Anonymous comments allowed

I've been receiving quite a bit of email from blog readers lately, if you are a reader, please leave a comment or two so I can get an idea of the user base.

Thanks for reading..

-grim

Keeping a watchful eye on our small part of the largest asset bubble in history

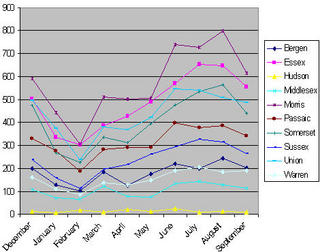

It's hard to argue that prices will remain stable with supply increasing at this rate. If this trend continues there will be significant pricing pressure on sellers in the near future. I expect this trend to continue through the winter months as we're heading into the winter sales slump. While I don't believe we'll see large price changes in a short period of time (due to both buyer and seller psychology), I do believe we're past the peak of this parabola. Nowhere to go now but down.

Buyers, please don't feel like somehow you are going to be 'priced out' or are 'missing the boat'. If you buy at this point you are the greater fool. Don't be pressured into a sale by your agent, family, or friends. Believe me when I tell you that you have nothing to gain and everything to lose.

Caveat Emptor!

-grim