Why renting just might be more financially sophisticated than everyone thinks.How many times have we all heard the term "bitter renter", how many times have you been called "jealous" for expousing your views on the housing bubble? Renters have always gotten the short end of the stick, stigmatized as not being financially savvy. It's the homeowners that are the intelligent investors. The public view, fortunately for renters, is incorrect, and I'm going to tell you why. Unfortunately, the answer is complicated and may be a bit difficult for many to understand. So grab yourself a cup of coffee and a chair, this is going to be a long ride.

We first need to understand what

arbitrage is. Some readers might know it already, so just bear with me. The simplest definition of arbitrate is the exploitation of market imbalances. Ok, maybe that really isn't so simple, so lets just use an example again. Say you spend half of your day in Manhattan, and half in Jersey. While walking down the street in Manhattan, you see someone selling scarves for $10.00, you make a mental note of the price. Coming home that evening, you see a similar scarf for sale for $5.00 and a lightbulb goes off. You can buy scarves in Jersey for $5 and sell them in Manhattan for $10. So the next day, you board the train with a handful of scarves, and that evening you return home richer. You've exploited the imbalance in scarf pricing to profit, little did you know you've just become an arbitrageur.

You are probably wondering what the heck this has to do with renting or buying a home. Just hold tight, I didn't say this was easy. You need to understand arbitrage first, otherwise this whole exercise was a waste.

Arbitrage exists in many financial markets today, in stocks, bonds, currencies, etc. In fact, arbitrage opportunities almost always exist anywhere where you have market imbalances. I'm sure by now you have already thought of one of the biggest arbitrage markets available to the average joe.. You got it, eBay. If you can buy something at Costco and sell it on eBay for more, that is arbitrage. If you can buy something at a garage sale and sell it for more on eBay, that's arbitrage. If you can buy something on eBay for less than it sells for locally, that is arbitrage.

Now that we've beaten the horse to a pulp, lets understand why renting in today's market is actually exploiting the current market imbalances. You are no longer a renter, but an arbitrageur. Let's take a look.

Two markets exist for a single similar product, housing. Those two markets are the rental market and the purchase market. You can get the same goods, housing, through both markets. You have two options if you want housing, buy or rent. The price of the good in either market is typically driven by economic fundamentals like median income, unemployment, interest rates, supply and demand for the good, etc. Just a few short years ago, pricing in both of these markets was similar. Stop, I'm not saying it cost the same to rent and buy, the cost is not, until you begin to factor in housing appreciation or depreciation, taxes, maintenance, rental increases, and the opportunity cost of the down payment. Yes, just a few short years ago these markets were both driven by similar fundamentals, thus arbitrage opportunities did not exist. Yes, a long long time ago in a universe far far away, it might have made sense to buy, but not anymore.

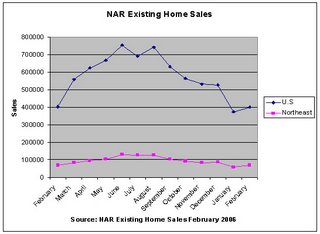

Why? Because house prices have become disconnected from the fundamentals that kept both markets in check (think of it as a form of arbitrage equilibrium). But something happened, the price in the purchase market shot up dramatically since the late 1990's, and the price on the rental market did not. A lightbulb should be going off in your head right now. Yes, a market imbalance has been developing opening the door for arbitrage. Let's walk through it.

You have two options:

1) Purchase housing in the purchase market, and provide that good to yourself.

2) Rent housing in the rental market, and provide that good to yourself.

In either case, the end result to you is the same, you were provided with equivalent housing. Rent-buy arbitrage asks the question, if a market imbalance exists that favors renting, why buy? How do we even know that a market balance exists?

I don't think I have to explain housing appreciation to anyone, it's been entirely out of control, but lets take a look at median rents in New Jersey.

Gross Rents - HistoricalNew Jersey

1990 - $756

2000 - $751

(Inflation Adjusted)

New Jersey Housing CharacteristicsNew Jersey (Median Gross Rents)

2000 - $837

2001 - $844

2002 - $843

2003 - $874

2004 - $877

I'll try to provide a graph of the relationship, but I don't have all the data I need on hand right now to graph a long enough time series of the data. However, if I did, from 1995-1999 you would see that the movement between the two markets moved in similar fashion, from 2000-2006 the rental market increased only slightly while the purchase market price disconnected from fundamentals and skyrocketed.

Now that we've identified an imbalance between the two markets, how do we exploit it. Well, I can tell you that you'd just be better off renting right now, but I'm sure you want to see it worked out. So here we go.

There just so happens to be a property on the GSMLS that is available for either rent or purchase. That property is located in Clifton, NJ, in a townhouse community.

The house exists in two markets:

Purchase Market Price $489,500

Rental Market Price $1,995/mo

(Now, I'm going to argue that because it's not currently rented, the rental price is likely higher than the market wishes to bear. Because this buyer purchased it for $450,000 recently, his carrying costs are much higher and thus must *ask* a higher rent, but let's not get too deep into that).

So lets examine the cost in the purchase market:

Down Payment: $97,900

2005 Taxes: $8,545

PITI: $3,203 (at 6.4%, 30y fixed)

Maintenance: $175/mo

Total Monthly Outlay: $3,378

On the rental market:

Total Monthly Outlay: $1,995

Monthly Differential: $1,383

Not so simple. We need to factor in:

1) Housing Appreciation

2) Housing Upkeep

3) Tax Increases

4) Maintenance Increases

5) Tax Benefits

6) Opportunity cost of the down payment

7) Interest rates

8) Rent Increases

9) Risk premium of purchasing

etc etc etc

Instead of working out all the math here, we're going to use one of the better rent versus buy calculators to do the work for us. I'm going to warn you, don't use a rent/buy calculator on a realty or mortgage site, they are almost always going to come up with a "buy" recommendation. Instead, use a caolculator from the Center for Economic and Policy Research (CEPR), you can find it here:

Costs of Ownership v. Renting CalculatorI've gone ahead and plugged in all the numbers, but I recommend that you go through the exercise yourself (I used the 28% tax bracket, 10y timeframe). The CEPR calculator tells us that if we can rent an equivalent place for less than $3,400 a month, take it. Well wait a minute, that exact same home is available for rent at $1,995 a month, why is the rent so low? Is something wrong? No. The imbalance between the two markets is so big it should be slapping you in the face. What is causing your cognitive dissonance is the fact that $1,995 a month seems like a big number. It really seems like you are throwing away that 2 thousand a month.. Well, let me assure you, you are not throwing away anything.

Some factors to consider.

1) What would the difference between your standard and itemized deductions be? Calculate those tax benefits for yourself to see the real impact that the property and mortgage interest deductions would add.

2) Opportunity cost of the downpayment. The appropriate downpayment for this home is $97,900. Let's just say your average return over the next 10 years would be a miniscule 5% yearly (low risk investments). In 10 years that sum would grow to approximately $160,000. If you like to live on the edge and expect a 7% yearly return, that amount would be closer to $200,000.

3) Opportunity cost of the monthly differential. Each month you would have close to $1,400 extra money. Over the course of the first year that differential adds up to $16,000 cash. If the past few years of rent increase are any indicator of future trends, that number isn't going to add up significantly. Can one of the finance readers calculate the exact amount. I'm guessing that invested at 7%, the differential will add up to close to $200,000 in 10 years.

So, at the end of 10 years the arbitrageur will have close to $400,000 in liquid investments on hand. In order for the purchase market position to pay off in the same time period, we would need a continued appreciation of approximately 6% a year over that same time period to break even.

Are you so sure the housing market will continue to appreciate at above historic returns for the next 10 years? The purchase position is not adequately priced to reflect the risk inherent in purchasing at the top of the bubble market.

So the next time someone calls you a renter, correct them. You are an arbitrageur.

Caveat Emptor,

Grim