least one consumer is still buying (albeit at less than asking). I'm still waiting for your insightful commentary, Anon 4:39.

Oops -

Anon "K" -

Sure! That would be fun! If you're really serious then post your email address (or get a temp free hotmail one) and I'll send you mine.

Anon 4:39...ad hominem attacks are the last refuge of those without anything intellgent to say.

And if you were right (which obviously you are not), and Michelle did sit around eating ice cream all day, then more credit to her for making smart investment decisions at the same time.

Anon 4:39...ad hominem attacks are the last refuge of those without anything intellgent to say.

And if you were right (which obviously you are not), and Michelle did sit around eating ice cream all day, then more credit to her for making smart investment decisions at the same time.

Sorry about the duplicate..it said the server connection was lost!

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home