The Best Of Lowball!

Welcome to a very special edition of Lowball!

In lieu of the normal Lowball! this weekend, we're going to take a trip back through time. I've gone through my database and put together a list biggest and best Lowball! offers.

Lowball! takes a look at home sales over the past week from a very different perspective. For those new to Lowball!, a lowball offer is when a buyer offers a significantly lower bid than asking in hopes that the seller accepts the offer. We take a list of home sales over the past week and pick out the sales that have the highest percentage difference between asking price and selling price.

The purpose of Lowball! is to show buyers that the market has changed and buyers now have considerably more leverage than sellers. Just a short time ago, Lowball! offers would have been laughed at and discarded, however, not any more. The fact that so many under-asking offers are being accepted is clear proof that the market is changing.The list does not contain all sales, I hand-pick the most interesting sales from the list. These listings might be the highest dollar drops, biggest percentage reductions, or sales in towns that are thought to still be 'hot'. Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Some background, these are closed sales on GSMLS from November of last year until approximately mid-July of this year. These are GSMLS only and do not include sales from NJMLS, MLSGuide, Monmounth MLS, discount brokers, or FSBOs. Unfortunately, this is not a complete list, there are a handful of Lowball! datasets that have been lost over the period. This exercise does not take into account properties that have been withdrawn, expired, and relisted (from an OLP perspective).

Hope everyone enjoys these. On to the list!

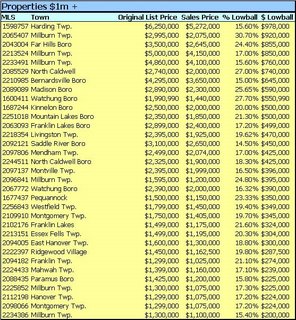

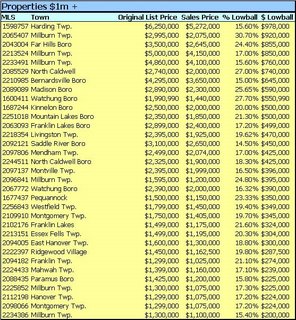

Properties above $1,000,000:

(click to enlarge)

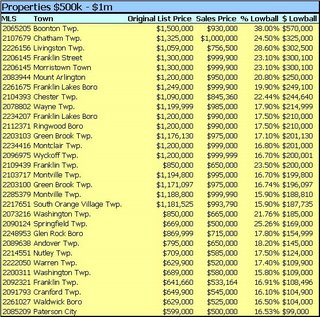

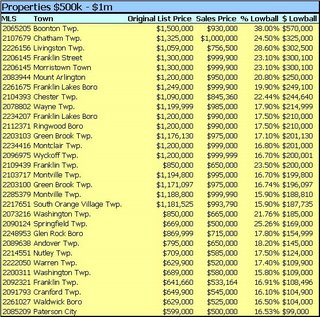

Properties from $500,000 to $1,000,000:

(click to enlarge)

Properties from $250,000 to $500,000:

(click to enlarge)

Properties below $250,000:

(click to enlarge)

Caveat Emptor!

Grim

In lieu of the normal Lowball! this weekend, we're going to take a trip back through time. I've gone through my database and put together a list biggest and best Lowball! offers.

Lowball! takes a look at home sales over the past week from a very different perspective. For those new to Lowball!, a lowball offer is when a buyer offers a significantly lower bid than asking in hopes that the seller accepts the offer. We take a list of home sales over the past week and pick out the sales that have the highest percentage difference between asking price and selling price.

The purpose of Lowball! is to show buyers that the market has changed and buyers now have considerably more leverage than sellers. Just a short time ago, Lowball! offers would have been laughed at and discarded, however, not any more. The fact that so many under-asking offers are being accepted is clear proof that the market is changing.The list does not contain all sales, I hand-pick the most interesting sales from the list. These listings might be the highest dollar drops, biggest percentage reductions, or sales in towns that are thought to still be 'hot'. Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Some background, these are closed sales on GSMLS from November of last year until approximately mid-July of this year. These are GSMLS only and do not include sales from NJMLS, MLSGuide, Monmounth MLS, discount brokers, or FSBOs. Unfortunately, this is not a complete list, there are a handful of Lowball! datasets that have been lost over the period. This exercise does not take into account properties that have been withdrawn, expired, and relisted (from an OLP perspective).

Hope everyone enjoys these. On to the list!

Properties above $1,000,000:

Properties from $500,000 to $1,000,000:

Properties from $250,000 to $500,000:

Properties below $250,000:

Caveat Emptor!

Grim

35 Comments:

I'll update these if I come across any data I missed.

"Cooling economy will not put an end to rate rises"

http://tinyurl.com/mys64

SAS

grim -

how do i lookup records based on expired MLS ids?

thanks in advance

this is good stuff grim. looks like a lot of flippers unloading

-- BM

Finally a realtor whos trying to explain the market--

Buying Tactics in Changing Markets

Over the last three decades, the real estate industry has seen unprecedented growth and profitability. Rates of home appreciation have been on a steady incline, resulting in many highly competitive housing markets. In many areas throughout the country, prospective homebuyers have been obliged to spend more, settle for less, or risk losing out on the housing hunt altogether.

Gradually, the market is beginning to show signs of changing. While certain areas remain highly active, national benchmarks such as rate of appreciation, average days on market and housing inventory indicate that real estate overall is edging towards a more balanced landscape. Homebuyers savvy enough to match their approach to the realities of today's market are more likely to find success.

Gauge Your Market Carefully

Identifying whether your market is "hot" or "cooling" is crucial when planning your home buying strategy. To do so, you must first properly define what your buying market is. In real estate, market is defined not only by geographical area but also by things like target price range and property type. For example, sales of high end single family homes in your most coveted neighborhood might be at a standstill while condo sales may be at an all time high.

With your market established, begin researching recent conditions. Are properties selling fast, or are they lingering on the market for months at a time? Are listings selling above, at, or below asking price? How often are buyers receiving multiple bids? How common are price reductions? How do local trends in the last month or two compare to trends in the six months previous? Often the best way to get a read on such factors is with a professionally prepared Comparative Market Analysis.

Things to Avoid

If your market is in fact showing signs of softening, don't count on future appreciation when making an offer on a home. In hot markets many buyers overpay based on the theory that rapid appreciation will soon cover the additional investment, but this is an inadvisable tactic if appreciation rates are slowing. By the same token, future increase in a home's value should not be counted on to cover the cost of necessary repairs.

One common buyer's tactic in hot markets is to waive the home inspection as means of sweetening the deal for the seller. This kind of buyer risk is unnecessary in balanced markets. Another popular strategy, the use of "no cost" mortgages (mortgages that defer up-front costs at the expense of higher interest rates), is also inadvisable. With interest rates edging slightly higher than in the past, there is generally more advantage in paying the "points" now rather than adding on to the mortgage interest rate, particularly if you're buying for the long term.

Home Search Tactics

Watch Older Listings - Homes that have lingered on the market for months can indicate sellers who are beginning to feel nervous. As a result, you may be able to find a home for less or afford a larger home than you thought possible if you keep an eye on "old" properties. Consider making an offer below listing offer on a home that has been on the market for sometime. A beleaguered seller may be more than willing to negotiate.

Look for Price Reductions - Buyers tend to instinctively focus on listings new to the marketplace, ignoring changes in previous listings. This is a mistake in high inventory, slowing markets as price reductions tend to be much more common. Pay attention to desirable homes that may be "just" outside of your price range - they may drop in price and fall right into your lap.

Negotiating

The true shift in power in a more balanced marketplace will be felt in the negotiation process. While previous years have been marked by the multiple offer bidding war, more reasonable markets are characterized by rounds of offers and counteroffers. Two things to consider:

Remain Patient with Sellers - Many sellers may resist the notion that the market is any less favorable to their position. If an offer you've made on a property is rejected, do not assume that you must make a higher offer to avoid losing the property. If given time, the seller may realize that the offer you've made is very reasonable given the current status of the market.

React to Counteroffers - Counteroffers, even if substantially higher than your original offer, indicate a seller's willingness to negotiate. In slower markets buyers should feel more free to respond to counter offers with figures just above or even identical to the original offer made.

--BM

List was updated..

Grim:

Can you make 250k-500k chart little bigger font...can't read. thanx.

Going today to see some homes in Manalapan area with realtor...like one house for 550K last week...realtor tells me to offer 525K..I told him to show him some more homes. He still keeps me emailing on the same house along with others thinking I might get emotional.

-Poignant

Grim, I am correct in assuming that "original list price" is not most recent list price? It would be interesting to see what intermediate mark-downs had been made, too. I'd love to know if the low-balls are successful right of the bat or if intermediate price adjustments softened things up for the buyers. And any rough idea of what percentage of all sales went for 15% or more off the original list price?

A good number of properties on the high end underwent significant price reductions prior to sale.

You can get a good idea of that by going through some of the older Lowball! postings.

I wanted to keep these as simple as possible.

grim

Here are some examples..

MLS: 2085529

North Caldwell Boro

Original List: $2,740,000

Reduced to: $2,499,000

Sold: $2,000,000

MLS: 2248565

Clifton City

Original List: $299,000

Reduced to: $269,000

Sold: $190,000

MLS: 2065407

Millburn Twp.

Original List: $2,995,000

Reduced to: $2,499,000

Sold: $2,075,000

Keep in mind that my list is almost devoid of "relist" properties. What is currently going on in the market is brokers are withdrawing properties prior to expiration and relisting them under a new MLS number with a lower price and a reset DOM counter. This is becoming incredibly common and almost impossible to track easily.

Thus, many listings that would have made the lowball list based on a high OLP are not included.

grim

Can you make 250k-500k chart little bigger font...can't read. thanx.

Click the image, it should bring up a larger version. Or are you still having issues even after you do that? If so, your browser might be set to resize images that are larger than your screen, you'll have to turn that off.

grim

Great tables, Grim...I almost can't believe that you make this quality of info available for free!

Your hard work and good sense is greatly, greatly appreciated...thank again!

The Grimster does it again.

BOOOOOOOOOYAAAAAAAAAAA

Babababa BUST!

Papapapapa PAtience Rational Buyers

Greedy grubbers are getting the message.

Bob

Look at this bubbleheads. The epicenter of real; estate bubble BLOWING UP!

BOOOOOOOOOOYAAAAAAAAAAA!

http://flippersintrouble.blogspot

.com/

Bob

LOOK AT THOSE LOSSES IN CALILALALAND!

WAVE NUMBER 2 IS HEADING THIS WAY BUBBLEHEADS.

JUST WAIT FOR WAVE 3 AND 4 . HEHEHE

BABABABA

BUST

Bob

PAIN!

EVER GET STUCK IN AN ELEVATOR AND WANT OUT.

LOTS AND LOTS OF BUBBLEHEADS IN OVER THEIR HEADS GETTING THIS FEELING. BUT NOONE WANTS YOUR HOUSE AT THE PRICE YOU OVERPAID FOR IT.

Lots and lots of sleepless nights going forward.

Think before you sign the dotted line. Do NOT count on someone else to do the thinking for you.

BOOOOOOOOOYAAAAAAAAA

Bob

The lowball data is always interesting. I don't think I've ever seen a Hoboken property on the list - is that due to the source data or is the Hoboken market staying closer to asking prices?

P.S. - Grim, saving this graphics as GIF instead of JPG will keep them more readable at small sizes. JPG is better for photos, GIF is better for text and line art.

I don't have access, or a contact with access, to the MLS system that represents Hoboken. That is why you seldom see Hudson properties on the list.

grim

few questions about open houses

What factors lead an agent or seller to hold an open house? Are there a certain # that are promised with a contract with a real estate agency? Who makes the decision, the seller or the agent? Do you hold more open houses, the fewer buyers you get calling about a house or do you hold an open house when 1st listed?

thanks.

If I remember NJ/NY, there are many times deals are made with cash under the table. Is this still going on?

If so, it could explain some of the discrepancies in the market.

anon 8/06/2006 03:50:00 PM,

A open house is nothing buy a party for the RE agent.....not you. Because people will come, odds are, they won't like the house, but the RE agent will then say..."well, check out my OTHER LISTINGS". Get it. Its a way for them to sell themselves #1, you with the open house #2.

Another reason RE agents are nothing but worthless.

Ever notice the only ones who don't think RE agents are worthless are RE agents.

That tells you something right there.

They create a need for themselves and joe six pack buys it hook, line, and sinker.

SAS

SAS-

Thanks for the input!! :) The reason I ask is this. A property I have been following in Maryland has sat on the market for 4 months, it was recently reduced by 20k (470k initially). I have yet to see any open houses and wondered why not? The guy listing it is known as the best agent in the area (actually internationally) according to some media report about him. Maybe this price point, he could care less, no? Thoughts?

Grim,

Great list, and I hate to bring anything up because I know how much work you put in, but would it be possible going forward to include sale dates? Just a little more info to paint a more detailed picture.

I think it's important for people to realize that a good number of these sales occurred at points when the market was still considered "hot" in mainstream media.

Lindsey

Hey Grim,

while you are at it..could you also do a double cart wheel, and drink a beer in 10 seconds while you make the spreadsheet.

;)

SAS

sorry Lindsey, I couldn't pass that one up, ya left the door too far open for me to resist.

Just havin fun..:)

anon /06/2006 06:55:46 PM,

yeah, maybe at that price point, and if he is that good, he proabley is working the high rollers so he can get that commision before the bubble deflates.

Who knows? Maybe the seller just doesn't want an open house? Sellers sometimes don't want that. Don't know why, but I have seen it. Hard to say.

Bottom line RE agents are not your friend, not my friend.

How do you know when a RE agent is lying?

He opens his mouth.

;)

SAS

{{{The lowball data is always interesting. I don't think I've ever seen a Hoboken property on the list - is that due to the source data or is the Hoboken market staying closer to asking prices?}}}

There seem to be many more properties in Hoboken & Jersey City on the market, but prices have not dropped at all.

Check out Craigslist. You cannot touch a one bedroom condo for less than $350,000.

But people buying in Hoboken or Jersey City are not concerned with price since most are wealthy suburban transplants, but more interested in how Trendy the specific area is. That is the real reason most areas outside Manhattan won't see any material & significant price drops.

At worst prices will only increase between 5% - 10% each year for the forseeable futre.

anon 8/06/2006 08:39:52 PM,

Lets put it this way, people in Hoboken are not as wealthy and trendy as you may think. If they were, they would live in Manhattan. End of story.

;)

SAS

At worst prices will only increase between 5% - 10% each year for the forseeable futre.

8/06/2006 08:39:52 PM

Based on what?

Most of these kids are just waiting for the two year mark so they can take advantage of the capital gain exemption.

Prices are already slipping pretty dramatically except for the waterfront, and the tidal wave of supply hasn't even hit yet.

The only place worse than Hoboken is JC, and the granddaddy is Edgewater.

in my opinion, this is just the start of a real storm. The low balls there are not really low balls. I would consider only 50% below asking prices as lowballs.

"At worst prices will only increase between 5% - 10% each year for the forseeable futre."

I live in West New York, on the water. Have you seen the number of new condos coming online on River Road? The amount of new supply is staggering. (Way more than the River Road can handle, but thats another story.)

what about the 900 units coming

on the market in W.Paterson,the

Khov complex.

anybody think that will have an

impact.

They are not even advertising it.

my understanding is , sales are

booming.

Anon 8:39 pm said..."But people buying in Hoboken or Jersey City are not concerned with price since most are wealthy suburban transplants, but more interested in how Trendy the specific area is. That is the real reason most areas outside Manhattan won't see any material & significant price drops.

At worst prices will only increase between 5% - 10% each year for the forseeable futre."

8/06/2006 08:39:52 PM

What are you basing this on?

Math, is law like gravity.

what about the 900 units coming

on the market in W.Paterson,the

Khov complex.

anybody think that will have an

impact.

They are not even advertising it.

my understanding is , sales are

booming.

----------------------------------

Anyone who buys from KHOV is a complete Jidiot. I new people who bought KHOV and they rig the house, the seal only 3 parts of the window, not all 4..They use bottom of the line wood. They are garbage. They are carboard mansions.

Keep Lowballing 50% or more is the way to go. Or just go buy the assesed price. Thats all those greedy people deserve. Nothing more. People can say that is being ridiculous, but hey isnt pricing your house 50-60% more than its worth ridiculous?? Just also keep in mind when bidding that the sellers probably paid some low price way back when. Find out what similar house were going for back in 98, 99 and 2000. See what that price is and make a fair guestamate of what the price would be now if the bubble didnt happen and make an offer accordingly. Just remember to forget 2001-2005 prices. Pretend they dont exist. Thats they way to a fair price.

We just made an offer on a home in South Jersey (Winslow Township/Camden Cty). The property has been on the market for 187 days. The OLP was $529,900, then dropped 4-5 times to current price of $439,890. The seller paid $329,900 for the house in May 2005. The 2006 taxes for this house is over $12,000 and the school system is inadequate. We made a lowball offer of $365,900 and the listing agent acted as if it was a smack in the face. Can she really be in that much denial about the current market? Maybe it is time for the seller to get an agent who will price her house properly.

I don't see much about Paulus Hook here, so I thought I'd share my experience. We've been interested in the area for some time now, and have made many lowball offers. There have been some small price reductions and incentives, but places are definitely selling, as we have lost four houses so far due to lowballing and waiting around. Maybe things will change soon- that's anyone's guess... But for now people are certainly buying, which we discovered first-hand, despite everything we hear.

Post a Comment

<< Home