Here is the first part in our HowTo series:

HowTo: Searching Tax RecordsThe purpose of the HowTo series is to educate home buyers. While I'd love to hang around the blog helping everyone hunt down information, I realize that I can probably help everyone much more by showing you HowTo find the info you need.

The first part in the series is HowTo track down public tax information. The public tax databases contain a wealth of important information that will help you become educated homebuyers. Until recently, searching the tax records involved a trip down to the county records office, and probably the better part of an afternoon. Not anymore, with just a few clicks I'm going to turn you into Sherlock Homes (what a terrible pun).

First, here are the links I use:

Morris County Tax BoardMonmouth County Tax Boardwww.taxrecords.comBergen County Tax Board (taxrecords.com database)

Why so many links? Open them up, take a look, not every site has the most up-to-date database, and some sites (like Monmouth) allow you to search more than one county.

So lets begin:

1) First we need to find the address of a home we are interested in. For this we'll go over to ForSaleByOwner.com, you can use the link over to the right of the page if you would like to support the site (I'm still waiting to make my first penny off those by the way).

2) At the top of the page there is a section called "Buying a home", lets type in Madison for the city, and use NJ for the state, click go.

3) Choose listing #20527608 ($599,000). Not every home has past sales records, if the home was owned for a very long period of time, it's possible that you will not find past sales records. Also, if the home is new, you may not find sales records. I picked Madison at random and chose this listing at random (but verified that it indeed had sales data).

4) Grab the address, the address is important, it's the key we'll be using to search the databases (for those that would rather not go to forsalebyowner.com, the address is "36 Albright".

5) Click the link for the Monmouth Tax Board, you'll see a page with a somewhat complicated form, don't be scared, it's easy.

6) Select "Morris - 2005" as your County, Select "Madison Borough" as your District, and Select "Advanced Search" as your Search Format.

7) Scroll down the page until you see the field marked "Street Addr", type in "36 Albright", the street suffix is not necessary (and I find it throws off the search on some tools, so don't bother). Scroll down to the bottom of the page and click the "Search" button.

8) You should be rewarded with a single entry returned. Click the "More Information" button on the left side of the record.

9) This is it, you've done it. We see the owners, we can verify what they paid for the home and when they purchased it, the assessed value and what the taxes are.

10) Click your back button twice to return back to the search screen. This time, we'll only use "Albright" as the Street Address. Why? Because we'd like to see the other properties in the neighborhood.

11) Now we'll go through the Morris County Tax Board site. Why? You might like it better, it might be updated more recently, the Monmouth Site might be down, It doesn't matter, just go.

12) At the top of the page you should see "SR1A's", hover your mouse over the button and you'll see "Search SR1A's" pop up, click it.

13) Click "Search SR1A's By Property Location" under "Select Search Critera". A box should pop up with a handful of fields.

14) Under District select "Madison", enter "36" for House Number and "Albright" for Street Address. You can leave SR1A Year blank. Click "Search".

15) Bingo, you'll see a similar record as we did in the first search. You may need to scroll the browser window to the right to reveal the "Detail" button. Click it when you find it. You'll see much of the same info as you did before. You can go back and click the "Tax" button if you'd like some more information on the property or tax.

16) I'll let you go through the Bergen and taxrecords.com sites on your own. Most of these follow the same pattern, so once you've mastered the search, you'll be comfortable on most any tax search database.

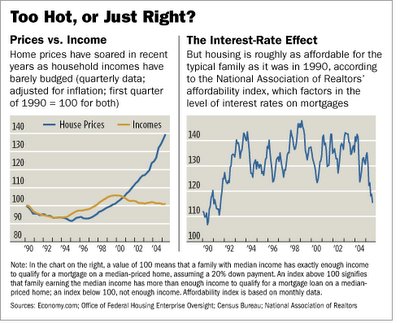

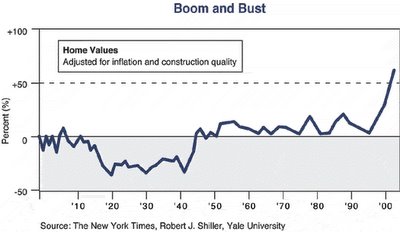

You've now become tax record experts, and are probably wondering why I wanted you all to become tax record experts. It's simple really, because we need to know what the current owner purchased the home for, and when they purchased it. Home values typically appreciate at about the rate of inflation. So we can use the inflation numbers to calculate the inflation adjusted price of the home in today's dollars. This will give you a good starting point for which to base your offer. "But wait," you ask, "what about the asking price?" Asking price? We here at NNJBubble believe no such thing, you can ask what you'd like, it doesn't mean we're going to pay it.

We only pay what we believe the asset to be worth, no more. We don't care what the neighbor got for his place, we don't care how well the market did in the past year, we simply don't care.

Refuse to buy into the mania and refuse to pay the asking price. If the seller rejects your offer, walk away, do not buy, do not bend, and do not let this process become emotional.

Caveat Emptor,

Grim