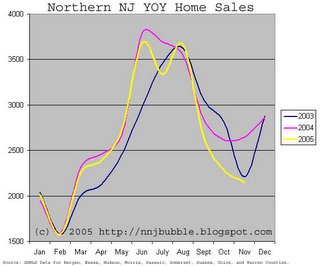

This is a story out of Boston/Mass however I think it is important to post here. We've already started to see beginnings of similar behavior in Northern NJ. Boston and Mass begun their decline earlier than the NNJ market, thus may serve as somewhat of a predictor of things to come for Northern NJ.

Cuts of up to 20% are now common as analysts see signs of a 'hard landing'

Boston-area homeowners trying to sell their houses are sharply reducing asking prices -- in some cases, by $100,000 or more -- in response to the sudden slowdown in the real estate market.

...

The median price of a single-family home in Massachusetts has dropped 7 percent in the past two months, to $349,000 for sales that closed in October. But reductions in asking prices of 10 percent or 20 percent are now common in both high and moderately priced neighborhoods, according to real estate agents and listings of homes for sale.

...

''The evidence -- both early data and the anecdotes -- are pointing more toward a hard rather than a soft landing" in the housing market, said Nicholas Perna, an economic consultant in Ridgefield, Conn. ''Prices could come down. Could it be 10 to 15 percent? There's no way of knowing, but what we're getting is more clues that you've got a decline in prices underway.

...

Last February, Gary and Susan Kazmer were confident of selling their Foxborough home for $949,900. He had landed a high-level job in Manhattan, and the couple planned to relocate their three daughters during the summer to a house they purchased in Mendham, N.J., with a bridge loan.

They built the Foxborough house on a pond in 1997 and filled it with extras: two marble fireplaces and hardwood floors with dark cherry borders. ''We called it our wow house," he said.

But it attracted little interest at that price, and Gil Campos of Re/Max Real Estate Center in Foxborough lowered the price to $899,000 in early August. Since then, it has been reduced four times, to $800,000. ''That's an unbelievable spiral," he said.

The Kazmers' limbo ended this week, when they accepted an offer, which Campos declined to disclose.

Like I've said before, we've already begun to see the beginnings locally. It's only a matter of time now before we're headed down the same path as the Boston area. Until then, enjoy the snow!

Caveat Emptor!

Grim