Northern New Jersey Housing Market Weakens In First Quarter

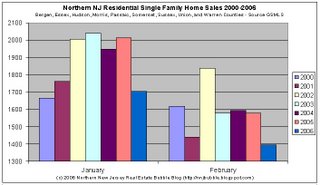

The first quarter is shaping up to be the worst in more than five years for the Northern New Jersey residential real estate market. The decline in residential single family home sales is a trend that began late last summer and is showing no sign of reversal.

Home sales for the first two months of 2006 showed significant declines compared to prior years, January sales saw a year over year decline of more than 15 percent, and February saw lows not seen for more than six years.

January

Median Home Sales (2000-2005) - 1976

Current Home Sales (2006) - 1705

(13.6% below median)

February

Median Home Sales (2000-2005) - 1585

Current Home Sales (2006) - 1395

(12% below median)

Caveat Emptor!

Grim

Home sales for the first two months of 2006 showed significant declines compared to prior years, January sales saw a year over year decline of more than 15 percent, and February saw lows not seen for more than six years.

January

Median Home Sales (2000-2005) - 1976

Current Home Sales (2006) - 1705

(13.6% below median)

February

Median Home Sales (2000-2005) - 1585

Current Home Sales (2006) - 1395

(12% below median)

Caveat Emptor!

Grim

40 Comments:

Weakens??????

Just heard that MLS# 2248783 LP: $425,000 had over 9 offers and the lucky winner offered over $550,000.

What weakening?

First, let me say that I was prepared to make an offer on that house. It's only fair that I offer that information up.

Second, realize that it is a typical Montclair Burgdorf listing. What does that mean? Price it low to get people interested and let a bidding war ensue. Seems like their strategy worked again.

Where did you get that information from? The status hasn't yet changed in gsmls..

grim

"Just heard that MLS# 2248783 LP: $425,000 had over 9 offers and the lucky winner offered over $550,000."

Hmm, 661 Valley Rd in Montclair.

Sold for $300,000 in June 2002.

Congrats to the "lucky winner" (the seller), who just found a sucker (the buyer) to pay $250,000 more than that.

Let me just add that I wouldn't have bid more than asking. My agent confirmed the multiple bids on that place, no hard confirmation of the selling price..

grim

Just heard that MLS# 2248783 LP: $425,000 had over 9 offers and the lucky winner offered over $550,000."

Hmm, 661 Valley Rd in Montclair.

Sold for $300,000 in June 2002.

Where can you get this information from ?

THe status won't change in GSMLS unitl the owner accepts the contract. Tuesday, which was yesterday, was "Best and Final" evening.

Crack me up that someone pops up one listing to combat a whole quarter's worth of data. Every market has exceptions, especially now, when there are still plenty of greater fools. I am surprised the market has declined as fast as it has, but it sure as hell has and one listing isn't gonna bring it back.

"Hmm, 661 Valley Rd in Montclair.

Sold for $300,000 in June 2002.

Where can you get this information from?"

Here:

http://www.domania.com

So, let me get this straight: Somebody paid $185,000 more than the normal appreciation rate from 2002. And in 2002, the house was over-priced to begin with. No, there's no bubble. (sarcasm off)

Upper Montclair will remain as one of those areas that is highly sought after--even when the air is just beginning to seep out of the bubble.

There was another home on Mt. Hebron that sold several months ago that was listed around $439K and sold for well over $500k and it had a kitchen the size of my suit closet.

It's just the area!

First poster:

I agree though, all the relative POS's i'm looking at are getting offers very close to asking.

Buyers aren't being patient enough and they're certainly NOT reading this blog.

Burgdorff just increased the price of a home in the Brookfield section of Upper Montclair. The home went from $599 to $579 and back to $599. It has been out there for a few weeks, but they can move some of those buyers around to the homes that are not doing as well.

BTW...as a former resident of UPM, they call it Brookfield because it FLOODS!!! I am surprised to see how people overbid is such a risky area. A home on Applegate (thinks that's the name) was listed at $499 and sold for something like $649, but it is UPM.

97 Mt. Hebron in UPM listed around $439K and sold for $525,100. This house was cute, but not worth $525K. Also, this house sat on the market for almost 60 days.

Crack me up that someone pops up one listing to combat a whole quarter's worth of data. Every market has exceptions, especially now, when there are still plenty of greater fools. I am surprised the market has declined as fast as it has, but it sure as hell has and one listing isn't gonna bring it back.

Agreed! Those areasthat were desirable prior to the boom will remain desirable. Just look at West Orange. When Montclair was very hot, those buyers that could not afford went to West Orange, and now just look at the number of homes in West Orange on the market--it's reverting back to the way it was. Same thing with Verona and Maplewood. South Orange is really hurting.

Mortgage rates up significantly this week..

Weekly Home Mortgage Rates

Mar. 8 Prev. Wk

percent+points

New York 6.41 + 0.20 6.22 + 0.18

National Avg 6.45 + 0.34 6.27 + 0.34

grim

"Let me just add that I wouldn't have bid more than asking. My agent confirmed the multiple bids on that place, no hard confirmation of the selling price."

Grim, does your agent hate you? :-)

Also, do you think a buyer's agent is really necessary these days? With the Internet, their value-add is minimal.

I had an agent, and every house that came into play, was one that I raised as something I was interested in seeing, and not the other way around. Then when it came to deal time, it just seemed like an unnecessary middle-man, especially when the seller agent sharks are clearly anxious to sell out the homeowner for a quick sale, and a full commission.

I've been stunned at the things the seller agents have told me, such as "these sellers are in deep financial trouble." If I ever use an agent to sell a home, they will know nothing other than room dimensions. They are not your friend, and not looking out for your interests.

Anon 2:39PM... who really cares about 1 listing... i certainly don't... maybe a realtor does... i look at stats and their trends... and this information provided by Grim is another piece of evidence that the housing boom is indeed over... and did end some time last year... also... i do believe that another piece of valuable information is on the new jersey association of realtors web-site... njar.com... it provides the 4th sales broken out by county... bergen county was down 19%, morris county was down 8.8%... i don't know the percentage for essex county but if you're interested you can just look it up... also... everyone... just remember... with each financial transaction that you make in your life, there's a winner and loser... there is no such thing as a win/win... you're either on the right or wrong side of a transaction... i wish everyone the best...

I've looked at two houses recently that my realtor approached as being of 'great value' and 'something that won't come along often'. When compared to the last three years and what is sitting on the maket now, they are good buys - they are clearly marked BELOW comparable homes and clearly draw in multiple bidders.

Also, I was told WEEKS in advance about both of these where the realtors were let in and they had time enough to generate full color brochures. You could imagine the first day open to the public, more traffic than usual. My realtor made a point to say they 'went' the first day on the market.

They're not sold yet, under contract. I think it will intereseting to see where they sell at. I also think that as the real market currents trickle down to these buyers, these folks may have wished that they weren't the lucky winners. Time will tell.

I've pushed back on my realtor about this because I could clearly see the whole set up coming. I've told them to count me out - ultimately there is no sure deal in this market and I'll leave it to someone else to walk in with a false sense of saving a few bucks near term.

This is not about a house needing a bathroom at all...It's about finding an architectural masterpiece built before anyone on this blog was born and which represents the best of the International Style and mid-century modern - priceless.

This just in:

Associated Press

March 7, 2006

Statistics Say 5-Year Housing Boom Officially Over

The five-year housing boom is indeed over, judging from growing statistical evidence and the performance of some of the nation's leading builders, and the slowdown is already rippling through the economy.

In the last week, the Commerce Department reported that January sales of new single-family homes fell 5 percent - the fourth decline in seven months - and the backlog of unsold new homes hit a record. And the National Association of Realtors said used home sales slipped 2.8 percent in January, the fourth straight drop and 5 percent below January 2005.

Builders also reported a few hiccups. Upscale Toll Brothers Inc. said signed contracts in the November-January period fell 21 percent from a year ago, and KB Home reported more buyers backing out of contracts.

http://cbs5.com/topstories/local_story_066093030.html

"This is not about a house needing a bathroom at all...It's about finding an architectural masterpiece built before anyone on this blog was born and which represents the best of the International Style and mid-century modern - priceless."

LOL, it's a bungalow!

They sold them in the Sears catalog for hundreds of dollars:

http://architecture.about.com/library/bl-bungalowplan-index.htm

LOL, "International Style"!

You must be a Realtor™...

Grim said: First, let me say that I was prepared to make an offer on that house.

Grim .... aren't you providing this blog to convince people NOT to buy in this market (don't catch a falling knife etc.?) Care to share why you are not following your own advice in this case?

I felt that at 425 the price was fair. Overpriced? Sure, but I've been looking for a craftsman bungalow for some time now, so I would have paid the premium at 425. At 550 it's nothing but overpriced. At $550 it would take somewhere around a 25% price reduction to hit the price that I thought was fair and more than 30% to hit a point where I thought it was a 'good deal'.

I didn't have to say what I did, I did so because I'm being honest.

jb

"Grim .... aren't you providing this blog to convince people NOT to buy in this market..."

Blog like this in not to give a directions or tell you what to do.. it's to provide an info - sort of guidance - not to lead you by hand.

Also, just because most of the houses are over priced it does not mean that you can't find a "good buy". Use you own judgment when reading a blog like this and (especially) when make a decision about buying a house or not - the "deal of the life time" are out there - you have to be lucky to find them and recognize/realize what they are

I looked at this house recently and it was obvious that the seller was pricing the house low in order to engender a bidding war.

Admittedly, the house has great curb appeal and I was attracted to it from that perspective. However, the brochure, listed 5 bedrooms (the floorplan only had 3, perhaps they counted the converted attic as one) and 2 baths (the floorplan only had 1 and I only saw 1 during my walkthrough). The second bathroom was to be completed prior to closing according to the brochure.

Oddly enough, no construction to be found anywhere in the house regarding the second bathroom... My realtor thought the bathroom might be put in the basement (I had to laugh and we went on our merry way to the next house). The backyard is mostly driveway and smaller than a postage stamp. The house is across the street from a rental apartment complex. Valley Road is also a very busy street in Montclair and traffic was continually whizzing by-some of it audible within the home.

However, it is a fantastically easy walk to town, so someone might have bought it for that reason alone. This would be the only reason to buy this house (wait, it did have a brand new kitchen - have to put that in!)

Even then, considering the outrageous property taxes in Montclair, expecially when the property is reassessed, someone got hosed...

$100,000 price drop:

MLS 2230846

328 Long Hill Drive, Short Hills

$1,495,000 => $1,395,000

Days on Market: 63

This house in Montclair is gorgeous at $599K:

http://www.realtor.com/Prop/1056029196

This is truly architectural excellence.

Photos here:

http://publicstage.gsmls.marketlinx.com/templates/media.asp?Uid=3557579&MlsNum=2249353

It's located at 48 Northview Ave.

The major issues are the tiny lot size, no garage, only 2 bedrooms, and whopping taxes for such a tiny house and lot of $11,325.

The house itself is nice, just take it and put it on a 1/4 or a 1/3 acre lot and it's ready to roll (but imagine the taxes then!).

I thought they originally wanted 100k more on that house and then lowered it. I could be wrong though... ;-)) It's been up for sale forever

Hey, everyone, great stuff here...I would love to hear opinions on Fair Lawn - good, bad, indifferent...all welcome...keep up the good work Grim...

Re: Fair Lawn

Its nice, my friend lived there for a while. But there's not a definitive down town or main street, if that's something you're looking for. High School is rated #47 by NJ Monthly. Close to Paterson and its a very Jewish community. Before everyone goes bezerk, I am not against the Jewish community but rather pointing this out as a matter of fact.

look at this poll @ yahoo finance

http://post.polls.yahoo.com/quiz/quizresults.php

more confirmation that sentiment has changed

sorry link does not work

try this:http://finance.yahoo.com/

look for todays poll

"RentinginNJ said...

Grim (or anyone else).

Do you have any thoughts on the yield curve suddenly springing back from its inversion? The 2yr has a higher yield than the 10 yr. for the fist time in 2 months.

11:41 PM"

Yes - the European Central Bank and the Bank of Japan are going to begin raising interest rates. There is a lot of money from those countries, the Chinese Government, and Oil Producing Countries that hold U.S. Treasury and other high quality USD denominated fixed income securities.

If you suddenly have central decision makers making public statements that reflect the potential of alternatives to USD fixed income to have more attractive terms (e.g. Japanese government bonds), it will tend to push USD fixed income prices down, and hence the yields have gone up over the last two weeks.

chicago

Grim:

Could you please start your charts from zero? That chart makes you look like you have an agenda...

I've had folks email me to tell me that the fact that I run this blog means that I have an agenda.

But sure, I can set the axis to start at zero going forward.

grim

We all have an agenda here, don't we?

We're all tyring to convince each other that RE prices will come down and the bubble is bursting in NNJ.

$50,000 price drop:

MLS 2246367

7 Norwood Terrace, Millburn

$599,000 => $549,000

Days on Market: 27

You can add Wayne NJ to the list of " one of those areas that is highly sought after "

Along with a bunch of other towns I can mention.

I would like to offer some information that might help explain why people buy at what you might think is too much or overvalued.

You see as your gross income goes above 110,000K you start loosing the ability to write off deductions, for example partership losses etc, even child tax credit starts to fade. At 150K it gets real ugly.

But mortgage intereste and property taxes still work at these income levels. So a second home or larger luxury home becomes attractive. You going to loose the money to taxes anyway so why not spend it on youself?

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home