Buyer sentiment rapidly changing, Sellers feeling pain

I came across this bit in Realty Times this morning, just more examples of the rapidly changing real estate market:

Ask Realty Times

Question: We purchased an ocean-front condo in south Florida last May. We've decided we want to sell. However, according to our real estate broker there have been few to no showings because people are just not coming to look and if we do sell at this point we'll loose anywhere from $75,000 to $100,000 or more. We understand that the real estate market is flat right now, but how shall we understand that (a) no one is looking and (b) we will be suffering such a large loss?

Answer: If you're a short-term speculator you have a lot of risk in selected markets and with selected projects. There is a belief among some buyers that in certain areas of the country condo units have been grossly oversold to investors and speculators. There is little reason to buy -- if this theory is true -- while prices are still declining.

Anyone else think that buyer sentiment isn't changing incredibly quickly? And before you start to rationalize why the Northern New Jersey market is 'different', you should go back and read this piece, Northern New Jersey Among Riskiest Real Estate Markets, which found Northern New Jersey to be just as risky (or more) than Southern Florida.

Even the realtors are changing their tunes (From Realty Times Market Conditions Report for NJ):

"There were more homes coming onto the market this month and about the same going under contract as in January but much less actually being sold. The average asking price is about the same.

The Spring Market is here and more and more homes are being listed for sale. We have passed the time of the double digit rise in home values and now is the time for Sellers to realize this and begin to rethink the market position of their homes. If Seller's continue to list their homes at Yesterday's Prices…more and more homes will remain on the market as buyers have more to choose from." - Leonard Klein, Realtor

"The Luxury market has leveled off. Rising interest rates, and double digit increases, are already "OLD" news." - Edward Meyers, Realtor

"For those Sellers who wish to market their home in this Spring Market, I recommend pricing aggressively, and make sure you are represented by..." - Susan Laskin, Realtor

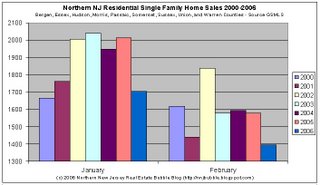

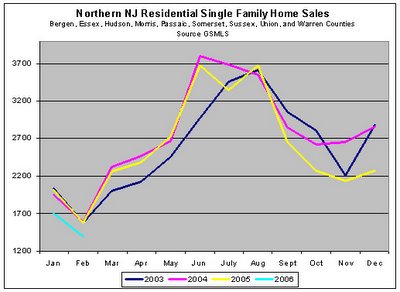

"...sales activity in January ran 12% less than January 2005 indicating that the weakness in the residential market which began in October has carried over into 2006. Further evidence that the market has softened comes from the continuing increase of unsold inventory which grew by more than 2,000 homes in January and now stands 46% higher than 1 year ago. Home buyers will clearly have much more to say in determining the selling price of a home in 2006 than was the case last year." - Spring Otteau Report

(emphasis added)

Caveat Emptor!

Grim

Ask Realty Times

Question: We purchased an ocean-front condo in south Florida last May. We've decided we want to sell. However, according to our real estate broker there have been few to no showings because people are just not coming to look and if we do sell at this point we'll loose anywhere from $75,000 to $100,000 or more. We understand that the real estate market is flat right now, but how shall we understand that (a) no one is looking and (b) we will be suffering such a large loss?

Answer: If you're a short-term speculator you have a lot of risk in selected markets and with selected projects. There is a belief among some buyers that in certain areas of the country condo units have been grossly oversold to investors and speculators. There is little reason to buy -- if this theory is true -- while prices are still declining.

Anyone else think that buyer sentiment isn't changing incredibly quickly? And before you start to rationalize why the Northern New Jersey market is 'different', you should go back and read this piece, Northern New Jersey Among Riskiest Real Estate Markets, which found Northern New Jersey to be just as risky (or more) than Southern Florida.

Even the realtors are changing their tunes (From Realty Times Market Conditions Report for NJ):

"There were more homes coming onto the market this month and about the same going under contract as in January but much less actually being sold. The average asking price is about the same.

The Spring Market is here and more and more homes are being listed for sale. We have passed the time of the double digit rise in home values and now is the time for Sellers to realize this and begin to rethink the market position of their homes. If Seller's continue to list their homes at Yesterday's Prices…more and more homes will remain on the market as buyers have more to choose from." - Leonard Klein, Realtor

"The Luxury market has leveled off. Rising interest rates, and double digit increases, are already "OLD" news." - Edward Meyers, Realtor

"For those Sellers who wish to market their home in this Spring Market, I recommend pricing aggressively, and make sure you are represented by..." - Susan Laskin, Realtor

"...sales activity in January ran 12% less than January 2005 indicating that the weakness in the residential market which began in October has carried over into 2006. Further evidence that the market has softened comes from the continuing increase of unsold inventory which grew by more than 2,000 homes in January and now stands 46% higher than 1 year ago. Home buyers will clearly have much more to say in determining the selling price of a home in 2006 than was the case last year." - Spring Otteau Report

(emphasis added)

Caveat Emptor!

Grim