Weekly Mortgage Rates Increase

Mortgage rates on the rise again. Treasury yields pushed higher yet this week, likely putting further pressure on mortgage rates to increase next week as well..

Weekly Home Mortgage Rates

30-Year Fixed

Feb. 15 Prev. Wk percent+points

New York 6.34 + 0.23 6.28 + 0.18

National Avg 6.37 + 0.37 6.32 + 0.35

5-Year Adjustable

Average 6.05 +0.40 5.99 +0.37

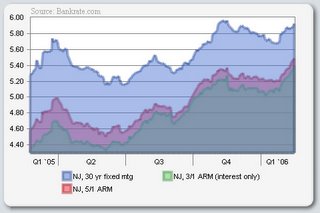

With changes up and down each week, it's hard to understand where rates are today in relation to a year ago. Nothing a chart won't help illustrate:

Weekly Home Mortgage Rates

30-Year Fixed

Feb. 15 Prev. Wk percent+points

New York 6.34 + 0.23 6.28 + 0.18

National Avg 6.37 + 0.37 6.32 + 0.35

5-Year Adjustable

Average 6.05 +0.40 5.99 +0.37

With changes up and down each week, it's hard to understand where rates are today in relation to a year ago. Nothing a chart won't help illustrate:

It should be obvious that the benefit of using a 5/1 ARM or 3/1 IO ARM has significantly decreased in the first quarter of 2006. Also notice how the spread between these mortgages has narrowed over the past year, a result of increased short term rates without a corresponding increase at the long end.

Increased rates on the ARM and I/O mortgages will undoubtedly have a negative impact on first quarter '06 sales in Northern NJ.

Caveat Emptor!

Grim

5 Comments:

Good piece over at The Street:

Shelter Glut Could Prove Bubble's Demise

n an extensive report detailing regional housing trends in the U.S., Morris found that about half of the U.S. housing market is frothy, and that the "bubble zone" may be overvalued by 35%-40%.

"Our research suggests that the areas infected by the housing market's version of irrational exuberance are big," Morris wrote. Indeed, they represent 50% of the housing market in value terms. That's $6 trillion, or 50% of the U.S. GDP., and is nearly the size of the German, French and U.K. economies put together, the economist notes.

Even a perfect soft-landing scenario, in which national homes prices just flatten, would imply a 35%-40% collapse in existing home sales. Together with a drying up of mortgage equity withdrawals, this would constitute a 3% drag on GDP, according to Morris.

grim

This might be the markets way of slowing the ARM/IO/NEGAM market.

Grim:

I was just reading about the futures market predicting (i.e. implicit in the prices) THREE tightenings (3/28, 5/10 & 6/28).

Interesting to say the least.

There is concern that Bernancke was to effusive in his comments and he may regret being so upbeat if the economy cools off dramatically.

chicago

By the way, there is a dark-horse here. If the price of gasoline plummets (say sub-$1.80), the resulting effect will surely be met with Big Ben tamping down the U.S. Consumer (Fed tightenings)

Building permits and housing starts to be released this morning at 8:30am.

grim

Post a Comment

<< Home