I came across this piece on Ben's blog this morning. I'm positing it here because I feel it is rather significant. If you've studied any economics you know the theory behind a perfectly competitive markets. If you don't, the model theorizes a type of market where no producer or consumer can influence prices directly. The model has five requirements for this to be possible:

1) Atomicity - A large number of buyers and sellers

2) Homogeneity - Good and services are perfect subsititutes

3) Perfect and complete information - All firms and consumers know the prices set

4) Equal access - All fims have access to information, technologies, resources

5) Free entry - Any firm may enter the market

The real estate market most certainly achieves the first requirement of atomicity. The second requirement is arguable in either direction, but does involve quite a bit of subjective taste. The third and fourth requirements, however, are very important in the real estate industry.

Why?

Because as long as the real estate industry controls the information and do not share it, there exists an information asymmetry in the market that gives a significant advantage to the real estate industry. This asymmetry allows those insiders to manipulate the market. Why? Because the industry has a vested interest in the market.

So why am I bringing this up today? Because of this.

Home sales on a slide across the countyOver the past several years, the News-Press has obtained sales and median price data for the South Coast from the Santa Barbara Association of Realtors. The group recently told the News-Press that it now refuses to make this data available to the newsroom. Other associations of Realtors across the county willingly continue to share sales and price information with the paper.Is this the beginning of a disconcerting trend to hide data and statistics from the public? If so, the Realtors would be able to spin the market any way they wish. It would only be through anecdotal stories and stale data that we would be able to know the market direction.

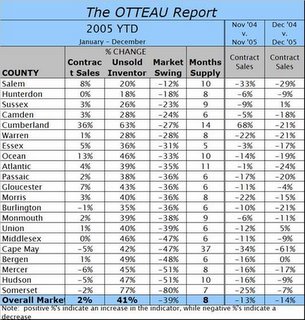

Hopefully, intelligent readers will realize that hiding this data from the public only further damages public trust for Realtors and the real estate industry. God knows that the Realtors were not shy with their information in a rapidly appreciating market. So why change now? Well, because the market is falling apart, and it is in their best interest to do everything they can to hide it.

Caveat Emptor!

Grim