Lowball! Bergen and Essex Counties

Welcome to another edition of Lowball!

Lowball! takes a look at home sales from a different perspective. For those new to Lowball!, a lowball offer is when a buyer offers a significantly lower bid than asking in hopes that the seller accepts the offer. We take a list of home sales from the past month and pick out the sales that have the highest percentage difference between list price and selling price.

The purpose of Lowball! is to show buyers that the market has changed and buyers now have considerably more leverage than sellers. Just a short time ago, Lowball! offers would have been laughed at and discarded, however, not any more. The fact that so many under-asking offers are being accepted is clear proof that the market is changing.The list does not contain all sales, I hand-pick the most interesting sales from the list. These listings might be the highest dollar drops, biggest percentage reductions, or sales in towns that are thought to still be 'hot'. Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Here are Bergen and Essex for the first half of the month, I'll publish the rest of the counties as time permits.

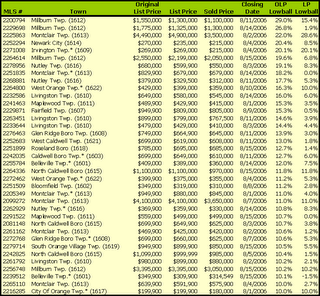

Bergen County

(click to enlarge)

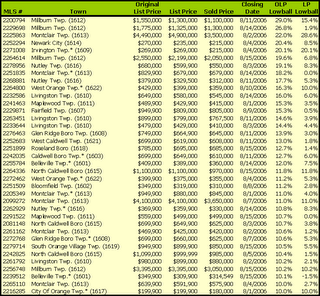

Essex County

(click to enlarge)

Caveat Emptor!

Grim

Lowball! takes a look at home sales from a different perspective. For those new to Lowball!, a lowball offer is when a buyer offers a significantly lower bid than asking in hopes that the seller accepts the offer. We take a list of home sales from the past month and pick out the sales that have the highest percentage difference between list price and selling price.

The purpose of Lowball! is to show buyers that the market has changed and buyers now have considerably more leverage than sellers. Just a short time ago, Lowball! offers would have been laughed at and discarded, however, not any more. The fact that so many under-asking offers are being accepted is clear proof that the market is changing.The list does not contain all sales, I hand-pick the most interesting sales from the list. These listings might be the highest dollar drops, biggest percentage reductions, or sales in towns that are thought to still be 'hot'. Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

Here are Bergen and Essex for the first half of the month, I'll publish the rest of the counties as time permits.

Bergen County

(click to enlarge)

Essex County

(click to enlarge)

Caveat Emptor!

Grim

36 Comments:

IMO,

So many sellers are listing their houses way above fair market price and set themselves up for failures.

I can easily spot a $100,000 difference among houses listed at the same price.

Grim-

I like the colors you are using on your charts this week. It reminds me of a fiesta!! Thanks for the hard work!!

Does everyone like the old or new format better?

grim

New format makes it harder to copy and paste MLS numbers. :(

Here's a suggestion that might make your life easy: save the spreadsheet as HTML, and paste that into your blog program. Would that even work?

On the lowballs, it's amazing to see how long ago some went into contract:

MLS 2256748: April 12 (over 4 months)

MLS 2200794: February 8 (over 6 months!)

I'll try the html and see if it works out. I think it is going to be a bit too wide.

jb

I like the new format. Thanks!

jw

That is NOT low ball. The guys who bought those houses at those prices are FOOLS. It is imperative to define low ball as 50% less of the asking price at this seller-still-not-wake-up market.

anon @ 10.59: Why dont YOU start collecting some data and help out instead of whining about stats here?

--BM

Hat tip to Mish at Global Economic Analysis for this piece..

Interest-only loans may start cheap, 'reset' scary

To head off potential problems, the largest mortgage originator in the United States, Countrywide Home Loans, quietly has begun sending out letters to thousands of borrowers who have been making only the minimum payments on the company's popular "PayOption" adjustable-rate mortgages.

The letters explain that "this is an early message to alert you that, based on your current payment trends and potential future interest rate changes, the monthly payment you will be required to pay may increase significantly."

A model letter provided to me by Countrywide includes this hypothetical example of what could be ahead for a California homeowner currently making only minimum payments monthly on a $402,000 loan.

The current full interest rate on the loan is 7.6 percent, but the borrower has been paying just $1,348.47, far less than what's needed to fully amortize the mortgage over its 30-year term.

If the loan reset at today's rates, the letter explains, the full payment required would be $2,887.50 - more than double what the homeowner has gotten used to paying. Future reset rates could be even steeper, making the potential payment crunch much worse.

I can't read the Essex county chart when I click on it.

Doesn't matter. Bergen County is all that's important anyway.

:) Maybe Bergen is important but I'm curious to see Hudson as well. I got Essex to work.

Make sure your browser isn't set to resize images to fit your screen.

grim

I say let the people who took out the interest only loans drowned in their inflated purchase price -- they drove the market up BY taking out these products.

The lowballs are great, its refreshing to see so much off the OLP!

on negative amort I/O's little focused on provision - prepayment penalties - I should have a good data point on a client situation hopefully in the next couple of weeks.

The upshot - there is no free lunch - all the money you saved on a low intro rate or else being able to make minimum payments will be overwhelmed by the extra money you have to fork out at the end to rid yourself of the albatross

chicago

"FOOLS"Ball!

BOOOOOOOOYAAAAAAAAAA

Bob

I say let the people who took out the interest only loans drowned in their inflated purchase price -- they drove the market up BY taking out these products.

The lowballs are great, its refreshing to see so much off the OLP!

8/19/2006 09:21:55 AM

U sez it brahta.

Three cheers for the Grimster!

Bleed'em dry

BOOOOOOOOYAAAAAAAA

Bob

Congrats YOU are a Bagholder now!

‘Sellers Are Starting To Realize, Buyers Don’t Have To Buy’

It’s Friday desk clearing time for this blogger. From Florida, “The number single-family home sales in Escambia and Santa Rosa counties dropped significantly from June to July, while median sales prices have dipped just slightly. ‘I’m noting more price reductions,’ said veteran Pensacola realtor Alexis Bolin, an outspoken critic of high home prices. ‘Reality has set in to the marketplace, and sellers are starting to realize that buyers are educated about this market, and that a lot of buyers don’t have to buy.’”

From Virginia. “Languishing ‘For Sale’ signs sitting for months in front of homes in Falls Church are not a problem for well-to-do long-time homeowners not burdened under the pressures of a ballooning adjustable rate mortgage. But for all those young families who bought into the binge, the viability of the lives they hoped to construct with in a $700,000 home will quickly vanish.”

BLEED"EM DRY!

Show & Tell Is becoming Show & BUST!

IT'S BAD REALLY BAD......

NOW THEY ARE CONCERNED?

WHY? CUZ THE CLASS ACTION LAWSUITS ARE A COMING.

Nontraditional Mortgage Guidance: "Within a Few Months"

According to the Post:

Regulators say the final version of the rules will be announced within a few months.

Excerpts from the WaPo: Insurers Urge Action On Risky Mortgages

Despite regulators' warnings that some popular types of mortgages are risky, lenders are still making them, and mortgage insurance companies have begun pleading with federal banking agencies to act quickly to restrict them.

The loans under scrutiny include interest-only mortgages and "option" mortgages, in which borrowers decide each month how much to repay. Because monthly payments are lower than with traditional fixed-rate mortgages, borrowers can buy more expensive houses. In the past five years, millions of Americans have bought or refinanced homes using these loans. The risk comes because eventually these loans "reset," meaning the payment is adjusted upward -- sometimes as much as doubling -- to repay the full interest and principal owed.

"We are deeply concerned about the potential contagion effect from poorly underwritten or unsuitable mortgages and home equity loans," Suzanne C. Hutchinson, executive vice president of the Mortgage Insurance Companies of America, wrote in a recent letter to regulators. ". . . The most recent market trends show alarming signs of undue risk-taking that puts both lenders and consumers at risk."

Many borrowers are paying as little as possible. About 70 percent of the people who take out an option adjustable-rate mortgage, which lets the buyer avoid paying even the full interest on the loan, end up paying the lowest permissible amount each month, according to the Federal Deposit Insurance Corp., which regulates banks. The amount unpaid is added to the mortgage balance, so borrowers end up owing more than when they started. Having no equity in a home increases the risk of foreclosure, especially when housing values fall and houses are hard to sell.

...

In 2000, just 1 percent of American homeowners who got new loans had these types of loans, but by May 2005, about a third of all borrowers did -- about the same percentage as in May 2006, according to new data from First American LoanPerformance, which tracks the statistics.

emphasis added

Just a little pump speech for those that have solid financials, some real assets (ya know 20% down payment) to buy a house and were not willing to play in the lunatics FOOLSball game the last 3 years.

YOUR time is nearing. YOU ARE IN THE DRIVER SEAT. YOU OWN THIS MARKET. DO NOT LISTEN TO the REALTORS propaganda..... HAVE NO SYMPATHY TO A SELLER ABOUT TO SEE THEIR EQUITY EVAPORATE.

it's time for you to be rewarded for your patience and sacrifice.

THIS IS ALL BUSINESS.

BLEED'EM DRY.

Bob

PLEASE READ VERY VERY SERIOUS STUFF HERE FOLKS.

July 10, 2006

Hon. Sheila Bair

Chair

Federal Deposit Insurance Corporation

550 17th Street, N.W.

Washington, DC 20429

Hon. Ben S. Bernanke

Chairman

Board of Governors

Federal Reserve System

20th Street and Constitution Avenue, N.W.

Washington, DC 20551

Hon. Susan S. Bies

Governor

Board of Governors

Federal Reserve System

20th Street and Constitution Avenue, N.W.

Washington, DC 20551

Hon. John C. Dugan

Comptroller of the Currency

250 E Street, S.W.

Washington, DC 20219

Hon. John M. Reich

Director

Office of Thrift Supervision

1700 G Street, N.W.

Washington, DC 20552

Dear Sir or Madam:

The Mortgage Insurance Companies of America (MICA) has long been strongly supportive of the banking agencies' work to ensure appropriate prudential standards for mortgage risk. Mortgage insurers of course have all of their risk concentrated in this area, and we are deeply concerned about the potential contagion effect from poorly-underwritten or unsuitable mortgages and home-equity loans. We hope the agencies will soon finalize the draft guidance released last December on nontraditional mortgages [70 FR 77249], in part because the most recent market trends show alarming signs of ongoing undue risk-taking that puts both lenders and consumers at risk.

Below, I would like quickly to note some recent mortgage-market data that support the proposed guidance and argue for rapid action. MICA has been particularly concerned that the guidance make clear that loans with simultaneous second liens are risky in and of themselves, with these risks of course heightened when they are "layered" with other non-traditional features such as payment-option and interest-only structures. Key recent findings include:

• In June, Standard and Poors (S&P) decided to revise its ratings criteria for mortgages with simultaneous second liens, often called "piggyback" mortgages. (1) This decision brings the S&P rating into alignment with the more conservative one by Moody's and confirms the higher risks posed by these structures. S&P based its decision on research confirming that, holding credit scores equal, mortgages in which the borrower finances the down payment are more likely to default than loans with cash down payments. S&P also concluded that housing markets are likely to experience more stress than originally anticipated, heightening the risk for borrowers with no cash downpayment and, therefore, no equity in their homes.

• The most recent data available from a survey conducted by the National Association of Realtors (2) shows that first-time homeowners - 40% of all borrowers in 2005 - had an average down payment of only 2% on homes costing $150,000, but 43% of these homeowners had no down payment at all.

• In general, non-traditional mortgages have become a still more significant part of the market, despite the cautionary note in the proposed guidance. (3) First-quarter data indicate that interest-only and payment-option products now account for 2 6% of mortgage loan originations - a sharp increase from last year. (4) Even more striking, a recent Fitch report notes that 40-year mortgages with payment-option features now account for 8% of total securitized mortgage volume, up from 2% for all of last year. (5) Subprime mortgages with fixed rates for two years and variable ones for the following 38 years account for 8% of total subprime originations in the first quarter of 2006, up from 2% in all of 2005. (6) Fitch notes particular concern with loans like this because of "double-teaser" clauses.

MICA has noted that industry practice did not change as significantly as required following the final guidance in 2005 on home-equity loans. (7) Although the non-traditional guidance is now only in draft form, one would have expected a far slower growth in industry reliance on non-traditional products in anticipation of final standards with far-reaching market impact. The fact that this did not occur reinforces the suggestion in our earlier comment letter (8) that the final guidance be accompanied by clear language regarding not only consistent enforcement by the agencies, but also clear penalties for those who disregard it.

We would be pleased to provide additional background on the findings noted above or any other market analysis that would be of assistance as your agencies finalize the nontraditional mortgage guidance.

Sincerely,

Suzanne C. Hutchinson signature

Suzanne C. Hutchinson

Could you please post such charts for Edison-Middlesex county, preferablly town houses.

Thanks,

KBR

WSJ

THE WEEK AHEAD

Housing

Measuring the Cracks in the Foundation

By MARK WHITEHOUSE

August 19, 2006; Page A2

Economists looking for evidence of a hard landing in the housing market will be watching closely next week when the National Association of Realtors releases its latest data on existing-home sales and prices.

Some think there is a chance the report will show the median price of a single-family home declined in July when compared with a year earlier. If so, that would be the first time prices have fallen in more than a decade.

Economic data often defy the forecasters, and monthly housing data are notoriously volatile. But whether the data show a decline or not, many people trying to sell their homes probably already have felt one. That is because the official numbers tend to be rosier than reality, particularly at turning points like the present.

For much of the past year, economists have been engaged in a slow-motion debate over where the housing market is headed. Most still predict a soft landing, in which sales would decline and prices would stall, but only enough to take a small bite out of economic growth. Lately, though, worries have mounted amid indications that the landing could be harder.

Last week, for example, the National Association of Home Builders reported that its index of new, single-family-home sales fell to a 15-year low. The previous week, luxury-home builder Toll Brothers Inc. said orders were down 47% in the three months ending July 31 from a year earlier. Chief Executive Robert Toll said he had never seen such a sharp downturn in an otherwise healthy economy.

For the most part, economists expect next week's housing reports, which include fresh July data from the Census Bureau on new homes, to confirm the downward trend they already see. But fresh data on median prices -- particularly for existing single-family homes, which make up most of the market -- could raise some eyebrows. So far this year, price gains have shown a sharp deceleration: In June, they were up only 1.09% from a year earlier, compared with 12.61% in January. Should prices actually fall in July, that will be a telling sign that housing could be in for the kind of sustained decline in prices that could weigh heavily on consumers' moods and finances.

Moreover, there is some reason to believe the reality is even harsher than the numbers reflect. That is because when home sales begin to slow, sellers offer incentives that the official prices don't reflect, such as help in paying buyers' closing or moving costs. Also, as sales volumes in the worst local markets decline, a larger share of the recorded sales tend to come from markets that are still doing relatively well -- a factor that can skew official prices upward.

The difference can be significant. Thomas Lawler, an economist and former vice president at Fannie Mae who has studied prices near his home in Loudoun County, Va., estimates that the average price of similar homes in July -- accounting for concessions -- was down 10% to 15% from a year earlier. The local realtors' organization, he says, reported only a 2.5% drop.

"There are a lot of people who would love to be able to sell their homes at last year's price," he says. "But they can't."

Looking at downtown South Orange area. Saw listing of condos/townhome on Mews Lane.

Prices for the units range from $450k to $389k for 2 bed 2.5 bath unit approx 1250 to 1300 sq ft. Any thoughts or comments.

Am i gonna be a bagholder?

"Am i gonna be a bagholder?"

The only way you wouldn't, is if South Orange was the only town to avoid price declines.

Think that's a likely scenario?

By the way, if you're condo shopping today (which means you'll be underwater for years), you might as well be underwater in Summit:

http://newjersey.craigslist.org/rfs/193123926.html

anon 11:13:24 AM,

No offense, but are you serious? or do you just like to type and post with no real meaning behind it?

I am not trying to be a jerk, but look how simple you sound?

I highly suggest, thumbing through this website, thumb through the archives etc...you will learn alot and answer your own questions and realize how silly of a question you are asking.

Please don't take this as a personal attack, there are just alot of heavyweights on this blog (me for one) whom don't like breadcrumbs.

Review, think, and then comeback with questions.

;)

SAS

$344500 REDUCED. Beautifully Updated 2BR Condo. Close to everything.

Yikes, the complex units were from a conversion and sold for much less than current asking. I could see selling price at $290k to move this.

Not holding the bag for Summit. thanks, unrealtor.

Anon 02:15:25 PM

I really value your input.

I didn't realize that I needed your approval before posting. Are you a heavyweight in your own mind or just "attempting" to make yourself "sound" important.

Nothing personal in my comments either.

anon 8/20/2006 02:32:29,

yup, guess I was a little harsh. sorry. One tends to hear same questions many times....

In my opinion, bottom line, no place in NJ is immune from the bubble, across the board, you are going to see major price reductions, some towns will be hit harder than others, but overall the values will go down. My first suggestion would be to get out of NJ, second is to raise cash, hold, and get out of debt if any. I would rent until this market shakes itself out. Like shytown says..."cross off 2006 and beware of the false bottom". A lowball at 20% ain't shit, its still overvalued. Orange, I suspect will take a harder hit then other towns. Why? Well...its Orange. Anything with that name has negative conotations, therefore nobody will be willing to buy it. Schools are shit etc..etc.. BUT, I would consider renting there. Cause who cares about rent. Just get cheap rent, and raise that cash.

Again, sorry if I bit your head off.

A note about being a heavyweight:

I am a heavyweight in my mind and alot of other peoples minds too. I actually come to this blog as a stress relief from my real life, and can post my opinions and feelings, and perhaps help someone out. What do I do for a living you ask? Our team makes sure American interests, patents, and intellectual property wins over global competition...Not an easy task these days. In our buisness, we care about who OWNS what, we make damn sure american companies get the royalties. Get the drift....

Take care,

SAS

8/20/2006 03:20:52 PM

Apologies accepted. I agree with you bout the "Orange" comment.

I took Grim's advice and looked at tax records. The people who purchased into Mews into 2005 are in bad resale position based upon prior years sales prices.

I try to KISS-keep it simple on the blog. Lots of good information.

Based upon my question, you would not know that i'm a copyright lawyer.

"Looking at downtown South Orange area. Saw listing of condos/townhome on Mews Lane.

There are 4 identical condos for sale in mews lane. None have sold in months and the prices are dropping further. The complex was built in 1986 and has a one time assessment of $4000 per unit just about to be approved. If you want to pay close to $400k for a 2BR, 2.5BA in a subpar school district with a train rambling by from the mid 80's please go right ahead. My own feeling is when this market bottoms out the units on the market now ($389k-$419k) will be going for around $340k.

I live in the Mews complex. Bought 5 years ago in the low $200's. Some idiot paid a mind bogglingp $450k for a unit last fall. Current units can't even sell for $390k. 4 units are currently for sale. People are looking but no one's buying. If you like it here play all 4 sellers off each other and get the best deal. None of them are different enough to warrant the big price differential.

What variables are used to determine if a property is overvalued?

Post a Comment

<< Home