The funny thing about bubbles, is that you never know when they’re over.”

Read Between All Those For-Sale Signs

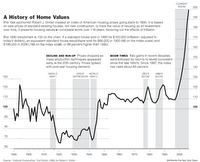

REAL bubbles pop. They are fully formed one moment and gone the next. Financial bubbles rarely meet with such a definitive end, which has always been the biggest problem with the metaphor. They let out their air in unpredictable bursts, and it’s usually impossible to figure out whether they have finished deflating or are just starting to.

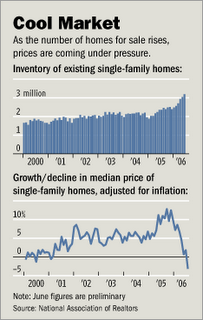

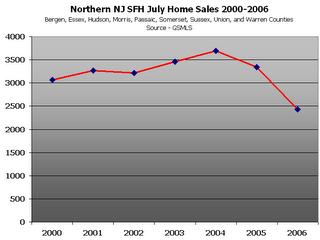

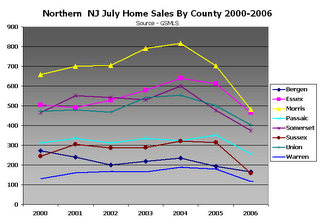

Still, the latest housing numbers seem like they could be a turning point. A real estate crash might not be the most likely outcome, but it certainly seems legitimate to think about what one would look like.

...

The collapse of most bubbles does not have a single obvious starting point, like a bad corporate earnings report or an interest-rate rise. Instead, the psychology of buyers and sellers shifts, slowly at first and then sometimes in a cascade.

“It’s always mystified people about why these things turn,” said Robert J. Shiller, a Yale economist and author of “Irrational Exuberance,” a history of speculation. “People want something concrete.”

There seem to be three major paths that housing could follow over the next year: a soft landing, the start of a long slump, or a crash. A soft landing is the one predicted — and preferred — by most economists on Wall Street and at the Fed. A long slump is what many past real estate booms turned into. A crash is the outcome that a small group of analysts say is the only possible ending for the biggest housing boom of all.

...

But earlier booms have been followed by modest price declines in some cities that turned into long periods in which increases trailed inflation. After peaking in much of California and the Northeast in the late 1980’s, house values fell during the recession of 1990-91 and then drifted for years, often rising more slowly than the price of milk.

In inflation-adjusted terms, prices in the New York and Washington areas did not return to their late-80’s peak until 2002. In Boston, it didn’t happen until 2000, and in San Francisco, 1999.