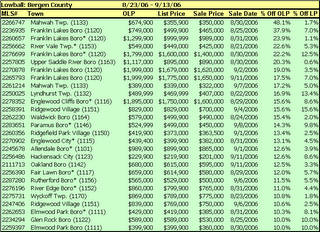

"We took a lot less than we thought we were going to get"

Sellers may have to adjust expectations and prices

Sometime after Mel and Hildy Warren agreed to buy a new home in the Four Seasons retirement community in Manalapan about a year-and-a-half ago, they were surprised to find out that a couple also moving there had actually sold their old home right away and moved into an apartment while waiting for their new house to be built.

"Everybody laughed," Hildy Warren said. "We all wondered why they'd sell so soon. It turned out they were right."

The real estate market has changed a lot in the past year. The number of available homes is up and the days when sellers could stick a "for sale" sign on the lawn and name their price are gone, at least for now.

"Prices from last year are not what they are this year," said Iris Lurie, broker/owner of Century 21 Mack-Morris Iris Lurie in Marlboro.

...

"We listed it higher, thinking that was the correct price," Hildy Warren said. "The market was telling us differently."

Over the course of three months, they reduced their initial asking price, which they declined to reveal, in steps. "We weren't getting any offers and we got concerned," Hildy Warren said.

Finally, they cut it to about 10 percent below the initial price. That very day, they received and accepted an offer. They will close on the deal this month.

"We took a lot less than we thought we were going to get," Hildy Warren said. "Buyers are getting very good deals. If we had sold six months earlier, we would have gotten more."

...

The result is sellers are learning to recognize that conditions have changed. "They're slowly accepting it," Appleby said. "No one likes to think they missed the peak of the market."

The result is sellers must be a bit more humble in their asking prices, if they want their homes to sell, Appleby said. They must also put more effort into "curb appeal," sprucing up the home inside and out to make it stand out.