Lowball! 11/13 - 11/19

Lowball! takes a look at home sales over the past week from a very different perspective. For those new to Lowball!, a lowball offer is when a buyer offers a significantly lower bid than asking in hopes that the seller accepts the offer. We take a list of home sales over the past week and pick out the sales that have the highest percentage difference between asking price and selling price.

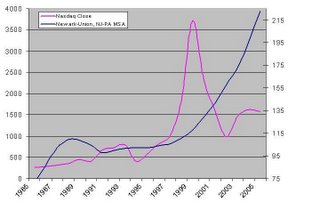

The reason for Lowball! is to show buyers that the market has changed and buyers now have considerably more leverage than sellers. Just a short time ago, lowball offers would have been laughed at and discarded, however, not any more. The fact that so many under-asking offers are being accepted is clear proof that the market is changing.

The list does not contain all sales, I hand-pick the most interesting sales from the list. These listings might be the highest dollar drops, biggest percentage reductions, or sales in towns that are thought to still be 'hot'. Please note, even with double digit percentage reductions, these homes are still incredibly overpriced.

This week's list of Lowball! sales is very interesting, and I'll tell you why. The first 6 listings were all lowball offers greater than 20% off the asking price, the lowball offers are getting deeper, and sellers are accepting. More then 75% of all sales over this period were Lowball! offers, that's right folks, out of some 590 sales I looked at on GSMLS, over 75% were offers under asking.

MLS# 2079066 - Vernon, NJ

Asking Price $169,900

Selling Price $120,000 (41.6% Lowball)

MLS# 2089089 - Madison, NJ

Asking Price $2,890,000

Selling Price $2,300,000 (25.7% Lowball)

MLS# 2088167 - Frelinghuysen, NJ

Asking Price $562,000

Selling Price $450,000 (24.9% Lowball)

MLS# 2089581 - Hoptatcong, NJ

Asking Price $205,000

Selling Price $165,000 (24.2% Lowball)

MLS# 2096901 - Hawthorne, NJ

Asking Price $429,900 (Originally $459,900)

Selling Price $350,000 (22.8% Lowball)

(Very interesting historic brownstone, built in the 1810's.)

MLS# 2093225 - Linden, NJ

Asking Price $459,900 (Originally $460,000)

Selling Price $375,000 (22.6% Lowball)

MLS# 2089944 - Pequannock, NJ

Asking Price $449,900

Selling Price $387,000 (16% Lowball)

MLS# 2074275 - Mahwah, NJ

Asking Price $999,900 (Originally Asking $1,099,000)

Selling Price $875,000 (14.3% Lowball, 20.4% from OLP)

MLS# 2103134 - Westfield, NJ

Asking Price $1,595,000

Selling Price $1,415,000 (12.7% Lowball)

MLS# 2068740 - Millburn, NJ

Asking Price $899,000 (Originally Asking $950,000)

Selling Price $ 800,000 (12.4% Lowball, 15.8% from OLP)

MLS# 2072601 - Boonton, NJ

Asking Price $619,000

Selling Price $555,000 (11.5% Lowball)

Biggest Dollar Lowball!

Peapack Gladstone, NJ (I will not post the MLS# of this one)

Asking Price $12,500,000 (Originally Asking $13,900,000)

Selling Price $11,500,000 ($1m off Asking, 2.4m off OLP)

A few closing notes, keep in mind this data is from GSMLS, not Hudson or NJMLS, thus this data neglects Lowball! offers through other systems. For example, Bergen listings are primarily on the NJMLS, so they often don't get their fair share as part of these listings. However, on the subject of Bergen, I always keep a close eye on Ridgewood, I feel it to be a good indicator of Bergen trends. So let me just throw one Bergen MLS drop out for the team..

MLS# 2074326 - Ridgewood, NJ

Asking Price $549,900 (Originally Asking $575,000)

Selling Price $520,000 (5.8% Lowball, 9.6% off OLP)

Caveat Emptor!

Grim