Lowball! Passaic, Sussex, and Warren Counties

Welcome to another edition of Lowball!

Lowball! takes a look at home sales from a different perspective. For those new to Lowball!, a lowball offer is when a buyer offers a significantly lower bid than asking in hopes that the seller accepts the offer. We take a list of home sales from the past month and pick out the sales that have the highest percentage difference between list price and selling price.

The purpose of Lowball! is to show buyers that the market has changed and buyers now have considerably more leverage than sellers. Just a short time ago, Lowball! offers would have been laughed at and discarded, however, not any more. The fact that so many under-asking offers are being accepted is clear proof that the market is changing.The list does not contain all sales, I hand-pick the most interesting sales from the list. These listings might be the highest dollar drops, biggest percentage reductions, or sales in towns that are thought to still be 'hot'. Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Here are Passaic, Warren, and Sussex for the first half of the month, I'll publish the rest of the counties as time permits.

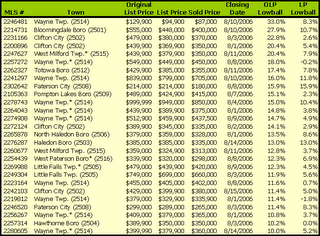

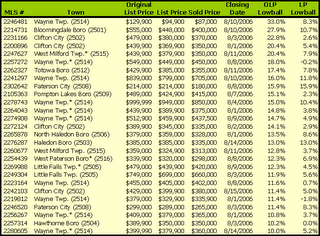

Passaic

(click to enlarge)

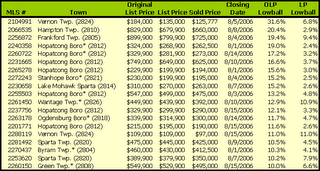

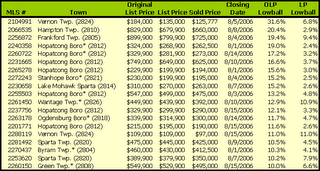

Sussex

(click to enlarge)

Warren (Included a few extra)

(click to enlarge)

Caveat Emptor!

Grim

Lowball! takes a look at home sales from a different perspective. For those new to Lowball!, a lowball offer is when a buyer offers a significantly lower bid than asking in hopes that the seller accepts the offer. We take a list of home sales from the past month and pick out the sales that have the highest percentage difference between list price and selling price.

The purpose of Lowball! is to show buyers that the market has changed and buyers now have considerably more leverage than sellers. Just a short time ago, Lowball! offers would have been laughed at and discarded, however, not any more. The fact that so many under-asking offers are being accepted is clear proof that the market is changing.The list does not contain all sales, I hand-pick the most interesting sales from the list. These listings might be the highest dollar drops, biggest percentage reductions, or sales in towns that are thought to still be 'hot'. Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Here are Passaic, Warren, and Sussex for the first half of the month, I'll publish the rest of the counties as time permits.

Passaic

(click to enlarge)

Sussex

(click to enlarge)

Warren (Included a few extra)

(click to enlarge)

Caveat Emptor!

Grim

22 Comments:

What percent of the total sales do these represent for the same time period?

Passaic - 18%

Sussex - 21%

Warren - 16%

grim-

thanks for your hard work!! Any chance we could see #s for union and/or middlesex counties?

thank-you!!

AFE (amy from edison)

Union will be up later tonite, I don't have the most recent set of Middlesex data.

jb

how do you find out the address of a property listed on the mls. realtor.com?

can u show monmouth? thx

FOOLSball

when you low ball, offer 50% less!

Countrywide Home Loans, quietly has begun sending out letters to thousands of borrowers who have been making only the minimum payments on the company's popular "PayOption" adjustable-rate mortgages.

The letters explain that "this is an early message to alert you that, based on your current payment trends and potential future interest rate changes, the monthly payment you will be required to pay may increase significantly."

A model letter provided to me by Countrywide includes this hypothetical example of what could be ahead for a California homeowner currently making only minimum payments monthly on a $402,000 loan.

The current full interest rate on the loan is 7.6 percent, but the borrower has been paying just $1,348.47, far less than what's needed to fully amortize the mortgage over its 30-year term.

If the loan reset at today's rates, the letter explains, the full payment required would be $2,887.50 - more than double what the homeowner has gotten used to paying. Future reset rates could be even steeper, making the potential payment crunch much worse.

John G. Walsh, a senior official at the federal Comptroller of the Currency, recently described his agency's concerns about poorly informed borrowers who don't realize that their artificially low monthly payments won't continue indefinitely.

"We've had consumers tell us they didn't know that after making 60 minimum payments on a [payment-option loan], they would owe more than they did when the loan was brand-new. They should certainly understand the basic bargain: The price of a low payment now is a much higher payment later.

Grim said...

Union will be up later tonite

Thanks grim..you are awesome...I think once this bubble thing comes down we faithful readers need to nominate you for a medal of honor for single-handedly bringing prices in nnj down!!!

There is a piece on MLS relisting on the front page of the Star Ledger this morning. I can't seem to get a link online.

grim

Sorry friend, but I had nothing to do with the market slowing or prices falling.

grim

The Grimster is JUST reporting the FACTS!

Something most fail to do.

A lesson to you Grubbing sellers.

Cut The Price Or ‘Learn To Chill’

A housing report from Maine Today. “The number of single-family homes for sale in Maine has hit record levels, industry figures show. More than 26,000 homes currently are on the market, compared to roughly 18,000 at this time last year, and 14,000 in 2004. Inventory has grown by more than 1,000 in just the past month.”

“This plentiful supply of homes has outpaced demand in many areas, and that is pushing down prices. In response, sellers are trimming their asking prices, and some real estate agents are becoming more creative to get their properties noticed, particularly in southern Maine.”

“An agent in Saco drew traffic to an open house, and put the home under contract, by slashing the price from $249,000 to $199,000. It’s no secret that home sales have slowed in much of the country. ‘Some sellers haven’t come to the reality that it’s a buyer’s market,’ said Realtor Cathy Manchester in Gray. ‘They’re still trying to get higher appreciations.’”

“Following appraisals from three real estate agents, Bruce Thistle in Windham listed his home last August for $259,000. He finally got it under contract this month, for $216,000. ‘A year ago, if you told me I’d sell the house for that price, I would have laughed,’ he said.”

“Thistle only had one showing during the first six months his home was for sale, even though he dropped the price $9,000 during that period. ‘I thought we’d sell it in days,’ he said. When Thistle’s listing expired in March, he switched Realtors and went with Manchester. She started the process at $240,000 and cut the price three times before finding a buyer.”

“In today’s market, (realtor) Noah Smith said, sellers need to be realistic about the condition of their homes and the asking price. That’s especially true in York County, where inventory has continued to grow in recent weeks. ‘Anyone who says the market is leveling off is in denial,’ Smith said.”

The Philadelphia Inquirer. “The bull market for houses led to a 50 percent surge in sales of million-dollar homes in the eight-county Philadelphia area. ‘A lot of people were afraid to miss the boat,’ said Albert Perry, president of the Greater Philadelphia Association of Realtors, of the home-buying activity in the last year. ‘That fear of loss is a powerful motivator.’”

Starving realtors starting to cave in and acknowledging house price declines.

A few months of NO commissions does the trick. NO Transactions NO COMMISH.

Starte lowering prices grubbers. This is 2006 and the market is tanking...you missed the top.

Bleed'em DRY.

The following is from era.com's web site. Is this the new trend?

Guaranteed sale, guaranteed price.

When you accept an offer from ERA Franchise Systems, Inc., the Sellers Security® Plan assures you that ERA Franchise Systems, Inc. will buy your current house if it doesn't sell within 180 days from the application date. ERA Franchise Systems, Inc. guarantees the purchase price offer, so you'll know in advance the minimum you can expect from the sale of your house. You'll also have plenty of time to see if any other buyer is willing to pay more.

You get the profit, ERA Franchise Systems, Inc. covers any loss.

Almost always, you will receive more than the price guaranteed by the agreement. If ERA Franchise Systems, Inc. ends up purchasing your house and then resells it for more than we have in it (including holding and closing expenses), the net profits are returned to you. But if ERA Franchise Systems Inc. sells it for less, you don't take the loss, ERA Franchise Systems, Inc. does.

ERA Mortgage Equity Advance Option can even help with your down payment.*

The ERA Mortgage Equity Advance Option allows qualified buyers to borrow against equity. You may use up to $500,000 of your available equity from the ERA® offer to purchase and close on your new home financed through ERA Mortgage. So if the down payment on your new home is contingent on the proceeds from your old one, the ERA Mortgage Equity Advance Option has you covered. For more details, e-mail us at Answers@ERAMortgage.com for more information.

Increased Buying Power.

The ERA® offer eliminates the uncertainty of contingency offers giving you the flexibility to move when you want. You are in a better negotiating position than other buyers who may still have to sell a home.

Sellers Security Plan qualification.

Your house must be a single-family primary residence. Houses must have an average appraised value of at least $50,000 and not more than $750,000. Mobile homes, co-ops, or multi-family homes are not eligible for the plan. Properties that have an abandoned storage tank on site are also not eligible.

Certain conditions apply. For complete details, see your participating ERA® Broker.

*Neither ERA Franchise Systems, Inc. nor its affiliated companies, including Cendant Corporation, provides any product or service in connection with the ERA Mortgage Equity Advance Option. All products and services provided by ERA Mortgage.

Hey DUMMIES Look;

More evidence that prices are at JOKE levels.

http://mysite.verizon.net/

vzeqrguz/housingbubble/

look Dummies.

Prices will be adjusting downward...either accept it or ride it to the bottom at about 33% lower.

http://mysite.verizon.net/

vzeqrguz/housingbubble/

new_york.html

There is a very good article in the August 21 issue of Barron's entitled,The No-Money Down Disaster.

Sorry, I don't have a link but if you can get it, I really think it's worth reading.

DLD

Houses at least 33% lower Condos have began to CRASH in price.

It's funny how many new houses continue to pop up on the market and you look at the price the Greedy Money grubbing It's not 2005 sellers are asking.

All I have to say to these grubbers is GOOD LUCK. You are going to be shocked what you are going to get in the end "if you have to sell".

Bababa

Bust

Bob

Grim-

But I do have to say that given your ability to continue reporting the facts you have provided a service that would really have no venue say even 5 years ago when this bubble started...maybe that's what the real estate industry and the Fed were banking on when they started telling us way back then that whatever the landing it will be soft!! I think having this venue helps a lot of people get info much more quickly than before the internet and thankfully we have someone like grim willing to put in the work to make this a useful source of invaluable info.

just my .02 cents

AFE

Few years back (2004?) money.cnn.com used to run stories about soon to be millionaires. All the “to be millionaires” had one thing in common - they held more than on real estate property. I would like to see CNN review the progress made by these would be millionaires.

Post a Comment

<< Home